Penalty Form

Understanding the Penalty Charge Notice Form

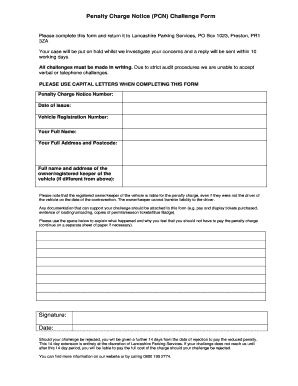

The Penalty Charge Notice (PCN) form is a critical document used to contest parking fines issued by local authorities. This form allows individuals to formally challenge a penalty charge they believe is unjust. The PCN form typically includes details about the alleged violation, the vehicle involved, and the issuing authority. Understanding the specifics of this form is essential for anyone looking to navigate the appeal process effectively.

Steps to Complete the Penalty Charge Notice Form

Completing the Penalty Charge Notice challenge form involves several key steps:

- Gather necessary information, including the PCN number, vehicle registration, and details of the alleged offense.

- Clearly state the grounds for your challenge, providing any evidence that supports your case, such as photographs or witness statements.

- Fill out the form accurately, ensuring all information is correct to avoid delays.

- Review your submission for completeness and clarity before sending it to the appropriate authority.

Legal Use of the Penalty Charge Notice Form

The Penalty Charge Notice form must be used in accordance with local laws and regulations. Each jurisdiction may have specific guidelines regarding how and when the form can be submitted. It is important to familiarize yourself with these rules to ensure that your challenge is valid and that you comply with any deadlines or procedural requirements.

Examples of Using the Penalty Charge Notice Form

There are various scenarios in which individuals may use the Penalty Charge Notice challenge form. Common examples include:

- Challenging a ticket issued for a parking violation that occurred while the driver was loading or unloading goods.

- Disputing a fine based on unclear signage or lack of proper notification regarding parking restrictions.

- Appealing a penalty due to extenuating circumstances, such as a medical emergency that prevented timely payment.

Required Documents for the Penalty Charge Notice Challenge

When submitting a challenge to a Penalty Charge Notice, certain documents may be required to support your case. These can include:

- A copy of the original penalty charge notice.

- Evidence supporting your claim, such as photographs, receipts, or witness statements.

- Any correspondence related to the penalty, including prior appeals or responses from the issuing authority.

Form Submission Methods

The Penalty Charge Notice challenge form can typically be submitted through various methods, depending on the local authority's guidelines. Common submission methods include:

- Online submission through the local authority's website, which may offer a streamlined process.

- Mailing the completed form to the designated address provided on the notice.

- In-person submission at the local authority's office, which may provide immediate confirmation of receipt.

Quick guide on how to complete penalty form

Complete Penalty Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to access the necessary forms and securely keep them online. airSlate SignNow provides all the features you require to create, alter, and electronically sign your documents swiftly without any hold-ups. Handle Penalty Form on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest method to alter and electronically sign Penalty Form without effort

- Obtain Penalty Form and click Get Form to begin.

- Utilize the tools at your disposal to finalize your document.

- Highlight key sections of your documents or obscure sensitive information with features that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which requires just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you prefer to deliver your form, via email, text (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs with just a few clicks from your chosen device. Alter and electronically sign Penalty Form and guarantee effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the penalty form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a charge notice PCN challenge?

A charge notice PCN challenge refers to the process of disputing a Penalty Charge Notice (PCN) issued for parking or traffic violations. By utilizing airSlate SignNow, you can easily create and send documents to formally challenge the charge notice, ensuring your case is presented clearly and professionally.

-

How can airSlate SignNow help with my charge notice PCN challenge?

airSlate SignNow provides a user-friendly platform to prepare, sign, and send documents related to your charge notice PCN challenge. With customizable templates and eSignature capabilities, you can streamline the process and ensure all necessary information is included in your challenge.

-

Is there a cost associated with using airSlate SignNow for a charge notice PCN challenge?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and provides access to features that simplify the charge notice PCN challenge process, making it a cost-effective solution.

-

What features does airSlate SignNow offer for handling charge notice PCN challenges?

airSlate SignNow includes features such as document templates, eSigning, and secure cloud storage, all of which are beneficial for managing your charge notice PCN challenge. These tools help you create professional documents quickly and keep track of your submissions.

-

Can I integrate airSlate SignNow with other applications for my charge notice PCN challenge?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. This means you can easily manage your charge notice PCN challenge alongside other tools you already use.

-

What are the benefits of using airSlate SignNow for a charge notice PCN challenge?

Using airSlate SignNow for your charge notice PCN challenge provides numerous benefits, including time savings, increased efficiency, and enhanced document security. The platform simplifies the entire process, allowing you to focus on building a strong case against the charge notice.

-

How secure is airSlate SignNow when dealing with charge notice PCN challenges?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your documents and personal information while you manage your charge notice PCN challenge, ensuring peace of mind.

Get more for Penalty Form

Find out other Penalty Form

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF