New Employee Form

What is the New Employee Form

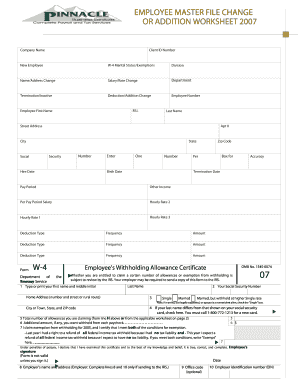

The New Employee Form is a crucial document used by employers in the United States to collect essential information from newly hired employees. This form typically includes personal details such as the employee's name, address, Social Security number, and tax withholding preferences. It serves as a foundational step in the onboarding process, ensuring that employers have the necessary information to comply with federal and state regulations. Proper completion of this form is vital for payroll processing and tax reporting purposes.

Steps to complete the New Employee Form

Completing the New Employee Form involves several important steps to ensure accuracy and compliance. First, the employee should gather personal information, including their Social Security number and tax filing status. Next, they will fill out sections related to personal identification, tax withholding preferences, and any benefits enrollment. It is essential to review the form thoroughly before submission to avoid any errors. Once completed, the form should be submitted to the HR department or the designated personnel responsible for processing employee documents.

Key elements of the New Employee Form

The New Employee Form contains several key elements that are crucial for both the employer and the employee. These elements typically include:

- Personal Information: Name, address, phone number, and email address.

- Social Security Number: Required for tax purposes and verification of identity.

- Tax Withholding Information: Employees indicate their filing status and any additional withholding allowances.

- Emergency Contact Information: Important for workplace safety and communication in case of emergencies.

- Benefits Enrollment: Sections for selecting health insurance and retirement plan options.

Legal use of the New Employee Form

The New Employee Form must be used in accordance with various legal requirements set forth by federal and state laws. Employers are required to collect accurate information to comply with tax laws and labor regulations. Additionally, the form should be stored securely to protect the employee's personal information. Employers must also ensure that they do not discriminate against employees based on the information provided in this form, adhering to regulations such as the Equal Employment Opportunity Commission (EEOC) guidelines.

Form Submission Methods

Submitting the New Employee Form can be done through various methods, depending on the employer's policies. Common submission methods include:

- Online Submission: Many companies utilize digital platforms for employees to fill out and submit forms electronically.

- Mail: Employees may also have the option to print the form, complete it manually, and send it via postal mail.

- In-Person Submission: Some employers require employees to submit the form in person to the HR department during the onboarding process.

Required Documents

When completing the New Employee Form, certain documents may be required to verify the information provided. Commonly required documents include:

- Identification: A government-issued photo ID, such as a driver's license or passport.

- Social Security Card: To verify the employee's Social Security number.

- Work Authorization: For non-citizens, proof of eligibility to work in the U.S. may be necessary.

Quick guide on how to complete new employee form 14931746

Complete New Employee Form effortlessly on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without any holdups. Manage New Employee Form across any platform with airSlate SignNow’s Android or iOS applications and streamline any document-related procedure today.

The most efficient way to edit and eSign New Employee Form with ease

- Obtain New Employee Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign New Employee Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new employee form 14931746

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a New Employee Form and why is it important?

A New Employee Form is a document that collects essential information from new hires, such as personal details, tax information, and emergency contacts. It is important because it streamlines the onboarding process, ensuring that all necessary data is gathered efficiently and securely.

-

How does airSlate SignNow simplify the New Employee Form process?

airSlate SignNow simplifies the New Employee Form process by allowing businesses to create, send, and eSign forms electronically. This eliminates the need for paper forms, reduces errors, and speeds up the onboarding process, making it easier for HR teams to manage new hires.

-

What features does airSlate SignNow offer for New Employee Forms?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning for New Employee Forms. These features help businesses tailor the onboarding experience to their needs while ensuring compliance and security.

-

Is there a cost associated with using airSlate SignNow for New Employee Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Each plan provides access to features that enhance the New Employee Form process, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other HR software for New Employee Forms?

Absolutely! airSlate SignNow integrates seamlessly with various HR software solutions, allowing you to streamline the New Employee Form process. This integration ensures that all employee data is synchronized across platforms, enhancing efficiency and reducing manual entry.

-

What are the benefits of using airSlate SignNow for New Employee Forms?

Using airSlate SignNow for New Employee Forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By digitizing the onboarding process, businesses can focus more on engaging with new hires rather than managing paperwork.

-

How secure is the information collected in New Employee Forms with airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect the information collected in New Employee Forms. This ensures that sensitive employee data remains confidential and secure throughout the onboarding process.

Get more for New Employee Form

Find out other New Employee Form

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast