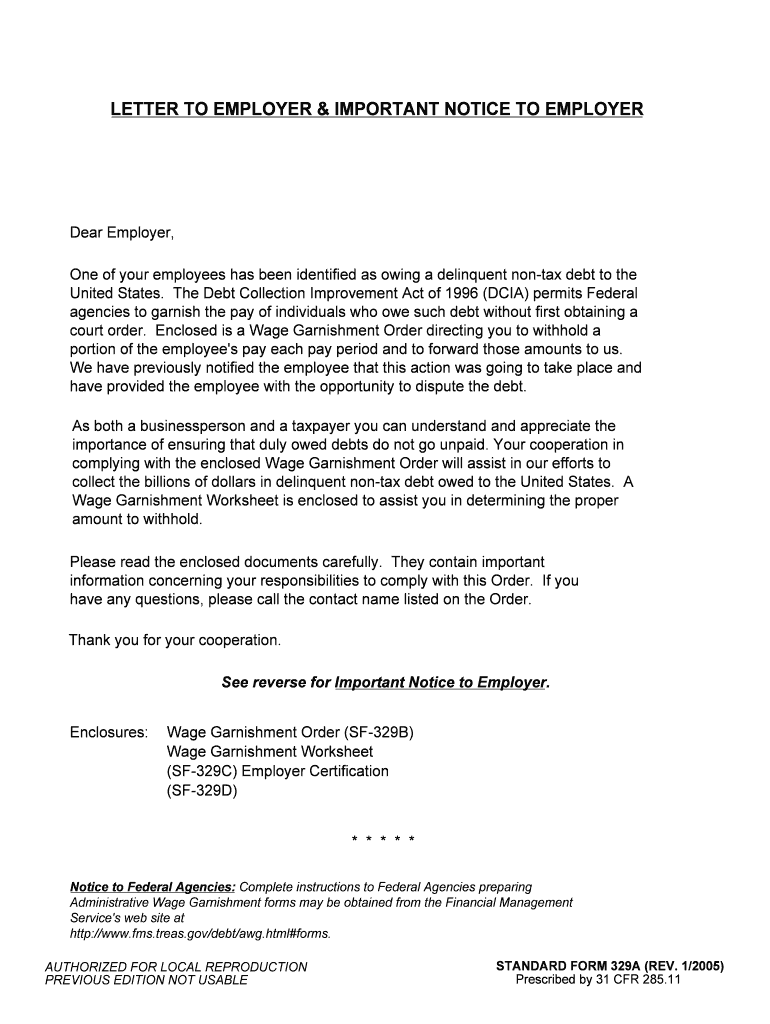

LETTER to EMPLOYER & IMPORTANT NOTICE GSA Gov Form

Key elements of a wage garnishment letter

A wage garnishment letter is a formal document that notifies an employer about the garnishment of an employee's wages. Understanding its key elements is essential for both employers and employees. The critical components of this letter include:

- Employee Information: Name, address, and Social Security number of the employee whose wages are being garnished.

- Creditor Information: Details of the creditor or agency requesting the garnishment, including their name and contact information.

- Amount to be Garnished: A clear statement of the amount to be deducted from the employee's wages and the frequency of these deductions.

- Legal Basis: Reference to the legal authority under which the garnishment is being issued, such as a court order or government directive.

- Instructions for the Employer: Specific instructions on how to process the garnishment, including timelines and payment methods.

- Contact Information: A point of contact for any questions or clarifications regarding the garnishment.

Steps to complete a wage garnishment letter

Completing a wage garnishment letter involves several important steps to ensure compliance with legal requirements. Follow these steps to create an effective garnishment letter:

- Gather Necessary Information: Collect all relevant details about the employee, creditor, and the garnishment amount.

- Draft the Letter: Use a clear and professional format to draft the letter, ensuring all key elements are included.

- Review Legal Requirements: Ensure the letter complies with federal and state laws regarding wage garnishment.

- Send the Letter: Deliver the letter to the employer through a secure method, such as certified mail, to confirm receipt.

- Follow Up: Verify with the employer that they have received the letter and understand the garnishment instructions.

Legal use of a wage garnishment letter

The legal use of a wage garnishment letter is governed by federal and state laws. It is crucial for the letter to adhere to these regulations to avoid legal complications. Key considerations include:

- Compliance with the Consumer Credit Protection Act: This act limits the amount that can be garnished and protects employees from excessive deductions.

- State-Specific Laws: Different states may have unique rules regarding the garnishment process, including maximum amounts and notification requirements.

- Proper Documentation: Ensure that all necessary legal documents, such as court orders, are included with the garnishment letter.

- Confidentiality: Maintain the confidentiality of the employee's information throughout the process to comply with privacy laws.

Examples of wage garnishment letters

Providing examples of wage garnishment letters can help clarify how to structure and format these documents. Here are a few scenarios:

- Sample Letter for Court-Ordered Garnishment: This letter includes details about the court case, the amount to be garnished, and instructions for the employer.

- Sample Letter for Child Support Garnishment: This letter specifies the garnishment for child support and outlines the payment schedule.

- Sample Letter for Tax Debt Garnishment: This example highlights the garnishment of wages due to unpaid taxes, including the relevant tax authority information.

Filing deadlines and important dates for wage garnishment

Understanding filing deadlines and important dates is crucial for compliance with wage garnishment procedures. Key dates include:

- Notification Deadline: Employers must notify the employee of the garnishment within a specific timeframe after receiving the garnishment letter.

- Payment Schedule: The letter should outline the schedule for payments to the creditor, including due dates.

- Response Time: Employers may have a limited time to respond to the garnishment notice, so timely action is essential.

Digital vs. paper version of a wage garnishment letter

Both digital and paper versions of a wage garnishment letter can be legally binding, provided they meet specific requirements. Considerations include:

- Legality of eSignatures: Ensure that digital signatures comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws.

- Security Measures: Use secure platforms for sending digital letters to protect sensitive information.

- Record-Keeping: Maintain accurate records of both digital and paper communications for legal compliance and future reference.

Quick guide on how to complete letter to employer amp important notice gsagov

Accomplish LETTER TO EMPLOYER & IMPORTANT NOTICE GSA gov effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, alter, and eSign your documents rapidly without delays. Handle LETTER TO EMPLOYER & IMPORTANT NOTICE GSA gov on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign LETTER TO EMPLOYER & IMPORTANT NOTICE GSA gov with ease

- Obtain LETTER TO EMPLOYER & IMPORTANT NOTICE GSA gov and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign LETTER TO EMPLOYER & IMPORTANT NOTICE GSA gov and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter to employer amp important notice gsagov

How to make an eSignature for the Letter To Employer Amp Important Notice Gsagov in the online mode

How to make an electronic signature for your Letter To Employer Amp Important Notice Gsagov in Chrome

How to generate an electronic signature for putting it on the Letter To Employer Amp Important Notice Gsagov in Gmail

How to create an eSignature for the Letter To Employer Amp Important Notice Gsagov straight from your smart phone

How to make an eSignature for the Letter To Employer Amp Important Notice Gsagov on iOS

How to make an electronic signature for the Letter To Employer Amp Important Notice Gsagov on Android

People also ask

-

What is a wage garnishment employee termination letter?

A wage garnishment employee termination letter is a formal document that notifies employees about the cessation of their employment and details any wage garnishments that will continue after termination. This letter is crucial for legal compliance and ensures that employees are aware of how their debts will be managed post-employment.

-

How can airSlate SignNow help with wage garnishment employee termination letters?

airSlate SignNow allows businesses to create, send, and eSign wage garnishment employee termination letters quickly and efficiently. With its user-friendly interface, you can easily customize the letter template to meet your specific needs, ensuring that all necessary details regarding the garnishment are included.

-

Are there any costs associated with generating a wage garnishment employee termination letter using airSlate SignNow?

airSlate SignNow offers a cost-effective solution for creating wage garnishment employee termination letters, with various pricing plans to suit different business sizes. You can start with a free trial to explore its features before committing to a subscription plan that best fits your needs.

-

What features does airSlate SignNow offer for managing wage garnishment employee termination letters?

Features of airSlate SignNow include template creation for wage garnishment employee termination letters, secure eSigning capabilities, and automated document storage and tracking. This streamlines the entire process, making it easier to manage employee separations while ensuring compliance with legal requirements.

-

Can I integrate airSlate SignNow with other HR software for wage garnishment employee termination letters?

Yes, airSlate SignNow seamlessly integrates with various HR software platforms, allowing for easy management of wage garnishment employee termination letters within your existing systems. This integration helps maintain consistency and accuracy across your HR processes and documentation.

-

What are the benefits of using airSlate SignNow for wage garnishment employee termination letters?

Using airSlate SignNow for wage garnishment employee termination letters provides numerous benefits, including faster document processing, reduced administrative burden, and enhanced compliance with legal requirements. Additionally, its cloud-based system ensures accessibility and security for your sensitive documents.

-

Is it easy to modify a wage garnishment employee termination letter template in airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly interface that enables businesses to easily modify wage garnishment employee termination letter templates. You can quickly adjust the content to reflect specific circumstances or changes in garnishment laws to ensure accurate communication.

Get more for LETTER TO EMPLOYER & IMPORTANT NOTICE GSA gov

- Application for usanaf employee 401k savings plan enrollment form da form 7426 jun

- Fort hood form 385 3 hood army

- Cnic instruction 11103 form

- M2 caliber 50 heavy barrel machine gun firing table i day practice scorecard da form 7448 apr

- Cfl course application cnic form 6110 1 2 pdf

- Fort knox form 5097 ammunition inspection fort knox ky knox army

- Navsup form 1046

- Da form 7455

Find out other LETTER TO EMPLOYER & IMPORTANT NOTICE GSA gov

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free