PRIVATE LOAN INFORMATION

Understanding Private Loan Information

Private loan information encompasses the details regarding loans that are not funded by the government. These loans are typically offered by banks, credit unions, or private lenders. Understanding this information is crucial for borrowers as it outlines the terms, interest rates, repayment schedules, and eligibility criteria associated with private loans. It is important to carefully review this information to make informed financial decisions.

How to Obtain Private Loan Information

To obtain private loan information, individuals can start by researching various lenders online. Many financial institutions provide comprehensive details about their loan offerings on their websites. Additionally, potential borrowers can contact lenders directly to request brochures or detailed documentation. It is advisable to compare several lenders to find the best terms and rates that suit individual financial situations.

Key Elements of Private Loan Information

Key elements of private loan information include:

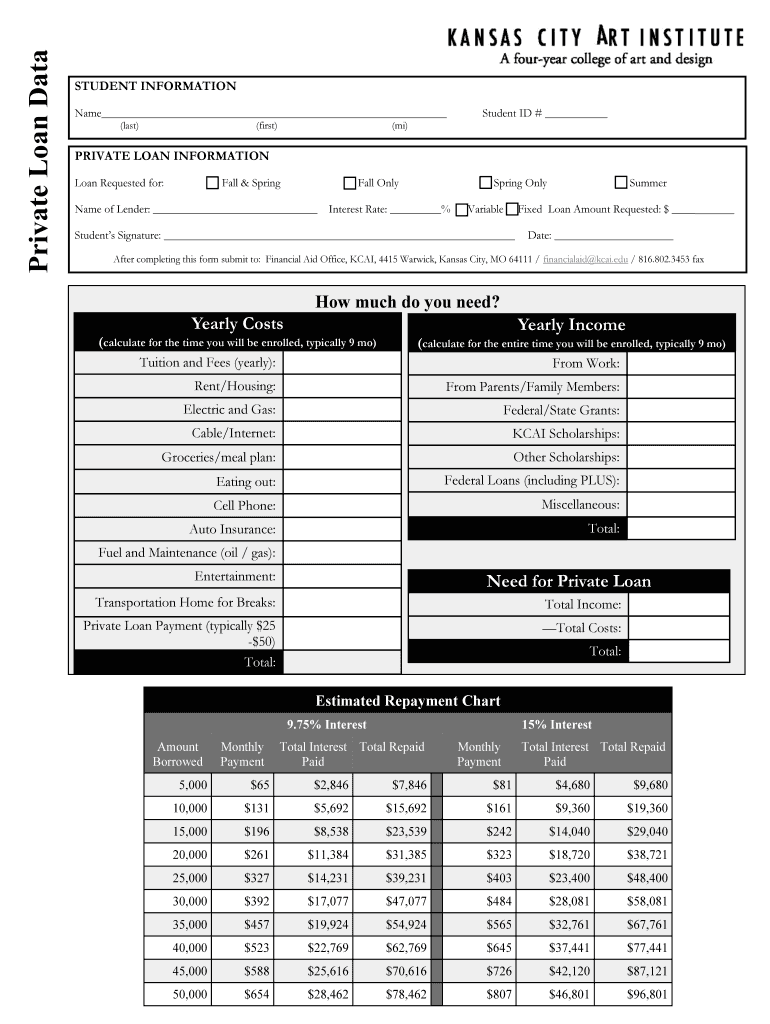

- Loan Amount: The total amount of money that can be borrowed.

- Interest Rates: The cost of borrowing, expressed as a percentage of the loan amount.

- Repayment Terms: The schedule and duration for repaying the loan.

- Fees: Any additional charges associated with the loan, such as origination fees or late payment penalties.

- Eligibility Criteria: The requirements that borrowers must meet to qualify for the loan.

Steps to Complete Private Loan Information

Completing private loan information typically involves several steps:

- Gather necessary personal and financial documents, such as income statements and credit reports.

- Research and compare different lenders to identify the best loan options.

- Fill out the loan application form provided by the chosen lender.

- Submit the application along with any required documentation.

- Review the loan agreement carefully before signing to ensure understanding of all terms.

Legal Use of Private Loan Information

Legal use of private loan information is governed by federal and state laws. Borrowers should ensure that they are aware of their rights and responsibilities under the Truth in Lending Act, which mandates clear disclosure of loan terms. Additionally, lenders must comply with regulations regarding fair lending practices. It is advisable for borrowers to consult legal resources or professionals if they have questions about the legality of their loan agreements.

Examples of Using Private Loan Information

Private loan information can be utilized in various scenarios, such as:

- Financing education through private student loans, which often require detailed information about tuition costs and living expenses.

- Securing funds for home improvement projects, where borrowers need to understand the loan terms to budget effectively.

- Consolidating debt, allowing individuals to combine multiple loans into one, necessitating a thorough understanding of interest rates and repayment plans.

Quick guide on how to complete private loan information

Effortlessly prepare [SKS] on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PRIVATE LOAN INFORMATION

Create this form in 5 minutes!

How to create an eSignature for the private loan information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PRIVATE LOAN INFORMATION and how can it help my business?

PRIVATE LOAN INFORMATION refers to the details and terms associated with private loans, which can be crucial for businesses seeking funding. Understanding this information can help you make informed decisions about financing options that suit your needs. With airSlate SignNow, you can easily manage and eSign documents related to private loans, streamlining the process.

-

How does airSlate SignNow ensure the security of my PRIVATE LOAN INFORMATION?

airSlate SignNow prioritizes the security of your PRIVATE LOAN INFORMATION by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect sensitive data, ensuring that your documents are safe from unauthorized access. You can confidently manage your loan documents knowing they are secure.

-

What features does airSlate SignNow offer for managing PRIVATE LOAN INFORMATION?

airSlate SignNow offers a range of features for managing PRIVATE LOAN INFORMATION, including customizable templates, automated workflows, and real-time tracking of document status. These tools help you efficiently handle loan agreements and related paperwork, saving you time and reducing errors. Our user-friendly interface makes it easy to navigate through your documents.

-

Is there a cost associated with using airSlate SignNow for PRIVATE LOAN INFORMATION?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. We offer various pricing plans that cater to different needs, ensuring you get the best value for managing your PRIVATE LOAN INFORMATION. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for managing PRIVATE LOAN INFORMATION?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to manage your PRIVATE LOAN INFORMATION alongside your existing tools. This integration enhances your workflow and ensures that all your documents are easily accessible in one place. Popular integrations include CRM systems and cloud storage services.

-

How can airSlate SignNow improve the efficiency of handling PRIVATE LOAN INFORMATION?

By using airSlate SignNow, you can signNowly improve the efficiency of handling PRIVATE LOAN INFORMATION through automated document workflows and eSigning capabilities. This reduces the time spent on paperwork and minimizes the risk of errors. Our platform allows for quick approvals and faster turnaround times, helping you secure loans more efficiently.

-

What support options are available for questions about PRIVATE LOAN INFORMATION?

airSlate SignNow provides comprehensive support options for any questions regarding PRIVATE LOAN INFORMATION. You can access our help center, which includes FAQs, tutorials, and guides. Additionally, our customer support team is available via chat and email to assist you with any specific inquiries or issues you may encounter.

Get more for PRIVATE LOAN INFORMATION

- Sample draft for request letter of employment form

- Motion fees 497332675 form

- Release of liability for student travel off campus for field trip form

- Interior design services agreement form

- Trust agreement form 497332678

- Letter promotion 497332679 form

- Motion summary judgment 497332680 form

- Release of college from liability regarding weight training form

Find out other PRIVATE LOAN INFORMATION

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe