I We Affirm that I We Did Not and Will Not File a Federal Income Tax Return Marist Form

Understanding the I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

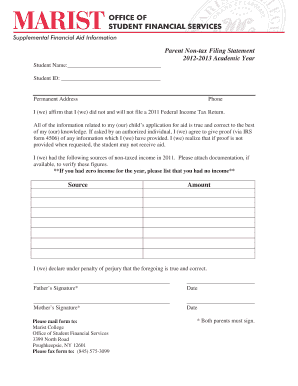

The form "I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist" serves as a declaration for individuals or entities that have not filed, and do not intend to file, a federal income tax return. This form is often used in various contexts, such as financial aid applications or specific legal situations where proof of non-filing is required. It helps clarify the tax status of the individual or entity, ensuring compliance with regulations and providing necessary documentation for various processes.

Steps to Complete the I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

Completing this form involves several straightforward steps:

- Begin by clearly stating your full name and any relevant identification numbers, such as Social Security Number or Employer Identification Number.

- Affirm your non-filing status by checking the appropriate boxes or providing a written statement as required.

- Include any additional information requested, such as your current address and contact details.

- Review the form for accuracy and completeness before submission.

- Sign and date the form to validate your declaration.

Legal Use of the I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

This form holds legal significance as it serves as an official statement regarding your tax filing status. It may be required in situations such as applying for federal financial aid, securing loans, or during audits. By submitting this form, you affirm that you are not subject to federal income tax obligations, which can protect you from potential legal issues related to tax compliance. It is essential to ensure that the information provided is truthful and accurate, as false declarations may lead to penalties.

Examples of Using the I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

There are various scenarios where this form may be applicable:

- A student applying for federal financial aid may need to submit this form to demonstrate that they have not filed taxes.

- An individual seeking a loan may be required to provide this affirmation to verify their tax status.

- During a legal proceeding, a party may need to present this form to affirm their non-filing status as part of their financial disclosures.

IRS Guidelines Regarding the I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

The IRS provides guidelines that outline the conditions under which individuals or entities are required to file a federal income tax return. Understanding these guidelines is crucial when completing the form. Generally, if your income falls below a certain threshold or if you meet specific criteria (such as age or filing status), you may not be required to file. This form serves as an affirmation of that status, ensuring that you are in compliance with IRS regulations.

Required Documents for the I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

When preparing to submit the form, you may need to gather certain documents to support your declaration. These might include:

- Proof of income, such as pay stubs or bank statements, to demonstrate that you did not meet the filing threshold.

- Identification documents, such as a driver's license or Social Security card.

- Any correspondence from the IRS or other tax authorities related to your filing status.

Eligibility Criteria for the I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

To use this form, individuals must meet specific eligibility criteria. Generally, this includes:

- Having a total income below the federal filing threshold for the applicable tax year.

- Not being claimed as a dependent on someone else's tax return.

- Meeting other specific conditions set forth by the IRS, which may vary based on filing status or age.

Quick guide on how to complete i we affirm that i we did not and will not file a federal income tax return marist

Prepare [SKS] effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the i we affirm that i we did not and will not file a federal income tax return marist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 'I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist'?

airSlate SignNow is a powerful eSignature solution that allows users to send and sign documents electronically. If you need to affirm that you did not and will not file a federal income tax return, our platform can help you create and manage the necessary documentation efficiently.

-

How can airSlate SignNow help me with tax-related documents?

With airSlate SignNow, you can easily create, send, and eSign tax-related documents, including affirmations like 'I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist.' Our user-friendly interface ensures that you can manage your documents without hassle.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs. Whether you are an individual or a large organization, you can find a plan that fits your budget while providing the necessary features to handle documents like 'I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist.'

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including those affirming tax statuses, are protected. We use advanced encryption and security protocols to safeguard your information, giving you peace of mind when managing documents like 'I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist.'

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your workflow. This means you can easily incorporate documents affirming your tax status, such as 'I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist,' into your existing systems.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features including customizable templates, automated workflows, and real-time tracking. These features make it easy to manage documents like 'I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist,' ensuring that you can handle your paperwork efficiently.

-

How can I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features and see how we can assist you in managing documents like 'I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist.' Our support team is also available to help you through the onboarding process.

Get more for I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

- South eastern distance rider association distanceriding form

- Corporate partner application national sheriffs association sheriffs form

- The same forms are used for these ships where occurring ashgate

- Invasive plant inventory and bird cherry control trials alaska form

- The taxpayer advocate service of the irs form

- Expiration date 01312026 form

- Estate sale contract template form

- Euromillions syndicate contract template form

Find out other I we Affirm That I we Did Not And Will Not File A Federal Income Tax Return Marist

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form