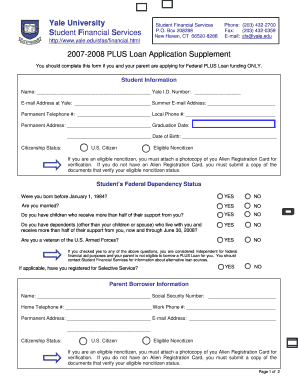

Yale University Student Financial Services PLUS Loan Form

Understanding the Yale University Student Financial Services PLUS Loan

The Yale University Student Financial Services PLUS Loan is a federal loan program designed to help graduate and professional students cover educational expenses. This loan is available to students who are enrolled at least half-time in a degree program. The PLUS Loan allows borrowers to finance the cost of their education, including tuition, room and board, and other associated costs. It is essential for students to understand the terms, interest rates, and repayment options associated with this loan to make informed financial decisions.

Eligibility Criteria for the PLUS Loan

To qualify for the Yale University Student Financial Services PLUS Loan, students must meet specific eligibility requirements. Applicants need to be U.S. citizens or eligible non-citizens, enrolled at least half-time in a graduate or professional program, and must not have an adverse credit history. Additionally, students must complete the Free Application for Federal Student Aid (FAFSA) to determine their financial need and eligibility for federal student aid.

Steps to Obtain the PLUS Loan

The process of obtaining the Yale University Student Financial Services PLUS Loan involves several key steps. First, students should complete the FAFSA to establish their financial need. Next, they must apply for the PLUS Loan through the U.S. Department of Education's website. After submitting the application, students will receive a credit check. If approved, borrowers will need to sign a Master Promissory Note (MPN) agreeing to the loan terms. Finally, funds will be disbursed directly to the university to cover tuition and other expenses.

Required Documents for the PLUS Loan Application

When applying for the Yale University Student Financial Services PLUS Loan, students need to prepare several documents. Essential documents include proof of identity, such as a driver's license or Social Security card, and financial information, which may include tax returns or income statements. Additionally, students should have their FAFSA confirmation and any other documentation requested by the financial aid office to ensure a smooth application process.

Repayment Options and Terms

The repayment terms for the Yale University Student Financial Services PLUS Loan typically begin six months after graduation, withdrawal, or dropping below half-time enrollment. Borrowers have various repayment plans available, including standard, graduated, and income-driven repayment plans. It is crucial for students to understand the interest rates, which are fixed, and to consider their financial situation when selecting a repayment plan that best suits their needs.

Legal Use of the PLUS Loan Funds

The funds from the Yale University Student Financial Services PLUS Loan must be used for qualified educational expenses. These expenses include tuition, fees, room and board, and other necessary costs associated with attending school. Misuse of loan funds can lead to serious consequences, including penalties and the requirement to repay the loan immediately. Students should keep accurate records of their expenses to ensure compliance with federal regulations.

Quick guide on how to complete yale university student financial services plus loan

Complete [SKS] effortlessly on any device

The management of online documents has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The easiest way to edit and eSign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data using tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign [SKS] and ensure outstanding communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Yale University Student Financial Services PLUS Loan

Create this form in 5 minutes!

How to create an eSignature for the yale university student financial services plus loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Yale University Student Financial Services PLUS Loan?

The Yale University Student Financial Services PLUS Loan is a federal loan program designed to help graduate and professional students cover educational expenses. This loan allows students to borrow up to the cost of attendance minus any other financial aid received. It is an essential resource for those looking to finance their education at Yale.

-

How do I apply for the Yale University Student Financial Services PLUS Loan?

To apply for the Yale University Student Financial Services PLUS Loan, you need to complete the Free Application for Federal Student Aid (FAFSA). Afterward, you can submit a PLUS Loan application through the Yale Student Financial Services website. Ensure you meet all eligibility requirements to streamline the process.

-

What are the interest rates for the Yale University Student Financial Services PLUS Loan?

The interest rates for the Yale University Student Financial Services PLUS Loan are set by the federal government and can vary each year. As of the latest updates, the rates are typically fixed, making it easier for students to budget their repayments. Always check the official Yale Student Financial Services website for the most current rates.

-

What are the repayment options for the Yale University Student Financial Services PLUS Loan?

Repayment options for the Yale University Student Financial Services PLUS Loan include standard, graduated, and income-driven repayment plans. Students can choose a plan that best fits their financial situation after graduation. It's important to review these options early to make informed decisions about managing loan repayments.

-

Are there any fees associated with the Yale University Student Financial Services PLUS Loan?

Yes, there are fees associated with the Yale University Student Financial Services PLUS Loan, typically a loan origination fee. This fee is deducted from the loan amount disbursed, so it's crucial to factor this into your borrowing needs. Always consult the Yale Student Financial Services for detailed fee information.

-

What benefits does the Yale University Student Financial Services PLUS Loan offer?

The Yale University Student Financial Services PLUS Loan offers several benefits, including flexible repayment options and the ability to defer payments while in school. Additionally, the loan may qualify for federal loan forgiveness programs under certain conditions. These features make it a valuable option for financing your education.

-

Can I consolidate my Yale University Student Financial Services PLUS Loan?

Yes, you can consolidate your Yale University Student Financial Services PLUS Loan with other federal loans through a Direct Consolidation Loan. This can simplify your payments and potentially lower your monthly payment amount. However, it's essential to understand the implications of consolidation on your loan benefits.

Get more for Yale University Student Financial Services PLUS Loan

- Special or limited power of attorney for real estate purchase transaction by purchaser nebraska form

- Limited power of attorney where you specify powers with sample powers included nebraska form

- Limited power of attorney for stock transactions and corporate powers nebraska form

- Special durable power of attorney for bank account matters nebraska form

- Nebraska business 497318408 form

- Nebraska property management package nebraska form

- Sample annual minutes for a nebraska professional corporation nebraska form

- Sample bylaws for a nebraska professional corporation nebraska form

Find out other Yale University Student Financial Services PLUS Loan

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile