Student Tax Non Filing Statement Yale University Form

What is the Student Tax Non Filing Statement at Yale University

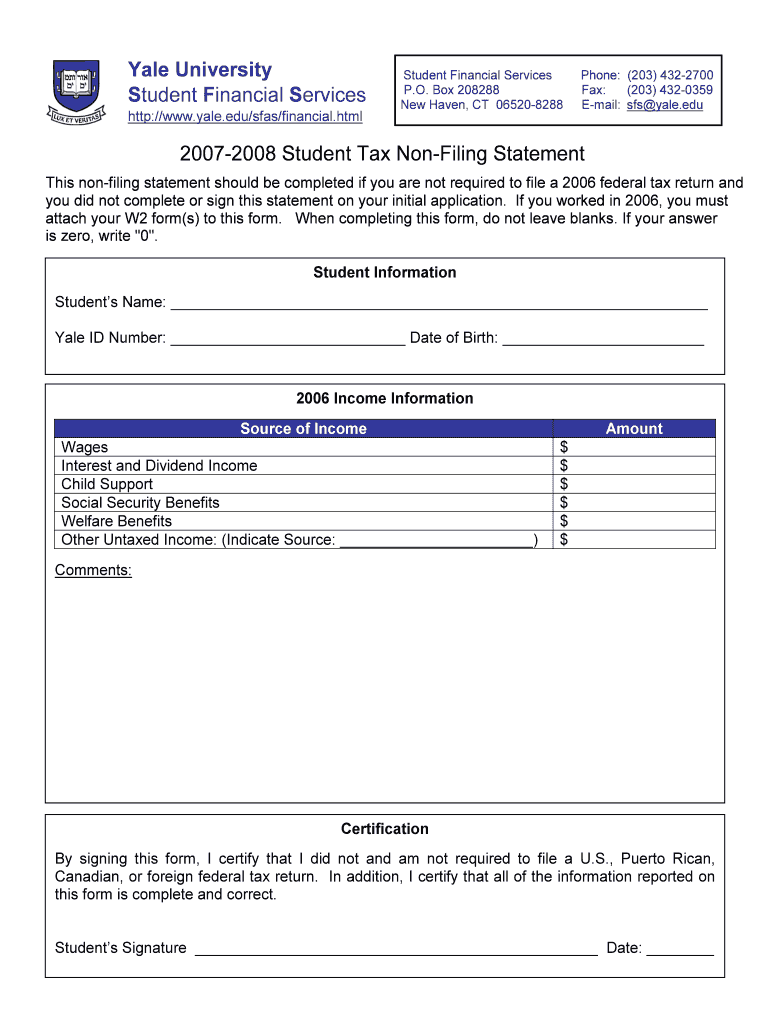

The Student Tax Non Filing Statement at Yale University is a document that certifies a student's non-filing status for tax purposes. This statement is particularly relevant for students who do not meet the income thresholds required to file a federal tax return. It serves as an official declaration that the student has not filed a tax return for the applicable tax year, which may be necessary for financial aid applications, scholarship eligibility, or other institutional requirements.

How to Obtain the Student Tax Non Filing Statement at Yale University

To obtain the Student Tax Non Filing Statement, students can typically access it through the Yale University financial aid office or the student services portal. Students may need to log in with their university credentials to download or request the form. It is advisable to check for any specific instructions or requirements provided by the university to ensure the correct document is obtained.

Steps to Complete the Student Tax Non Filing Statement at Yale University

Completing the Student Tax Non Filing Statement involves several straightforward steps:

- Access the form through the Yale University financial aid portal.

- Fill in your personal information, including your name, student ID, and the tax year in question.

- Indicate your non-filing status by checking the appropriate box.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form as instructed, either online or via mail, depending on university guidelines.

Legal Use of the Student Tax Non Filing Statement at Yale University

The Student Tax Non Filing Statement is legally recognized as a valid document for various purposes, including financial aid applications and verification processes. It is essential for students to ensure that the information provided is accurate, as misrepresentation can lead to penalties or loss of financial aid. This document may be required by institutions or organizations that need proof of a student's tax status.

Key Elements of the Student Tax Non Filing Statement at Yale University

Key elements of the Student Tax Non Filing Statement include:

- Personal Information: The student's name, identification number, and contact information.

- Tax Year: The specific year for which the non-filing status is being declared.

- Certification Statement: A declaration affirming that the student has not filed a tax return.

- Signature: The student's signature and date, confirming the accuracy of the information.

IRS Guidelines Related to Non-Filing Status

The IRS provides guidelines regarding who is required to file a tax return based on income levels, filing status, and age. Students who fall below these thresholds may not need to file a return and can use the Student Tax Non Filing Statement to confirm their status. Understanding these guidelines can help students determine their eligibility and ensure compliance with tax regulations.

Quick guide on how to complete student tax non filing statement yale university

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained immense traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without holdups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-centric procedure today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device. Adjust and eSign [SKS] while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Student Tax Non Filing Statement Yale University

Create this form in 5 minutes!

How to create an eSignature for the student tax non filing statement yale university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Student Tax Non Filing Statement Yale University?

The Student Tax Non Filing Statement Yale University is a document that confirms a student's non-filing status for tax purposes. This statement is essential for students who do not meet the income threshold for filing taxes but need to provide proof of their financial situation for various applications.

-

How can I obtain the Student Tax Non Filing Statement Yale University?

To obtain the Student Tax Non Filing Statement Yale University, students can request it through the university's financial aid office or online portal. The process is straightforward and typically requires verification of your student status and financial information.

-

Is there a fee associated with the Student Tax Non Filing Statement Yale University?

There is usually no fee for obtaining the Student Tax Non Filing Statement Yale University. However, it's advisable to check with the university's financial aid office for any potential administrative fees that may apply.

-

How does the Student Tax Non Filing Statement Yale University benefit students?

The Student Tax Non Filing Statement Yale University benefits students by providing necessary documentation for financial aid applications, scholarships, and other financial assistance programs. It helps clarify a student's financial situation without the need for tax returns.

-

Can I use the Student Tax Non Filing Statement Yale University for other institutions?

Yes, the Student Tax Non Filing Statement Yale University can often be used for applications to other institutions or programs that require proof of non-filing status. However, it's important to verify that the receiving institution accepts this specific document.

-

What information is included in the Student Tax Non Filing Statement Yale University?

The Student Tax Non Filing Statement Yale University typically includes the student's name, identification number, and a declaration of non-filing status. It may also provide additional details regarding the student's financial situation as required by the institution.

-

How does airSlate SignNow facilitate the process of obtaining the Student Tax Non Filing Statement Yale University?

airSlate SignNow streamlines the process of obtaining the Student Tax Non Filing Statement Yale University by allowing students to eSign and send documents securely and efficiently. This easy-to-use platform ensures that all necessary paperwork is handled quickly, saving time and effort.

Get more for Student Tax Non Filing Statement Yale University

- Lease purchase agreements package new hampshire form

- Satisfaction cancellation or release of mortgage package new hampshire form

- Premarital agreements package new hampshire form

- Painting contractor package new hampshire form

- Framing contractor package new hampshire form

- Foundation contractor package new hampshire form

- Plumbing contractor package new hampshire form

- Brick mason contractor package new hampshire form

Find out other Student Tax Non Filing Statement Yale University

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free