Gift in Kind Donation Form Belmont

What is the Gift In Kind Donation Form Belmont

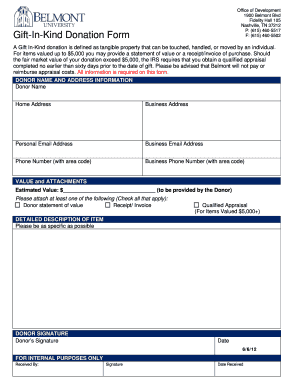

The Gift In Kind Donation Form Belmont is a specialized document used to record non-cash donations made to charitable organizations. This form is essential for both donors and nonprofits, as it provides a formal acknowledgment of the donation, ensuring that all parties have a clear record of the transaction. It typically includes details such as the donor's information, a description of the donated items, and their estimated value, which is crucial for tax purposes.

How to use the Gift In Kind Donation Form Belmont

Using the Gift In Kind Donation Form Belmont involves several straightforward steps. First, gather all necessary information about the donation, including the items being donated and their estimated value. Next, fill out the form with the donor's details, including name, address, and contact information. Once completed, both the donor and the recipient organization should sign the form to validate the donation. Retain a copy for personal records, as it may be required for tax deductions.

Steps to complete the Gift In Kind Donation Form Belmont

Completing the Gift In Kind Donation Form Belmont requires attention to detail. Follow these steps:

- Identify the items you wish to donate and assess their fair market value.

- Fill in the donor's name, address, and contact information on the form.

- Provide a detailed description of the donated items, including quantity and condition.

- Sign and date the form to confirm the donation.

- Ensure the recipient organization also signs the form for acknowledgment.

Key elements of the Gift In Kind Donation Form Belmont

The key elements of the Gift In Kind Donation Form Belmont include:

- Donor Information: Name, address, and contact details.

- Recipient Organization: Name and address of the charity receiving the donation.

- Description of Items: Detailed information about the donated items.

- Estimated Value: Fair market value of the donated items.

- Signatures: Required signatures from both the donor and the recipient organization.

Legal use of the Gift In Kind Donation Form Belmont

The Gift In Kind Donation Form Belmont serves a legal purpose by documenting the transfer of ownership of donated items. This form is important for tax reporting, as it provides proof of the donation for both the donor and the nonprofit. It is advisable for donors to retain a copy of the signed form for their records, as it may be requested by the IRS during tax audits. Proper use of this form helps ensure compliance with tax regulations regarding charitable contributions.

IRS Guidelines

The IRS provides specific guidelines regarding the valuation and reporting of non-cash donations. Donors must ensure that the estimated value of the donated items is reasonable and based on fair market value. For items valued over five hundred dollars, additional documentation may be required, such as a qualified appraisal. The Gift In Kind Donation Form Belmont can serve as a supporting document in tax filings, helping to substantiate the donor's claims for charitable deductions.

Quick guide on how to complete gift in kind donation form belmont

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gift in kind donation form belmont

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Gift In Kind Donation Form Belmont?

A Gift In Kind Donation Form Belmont is a specialized document used to record non-cash donations made to organizations in Belmont. This form helps streamline the donation process and ensures that both the donor and recipient have a clear record of the transaction. Utilizing airSlate SignNow, you can easily create and manage these forms online.

-

How can I create a Gift In Kind Donation Form Belmont using airSlate SignNow?

Creating a Gift In Kind Donation Form Belmont with airSlate SignNow is simple and efficient. You can start by selecting a template or designing your own form from scratch. The platform allows you to customize fields, add your branding, and send the form for eSignature, making the process seamless.

-

Is there a cost associated with using the Gift In Kind Donation Form Belmont?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for nonprofits. The cost of using the Gift In Kind Donation Form Belmont will depend on the features you choose and the volume of documents you need to manage. Check our pricing page for detailed information on plans and features.

-

What are the benefits of using the Gift In Kind Donation Form Belmont?

Using the Gift In Kind Donation Form Belmont provides numerous benefits, including improved organization and tracking of donations. It also enhances transparency between donors and organizations, ensuring that all parties have a clear understanding of the donation's value. Additionally, the eSignature feature speeds up the process, making it more efficient.

-

Can I integrate the Gift In Kind Donation Form Belmont with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can connect the Gift In Kind Donation Form Belmont with CRM systems, accounting software, and other tools to streamline your donation management process. This integration helps maintain accurate records and improves overall efficiency.

-

How secure is the Gift In Kind Donation Form Belmont on airSlate SignNow?

Security is a top priority at airSlate SignNow. The Gift In Kind Donation Form Belmont is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains safe. We comply with industry standards to provide a secure environment for all your document transactions.

-

Can I customize the Gift In Kind Donation Form Belmont to fit my organization's needs?

Absolutely! airSlate SignNow allows you to fully customize the Gift In Kind Donation Form Belmont to meet your organization's specific requirements. You can add or remove fields, adjust the layout, and incorporate your branding elements to create a form that reflects your organization's identity.

Get more for Gift In Kind Donation Form Belmont

- Ohio limited 497322236 form

- Request lien form 497322238

- Ohio quitclaim deed 497322239 form

- General warranty deed from husband and wife to corporation ohio form

- Limited warranty deed from husband and wife to corporation ohio form

- Ohio divorce form

- Ohio corporation form

- Notice of payment individual ohio form

Find out other Gift In Kind Donation Form Belmont

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document