Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

What is the Virginia Resident Form 760 Individual Income Tax Return

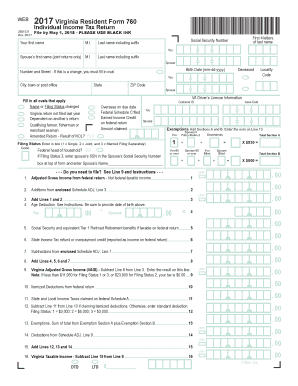

The Virginia Resident Form 760 is the official document used by residents of Virginia to report their individual income for state tax purposes. This form is essential for calculating the amount of state income tax owed based on the taxpayer's income, deductions, and credits. It is specifically designed for individuals who are considered full-year residents of Virginia and need to declare their income from all sources, including wages, interest, dividends, and other taxable income.

Steps to complete the Virginia Resident Form 760 Individual Income Tax Return

Completing the Virginia Resident Form 760 involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, such as W-2 forms, 1099 forms, and records of any other income.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Complete the sections detailing your total income, including wages, interest, and dividends.

- Claim deductions and credits: Review the available deductions and credits to reduce your taxable income, and fill in the appropriate sections.

- Calculate tax liability: Use the tax tables provided by the Virginia Department of Taxation to determine your tax liability based on your taxable income.

- Sign and date the form: Ensure that you sign and date the form before submission to validate it.

How to obtain the Virginia Resident Form 760 Individual Income Tax Return

The Virginia Resident Form 760 can be obtained through several methods:

- Online: Download the form directly from the Virginia Department of Taxation's official website in PDF format.

- Tax preparation software: Many tax preparation programs include the Virginia Resident Form 760, allowing for electronic filing.

- Local tax offices: Visit local tax offices or libraries where physical copies of the form may be available.

Key elements of the Virginia Resident Form 760 Individual Income Tax Return

Understanding the key elements of the Virginia Resident Form 760 is crucial for accurate completion:

- Filing status: Indicate whether you are filing as single, married filing jointly, or married filing separately.

- Income details: Clearly report all sources of income, including wages, salaries, and investment income.

- Deductions: Identify applicable deductions, such as standard or itemized deductions, to reduce taxable income.

- Tax credits: Include any eligible tax credits that can further reduce your tax liability.

- Signature: A valid signature is required to authenticate the form and confirm that the information provided is accurate.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Virginia Resident Form 760 to avoid penalties:

- Annual filing deadline: The form is typically due on May 1 for the previous tax year.

- Extensions: If you cannot meet the deadline, you may file for an extension, which generally extends the deadline to November 1.

Legal use of the Virginia Resident Form 760 Individual Income Tax Return

The Virginia Resident Form 760 is legally binding once signed and submitted. It must be filled out accurately to comply with state tax laws. Misrepresentation or failure to file can result in penalties, including fines and interest on unpaid taxes. It is essential to ensure that all reported income and deductions are legitimate and supported by documentation to avoid legal complications.

Quick guide on how to complete 2017 virginia resident form 760 individual income tax return 2017 virginia resident form 760

Effortlessly prepare Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Easily modify and eSign Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 without hassle

- Find Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

Tax Policy: How can I use my Individual Taxpayer Identification Number as a resident alien with no income to form an LLC?

The State of Wyoming, which is where you say you want to form the LLC, does not require that you have an EIN in order to form the LLC; all that you are required to do is file articles of organization and have a registered agent with an address in Wyoming. In fact, I'm not aware of any state in which you must have an EIN in order to form an LLC.The IRS does not require that you have an EIN unless you have employees, operate your business as a corporation (which you probably don't need to do as a single-member LLC), or some other special situations; see http://www.irs.gov/businesses/sm.... If you don't absolutely need an EIN, I wouldn't apply for one.As far as the ITIN goes, you will not be able to get one without a copy of the federal tax return unless one of the exceptions listed in the instructions applies. The most common exceptions are (a) you open an interest-bearing account with a bank and the bank asks for one so that they can report interest to the IRS, and (b) you are a student or professor receiving a stipend or honoraria. Since you say you have no income, I doubt that any of the exceptions applies, but it doesn't hurt to check - look at IRS Publication 1915, http://www.irs.gov/pub/irs-pdf/p....

-

Is the filing of Individual Income tax returns mandatory to claim Relief u/s 89(1) of the income tax act? Suppose I received arrears of 2014-15 in 2017-18, is ITR mandatory for 2014-15? Or is relief allowed by filing form 10E?

Its not mandatory to file ITR for 2014–15. However you need to consider the income of 2014–15, to calculate the relief u.s 89(1), basically the calculation is to consider the fact that had the amount been received in 2014–15, what would be tax liablity, and its not appropriate to pay the tax liablity on arrears received, considering it completely in 2017–18.For any further information you can ping me at sfstaxsolutions17@gmail.com

Create this form in 5 minutes!

How to create an eSignature for the 2017 virginia resident form 760 individual income tax return 2017 virginia resident form 760

How to make an eSignature for the 2017 Virginia Resident Form 760 Individual Income Tax Return 2017 Virginia Resident Form 760 online

How to create an electronic signature for your 2017 Virginia Resident Form 760 Individual Income Tax Return 2017 Virginia Resident Form 760 in Google Chrome

How to make an eSignature for signing the 2017 Virginia Resident Form 760 Individual Income Tax Return 2017 Virginia Resident Form 760 in Gmail

How to create an electronic signature for the 2017 Virginia Resident Form 760 Individual Income Tax Return 2017 Virginia Resident Form 760 from your mobile device

How to make an eSignature for the 2017 Virginia Resident Form 760 Individual Income Tax Return 2017 Virginia Resident Form 760 on iOS devices

How to create an electronic signature for the 2017 Virginia Resident Form 760 Individual Income Tax Return 2017 Virginia Resident Form 760 on Android devices

People also ask

-

What is the Virginia Resident Form 760 Individual Income Tax Return?

The Virginia Resident Form 760 Individual Income Tax Return is the official form used by Virginia residents to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and need to comply with Virginia tax regulations. By accurately completing the Virginia Resident Form 760, taxpayers can ensure they fulfill their tax obligations and potentially qualify for various credits.

-

How can I eSign the Virginia Resident Form 760 Individual Income Tax Return?

With airSlate SignNow, you can easily eSign the Virginia Resident Form 760 Individual Income Tax Return in just a few clicks. Our platform allows you to upload your completed tax form, add your signature, and send it securely to the necessary parties. This simplifies the process of submitting your tax return, making it faster and more efficient.

-

Is there a cost to use airSlate SignNow for the Virginia Resident Form 760?

AirSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. You can choose from various subscription options that allow you to eSign the Virginia Resident Form 760 Individual Income Tax Return without breaking the bank. Check our website for detailed pricing information and find the plan that suits you best.

-

What features does airSlate SignNow offer for managing the Virginia Resident Form 760?

AirSlate SignNow provides a user-friendly interface and robust features for managing your Virginia Resident Form 760 Individual Income Tax Return. Features include automated reminders, template creation, and secure storage options, ensuring that your tax documents are easily accessible and organized. This streamlines the process of completing and submitting your tax return.

-

Can I integrate airSlate SignNow with other applications for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various popular applications, enhancing your ability to manage the Virginia Resident Form 760 Individual Income Tax Return. You can connect with platforms like Google Drive, Dropbox, and others to streamline your document management process. This integration helps ensure that your tax documents are in one place and easily accessible.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your Virginia Resident Form 760 Individual Income Tax Return offers numerous benefits, including enhanced security, ease of use, and time-saving features. Our platform ensures that your documents are stored securely and can be signed electronically from any device. This not only speeds up the filing process but also reduces the likelihood of errors.

-

How do I get started with airSlate SignNow for my Virginia Resident Form 760?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, upload your Virginia Resident Form 760 Individual Income Tax Return, and follow the prompts to eSign and send your document. Our intuitive platform guides you through each step, making it accessible even for those who are not tech-savvy.

Get more for Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- Metlife change of beneficiary by policy owner form mail to

- Authorization for payoff form

- Home affordable modification program government monitoring data form

- Uniform residential loan application fillable 177159

- Vba 22 8691 arepdf form

- Direct deposit forms for provident bank

- Line of credit ssfcu form

- Form 7004 rev december

Find out other Virginia Resident Form 760 Individual Income Tax Return Virginia Resident Form 760

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document