Student Tax Non Filing Statement Yale University Form

What is the Student Tax Non Filing Statement Yale University

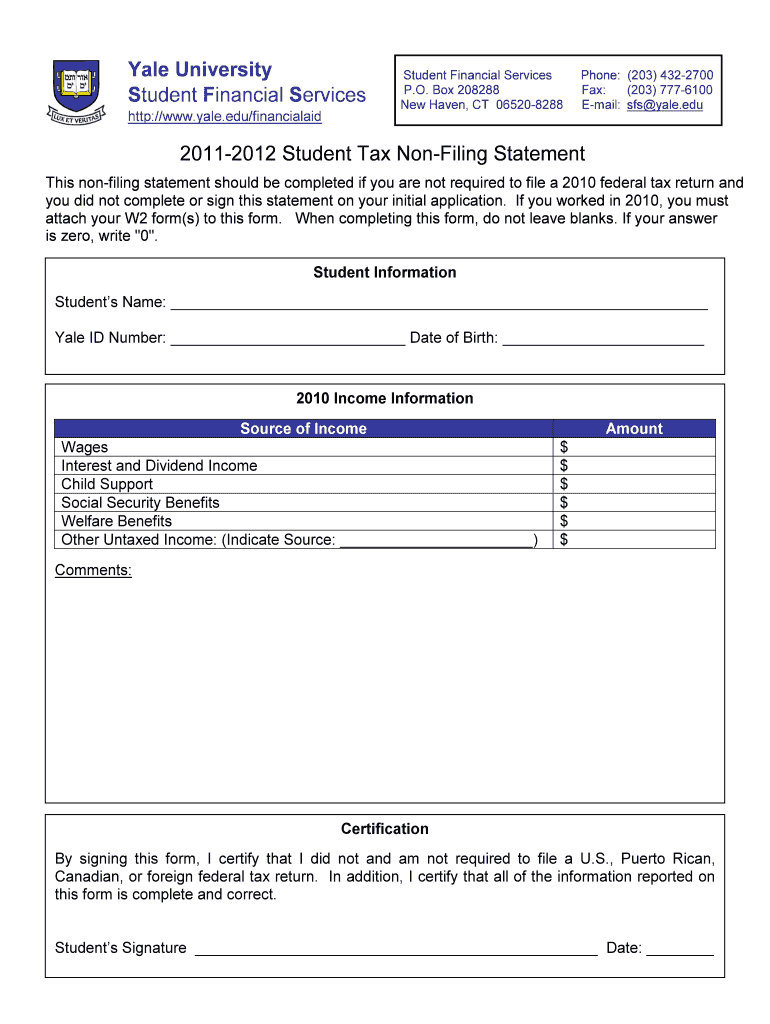

The Student Tax Non Filing Statement from Yale University is a document that certifies a student's status regarding tax filing requirements. This statement is particularly relevant for students who may not have earned enough income to necessitate filing a federal tax return. By providing this statement, students can clarify their financial situation to various institutions, such as financial aid offices or lenders, who may require proof of non-filing for eligibility assessments.

How to obtain the Student Tax Non Filing Statement Yale University

Students can obtain the Student Tax Non Filing Statement through Yale University's financial aid office. Typically, the process involves filling out a request form that may be available online or in person. Students should ensure they have their student identification and any necessary documentation ready to expedite the process. It is advisable to check the university's official website or contact the financial aid office directly for specific instructions and any potential fees associated with obtaining the statement.

Steps to complete the Student Tax Non Filing Statement Yale University

Completing the Student Tax Non Filing Statement involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and student ID.

- Access the form through the Yale University financial aid website or office.

- Fill out the required fields accurately, ensuring all information matches your official records.

- Review the completed form for any errors or omissions.

- Submit the form as instructed, either online or in person, depending on the university's guidelines.

Legal use of the Student Tax Non Filing Statement Yale University

The Student Tax Non Filing Statement serves as a legal document that can be used in various contexts, such as applying for financial aid or verifying income status. It is important for students to understand that this statement is a formal declaration and should be used responsibly. Institutions may require this document to assess eligibility for financial assistance, scholarships, or loans, making its accurate completion and submission crucial.

Key elements of the Student Tax Non Filing Statement Yale University

Key elements of the Student Tax Non Filing Statement include:

- Student Identification: The student's name, ID number, and contact information.

- Income Information: A declaration of income status, indicating that the student did not earn enough to file.

- Signature: The student's signature, confirming the accuracy of the information provided.

- Date: The date the statement is completed and submitted.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding who is required to file a tax return. Generally, if a student's income is below a certain threshold, they are not obligated to file. The IRS outlines these thresholds annually, and students should refer to the IRS website or consult a tax professional to confirm their filing requirements. Understanding these guidelines can help students accurately complete the Student Tax Non Filing Statement and ensure compliance with federal tax laws.

Quick guide on how to complete student tax non filing statement yale university 12829425

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, through email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Student Tax Non Filing Statement Yale University

Create this form in 5 minutes!

How to create an eSignature for the student tax non filing statement yale university 12829425

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Student Tax Non Filing Statement Yale University?

The Student Tax Non Filing Statement Yale University is a document that certifies a student's non-filing status for tax purposes. This statement is essential for students who do not meet the income threshold required to file a federal tax return. It can be used for financial aid applications and other official purposes.

-

How can I obtain the Student Tax Non Filing Statement Yale University?

To obtain the Student Tax Non Filing Statement Yale University, students can request it through the university's financial aid office or online portal. The process is straightforward and typically requires verification of your student status. Once requested, the statement will be provided in a timely manner.

-

Is there a fee associated with the Student Tax Non Filing Statement Yale University?

There is generally no fee for obtaining the Student Tax Non Filing Statement Yale University. The university provides this document as part of its commitment to support students in their financial aid processes. Always check with the financial aid office for any specific requirements.

-

What are the benefits of using airSlate SignNow for the Student Tax Non Filing Statement Yale University?

Using airSlate SignNow for the Student Tax Non Filing Statement Yale University allows for a seamless eSigning experience. The platform is user-friendly and cost-effective, enabling students to quickly sign and send their documents securely. This ensures that your statement is processed efficiently.

-

Can I integrate airSlate SignNow with other applications for managing the Student Tax Non Filing Statement Yale University?

Yes, airSlate SignNow offers integrations with various applications that can help manage the Student Tax Non Filing Statement Yale University. This includes popular tools for document management and financial aid processing. These integrations streamline workflows and enhance productivity.

-

How secure is the Student Tax Non Filing Statement Yale University when using airSlate SignNow?

The security of the Student Tax Non Filing Statement Yale University is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive information. Users can confidently send and sign documents knowing their data is secure.

-

What features does airSlate SignNow offer for handling the Student Tax Non Filing Statement Yale University?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking for the Student Tax Non Filing Statement Yale University. These tools simplify the document management process, making it easier for students to handle their tax-related paperwork efficiently.

Get more for Student Tax Non Filing Statement Yale University

- Electrical contract for contractor new jersey form

- Sheetrock drywall contract for contractor new jersey form

- Flooring contract for contractor new jersey form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract new jersey form

- Notice of intent to enforce forfeiture provisions of contact for deed new jersey form

- Final notice of forfeiture and request to vacate property under contract for deed new jersey form

- Buyers request for accounting from seller under contract for deed new jersey form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed new jersey form

Find out other Student Tax Non Filing Statement Yale University

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement