Sc1040a Form

What is the Sc1040a Form

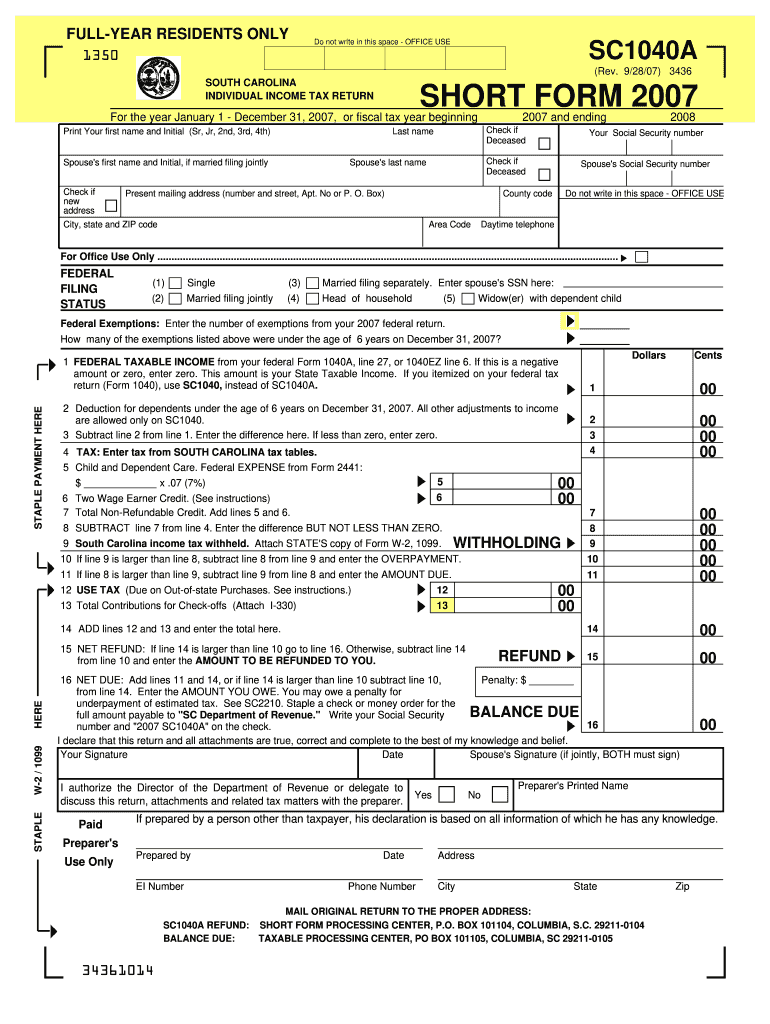

The Sc1040a Form is a simplified version of the standard tax return form used by residents of South Carolina. It is designed for individuals who meet specific criteria, allowing them to file their state income taxes more efficiently. This form is typically used by taxpayers with straightforward financial situations, such as those who do not itemize deductions and have a limited number of income sources. Understanding the purpose of the Sc1040a Form is essential for ensuring compliance with state tax regulations.

How to use the Sc1040a Form

Using the Sc1040a Form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully read the instructions provided with the form to ensure accurate completion. Fill out the form by entering your personal information, income details, and any applicable deductions. After completing the form, review it for errors before submitting it to the South Carolina Department of Revenue. The form can be filed electronically or mailed, depending on your preference.

Steps to complete the Sc1040a Form

Completing the Sc1040a Form can be straightforward if you follow these steps:

- Collect all relevant financial documents, including income statements.

- Download the Sc1040a Form from the South Carolina Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages and any other earnings.

- Apply any deductions or credits you may qualify for.

- Calculate your total tax liability based on the provided instructions.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the appropriate address.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Sc1040a Form to avoid penalties. Typically, the deadline for submitting your South Carolina state tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you require more time to file, you can request an extension, but this does not extend the time to pay any taxes owed.

Legal use of the Sc1040a Form

The Sc1040a Form is legally recognized for filing state income taxes in South Carolina. Using this form is appropriate for eligible taxpayers who meet the criteria outlined by the South Carolina Department of Revenue. Filing this form accurately and on time is essential to comply with state tax laws and avoid potential legal issues, including fines or penalties.

Required Documents

When preparing to complete the Sc1040a Form, certain documents are necessary to ensure accurate reporting. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions or credits, if applicable

- Personal identification information, such as your Social Security number

Who Issues the Form

The Sc1040a Form is issued by the South Carolina Department of Revenue. This state agency is responsible for administering tax laws and collecting state taxes. Taxpayers can obtain the form directly from the agency's website or through authorized tax preparation services. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Quick guide on how to complete sc1040a form

Effortlessly prepare Sc1040a Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Sc1040a Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Sc1040a Form effortlessly

- Locate Sc1040a Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Sc1040a Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1040a form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC1040A Form?

The SC1040A Form is a simplified tax form used by residents of South Carolina to report their income and calculate their state tax liability. It is designed for individuals with straightforward tax situations, making it easier to file. Understanding the SC1040A Form is essential for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the SC1040A Form?

airSlate SignNow provides a seamless platform for electronically signing and sending the SC1040A Form. Our solution simplifies the document management process, allowing users to complete their tax forms quickly and securely. With airSlate SignNow, you can ensure that your SC1040A Form is signed and submitted on time.

-

What are the pricing options for using airSlate SignNow for the SC1040A Form?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Our plans are cost-effective, ensuring that you can manage your SC1040A Form and other documents without breaking the bank. Visit our pricing page for detailed information on the options available.

-

Is airSlate SignNow secure for handling the SC1040A Form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the SC1040A Form. We use advanced encryption and security protocols to protect your data. You can trust airSlate SignNow to keep your information secure while you manage your tax forms.

-

Can I integrate airSlate SignNow with other software for the SC1040A Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the SC1040A Form. Whether you use accounting software or document management systems, our platform can enhance your productivity through seamless integration.

-

What features does airSlate SignNow offer for the SC1040A Form?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for the SC1040A Form. These tools help you manage your documents efficiently and ensure that all necessary signatures are obtained promptly. Our user-friendly interface makes it easy to navigate through the process.

-

How does airSlate SignNow improve the eSigning process for the SC1040A Form?

airSlate SignNow enhances the eSigning process for the SC1040A Form by providing a fast and intuitive platform for users. With features like mobile signing and reminders, you can ensure that your documents are signed quickly and efficiently. This reduces delays and helps you meet important tax deadlines.

Get more for Sc1040a Form

Find out other Sc1040a Form

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online