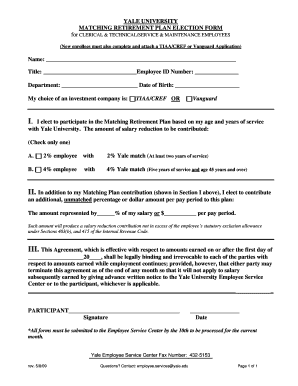

MATCHING RETIREMENT PLAN Yale University Form

Understanding the MATCHING RETIREMENT PLAN at Yale University

The MATCHING RETIREMENT PLAN at Yale University is designed to help employees save for retirement while benefiting from employer contributions. This plan allows Yale to match a portion of the contributions made by employees, enhancing their retirement savings. The plan typically includes options for both pre-tax and post-tax contributions, giving employees flexibility in how they manage their retirement funds.

Steps to Utilize the MATCHING RETIREMENT PLAN

To effectively use the MATCHING RETIREMENT PLAN, employees should follow these steps:

- Review the plan details provided by Yale's Human Resources department.

- Determine your contribution level based on your financial situation and retirement goals.

- Complete the necessary enrollment forms, ensuring you select the appropriate contribution type.

- Submit your forms electronically or via mail as directed by the HR guidelines.

- Monitor your contributions and employer matches through your retirement account statements.

Eligibility Criteria for the MATCHING RETIREMENT PLAN

Eligibility for the MATCHING RETIREMENT PLAN at Yale University generally includes all full-time employees. Specific criteria may vary based on employment status, length of service, and other factors. It is advisable for employees to consult the HR department for detailed information regarding their eligibility and any required documentation.

Required Documents for Enrollment in the MATCHING RETIREMENT PLAN

To enroll in the MATCHING RETIREMENT PLAN, employees typically need to provide the following documents:

- A completed enrollment form, indicating your chosen contribution level.

- Identification documents, such as a driver's license or employee ID.

- Any previous retirement plan statements if applicable.

These documents help ensure a smooth enrollment process and compliance with the plan's requirements.

Legal Considerations for the MATCHING RETIREMENT PLAN

The MATCHING RETIREMENT PLAN must comply with federal regulations, including those set forth by the Internal Revenue Service (IRS). Employees should be aware of contribution limits and tax implications associated with their retirement savings. Understanding these legal aspects is essential for maximizing benefits and ensuring compliance.

Examples of Contributions in the MATCHING RETIREMENT PLAN

Employees can benefit from various contribution scenarios under the MATCHING RETIREMENT PLAN. For instance, if an employee contributes five percent of their salary, Yale may match up to a certain percentage, effectively doubling the employee's contribution. This matching mechanism can significantly enhance the total retirement savings over time, illustrating the value of participating in the plan.

Quick guide on how to complete matching retirement plan yale university

Complete [SKS] effortlessly on any gadget

Managing documents online has gained immense traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and bears the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MATCHING RETIREMENT PLAN Yale University

Create this form in 5 minutes!

How to create an eSignature for the matching retirement plan yale university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MATCHING RETIREMENT PLAN at Yale University?

The MATCHING RETIREMENT PLAN at Yale University is a benefit designed to help employees save for retirement. It allows the university to match a portion of the contributions made by employees, enhancing their overall retirement savings. This plan is an essential part of Yale's commitment to supporting its staff's financial well-being.

-

How does the MATCHING RETIREMENT PLAN at Yale University work?

Under the MATCHING RETIREMENT PLAN at Yale University, employees contribute a percentage of their salary to their retirement accounts. Yale then matches these contributions up to a certain limit, effectively doubling the employee's investment in their future. This structure encourages employees to save more for retirement.

-

What are the benefits of the MATCHING RETIREMENT PLAN at Yale University?

The primary benefit of the MATCHING RETIREMENT PLAN at Yale University is the additional financial support it provides for retirement savings. Employees can signNowly increase their retirement funds through the university's matching contributions. This plan also promotes long-term financial security for employees.

-

Are there any costs associated with the MATCHING RETIREMENT PLAN at Yale University?

There are no direct costs for employees to participate in the MATCHING RETIREMENT PLAN at Yale University. However, employees should consider their own contributions, as the university matches a percentage of what they invest. This makes it a cost-effective way to enhance retirement savings.

-

Can I change my contribution amount to the MATCHING RETIREMENT PLAN at Yale University?

Yes, employees can adjust their contribution amounts to the MATCHING RETIREMENT PLAN at Yale University. This flexibility allows individuals to increase or decrease their savings based on their financial situation. It's important to review your contributions regularly to maximize the benefits of the matching plan.

-

What investment options are available under the MATCHING RETIREMENT PLAN at Yale University?

The MATCHING RETIREMENT PLAN at Yale University offers a variety of investment options tailored to different risk tolerances and financial goals. Employees can choose from mutual funds, stocks, and bonds to create a diversified portfolio. This variety helps employees align their investments with their retirement objectives.

-

How do I enroll in the MATCHING RETIREMENT PLAN at Yale University?

Enrolling in the MATCHING RETIREMENT PLAN at Yale University is a straightforward process. Employees can sign up through the university's HR portal or during open enrollment periods. It's advisable to review the plan details and contribution limits before enrolling to make informed decisions.

Get more for MATCHING RETIREMENT PLAN Yale University

- Painting contract for contractor new hampshire form

- Trim carpenter contract for contractor new hampshire form

- Fencing contract for contractor new hampshire form

- Hvac contract for contractor new hampshire form

- Landscape contract for contractor new hampshire form

- Commercial contract for contractor new hampshire form

- Excavator contract for contractor new hampshire form

- Renovation contract for contractor new hampshire form

Find out other MATCHING RETIREMENT PLAN Yale University

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template