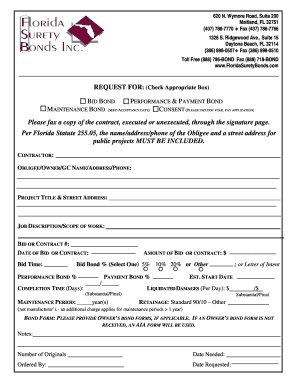

Florida Surety Bonds Form

What is the Florida Surety Bond?

A Florida surety bond is a legally binding agreement between three parties: the principal, the obligee, and the surety. The principal is the individual or business that needs the bond, the obligee is the entity requiring the bond, and the surety is the company that backs the bond. This type of bond ensures that the principal will fulfill their obligations, such as complying with laws or completing projects, and provides financial protection to the obligee in case of default. Florida surety bonds are commonly used in various industries, including construction, real estate, and licensing, to guarantee compliance with state regulations.

How to Obtain Florida Surety Bonds

Obtaining a Florida surety bond involves several steps. First, you need to identify the specific type of bond required for your situation. Next, you should gather necessary documentation, which may include personal and business financial information, credit history, and any relevant licenses. Afterward, you can approach a surety bond provider or broker who specializes in Florida surety bonds. They will assess your application, determine the bond amount, and provide a quote. Once you agree to the terms, you will pay the premium, and the surety will issue the bond.

Key Elements of Florida Surety Bonds

Florida surety bonds consist of several key elements that define their function and requirements. These include:

- Bond Amount: The total dollar amount that the surety guarantees to the obligee.

- Premium: The cost of the bond, typically a percentage of the bond amount, paid to the surety.

- Obligee: The party requiring the bond, often a government agency or regulatory body.

- Principal: The individual or business that purchases the bond to guarantee compliance.

- Duration: The time period for which the bond is valid, often aligned with the project or licensing period.

Steps to Complete Florida Surety Bonds

To complete a Florida surety bond, follow these steps:

- Determine the type of surety bond needed based on your project or licensing requirements.

- Collect all necessary documentation, including financial statements and identification.

- Contact a surety bond provider to discuss your needs and obtain a quote.

- Review the terms and conditions of the bond, including the premium and coverage amount.

- Complete the application process, providing all requested information accurately.

- Pay the premium to the surety to finalize the bond issuance.

- Receive the bond and ensure it is filed with the appropriate obligee.

Legal Use of Florida Surety Bonds

Florida surety bonds are used legally to ensure compliance with state laws and regulations. They are often required in various sectors, such as construction, where contractors must obtain bonds to guarantee project completion and adherence to safety standards. Additionally, certain professions, like insurance agents and mortgage brokers, require surety bonds to protect consumers and ensure ethical practices. The legal framework governing these bonds is outlined in Florida statutes, which specify the conditions under which bonds must be obtained and maintained.

Eligibility Criteria for Florida Surety Bonds

Eligibility for Florida surety bonds typically depends on several factors, including:

- Creditworthiness: Surety companies assess the credit history and financial stability of the principal.

- Business Experience: The principal's experience in their industry can influence eligibility, particularly for larger bond amounts.

- Financial Documentation: Applicants must provide financial statements, tax returns, and other relevant documents to demonstrate their ability to fulfill bond obligations.

Quick guide on how to complete florida surety bonds

Complete Florida Surety Bonds effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage Florida Surety Bonds on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Florida Surety Bonds with ease

- Locate Florida Surety Bonds and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers expressly for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to secure your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Florida Surety Bonds and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida surety bonds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Florida surety bonds?

Florida surety bonds are legally binding agreements that ensure the fulfillment of a contract or obligation. They protect the interests of the parties involved, providing financial security in case of non-compliance. Understanding Florida surety bonds is essential for businesses looking to operate legally and responsibly in the state.

-

How much do Florida surety bonds cost?

The cost of Florida surety bonds varies based on several factors, including the bond amount and the applicant's creditworthiness. Typically, businesses can expect to pay a percentage of the total bond amount as a premium. It's advisable to get quotes from multiple providers to find the best pricing for Florida surety bonds.

-

What types of Florida surety bonds are available?

There are several types of Florida surety bonds, including contractor bonds, license bonds, and court bonds. Each type serves a specific purpose and is required for different industries or situations. Understanding the various types of Florida surety bonds can help businesses determine which ones they need to comply with state regulations.

-

How can I apply for Florida surety bonds?

Applying for Florida surety bonds is a straightforward process. Businesses typically need to fill out an application, provide necessary documentation, and undergo a credit check. Once approved, the bond can be issued quickly, allowing businesses to meet their obligations efficiently.

-

What are the benefits of using airSlate SignNow for Florida surety bonds?

Using airSlate SignNow for Florida surety bonds streamlines the document signing process, making it easy to send and eSign necessary paperwork. This cost-effective solution enhances efficiency and reduces turnaround times. With airSlate SignNow, businesses can manage their Florida surety bonds with ease and confidence.

-

Are Florida surety bonds required for all businesses?

Not all businesses in Florida are required to obtain surety bonds, but many industries do have specific bonding requirements. For example, contractors and certain licensed professionals must secure Florida surety bonds to operate legally. It's important for businesses to research their industry regulations to determine if they need a bond.

-

Can Florida surety bonds be canceled or renewed?

Yes, Florida surety bonds can be canceled or renewed, depending on the terms of the bond agreement. Businesses should review their bond's conditions and consult with their surety provider for specific procedures. Staying informed about the status of Florida surety bonds is crucial for maintaining compliance.

Get more for Florida Surety Bonds

Find out other Florida Surety Bonds

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online