TAX FILER INFORMATION Student 1213 Pub Concordia University

Understanding the TAX FILER INFORMATION Student 1213 pub Concordia University

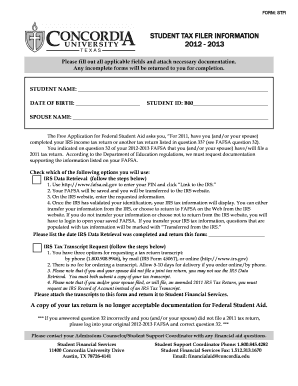

The TAX FILER INFORMATION Student 1213 pub Concordia University is a specific form designed for students at Concordia University to provide essential tax-related information. This form is crucial for students who may be applying for financial aid, scholarships, or tax credits. It helps ensure that the university has accurate information regarding the student's tax status, which can impact their financial aid eligibility and tax obligations.

Steps to Complete the TAX FILER INFORMATION Student 1213 pub Concordia University

Completing the TAX FILER INFORMATION Student 1213 pub involves several key steps. First, gather all necessary documentation, such as your Social Security number and any relevant tax documents. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay particular attention to sections that require financial details, as errors can lead to delays in processing. After completing the form, review it for any mistakes before submitting it according to the instructions provided.

Key Elements of the TAX FILER INFORMATION Student 1213 pub Concordia University

This form includes several important sections that students must fill out. Key elements typically involve personal identification information, income details, and tax filing status. Additionally, students may need to provide information about their dependents, if applicable. Each section is designed to capture comprehensive data that reflects the student's financial situation, which is vital for accurate assessment by the university.

Legal Use of the TAX FILER INFORMATION Student 1213 pub Concordia University

The TAX FILER INFORMATION Student 1213 pub is used legally within the context of financial aid and tax reporting. It ensures that the university complies with federal and state regulations regarding student financial aid. By accurately reporting tax information, students help the institution maintain transparency and integrity in its financial assistance programs, which is essential for both compliance and ethical standards.

Obtaining the TAX FILER INFORMATION Student 1213 pub Concordia University

Students can obtain the TAX FILER INFORMATION Student 1213 pub directly from Concordia University’s financial aid office or through the university’s official website. It is advisable to check for the most recent version of the form to ensure compliance with any updates or changes in tax regulations. Additionally, students may contact the financial aid office for guidance on how to fill out the form correctly.

IRS Guidelines Related to the TAX FILER INFORMATION Student 1213 pub Concordia University

When completing the TAX FILER INFORMATION Student 1213 pub, it is important to adhere to IRS guidelines. These guidelines provide clarity on what constitutes taxable income, how to report it, and the implications for financial aid. Understanding these regulations helps students accurately represent their financial situation, which can affect their eligibility for various aid programs. Students should familiarize themselves with the IRS publications relevant to student taxation to ensure compliance.

Quick guide on how to complete tax filer information student 1213 pub concordia university

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage [SKS] on any device through airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronic sign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TAX FILER INFORMATION Student 1213 pub Concordia University

Create this form in 5 minutes!

How to create an eSignature for the tax filer information student 1213 pub concordia university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TAX FILER INFORMATION Student 1213 pub Concordia University?

The TAX FILER INFORMATION Student 1213 pub Concordia University is a document that provides essential tax information for students at Concordia University. It helps students understand their tax obligations and benefits, ensuring they are well-informed when filing their taxes.

-

How can airSlate SignNow assist with the TAX FILER INFORMATION Student 1213 pub Concordia University?

airSlate SignNow simplifies the process of signing and sending the TAX FILER INFORMATION Student 1213 pub Concordia University. With our user-friendly platform, students can easily eSign their documents, ensuring a quick and efficient submission process.

-

What are the pricing options for using airSlate SignNow for TAX FILER INFORMATION Student 1213 pub Concordia University?

airSlate SignNow offers flexible pricing plans that cater to different needs, including students needing to manage their TAX FILER INFORMATION Student 1213 pub Concordia University. Our cost-effective solutions ensure that you can access essential features without breaking the bank.

-

What features does airSlate SignNow provide for managing TAX FILER INFORMATION Student 1213 pub Concordia University?

Our platform includes features such as document templates, secure eSigning, and real-time tracking, all tailored to help you manage your TAX FILER INFORMATION Student 1213 pub Concordia University efficiently. These tools streamline the process, making it easier for students to handle their tax documents.

-

Are there any benefits to using airSlate SignNow for TAX FILER INFORMATION Student 1213 pub Concordia University?

Using airSlate SignNow for your TAX FILER INFORMATION Student 1213 pub Concordia University offers numerous benefits, including enhanced security, reduced paperwork, and faster processing times. Our solution empowers students to focus on their studies while we handle the document management.

-

Can airSlate SignNow integrate with other tools for managing TAX FILER INFORMATION Student 1213 pub Concordia University?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage your TAX FILER INFORMATION Student 1213 pub Concordia University alongside other tools you may already be using. This integration enhances your workflow and ensures all your documents are in one place.

-

Is airSlate SignNow secure for handling TAX FILER INFORMATION Student 1213 pub Concordia University?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your TAX FILER INFORMATION Student 1213 pub Concordia University. You can trust that your sensitive information is safe with us.

Get more for TAX FILER INFORMATION Student 1213 pub Concordia University

Find out other TAX FILER INFORMATION Student 1213 pub Concordia University

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document