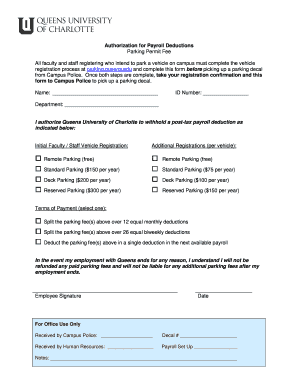

Payroll Deductions Queens University of Charlotte Form

Understanding Payroll Deductions at Queens University of Charlotte

Payroll deductions at Queens University of Charlotte refer to the amounts withheld from an employee's paycheck for various purposes. These deductions can include federal and state taxes, Social Security, Medicare, health insurance premiums, retirement contributions, and other voluntary or mandatory deductions. Understanding these deductions is crucial for employees to manage their finances effectively and ensure compliance with tax regulations.

Steps to Complete Payroll Deductions at Queens University of Charlotte

To complete payroll deductions, employees should follow these steps:

- Review the payroll deduction policies provided by the university.

- Fill out the necessary forms, such as tax withholding forms (e.g., W-4) and benefits enrollment forms.

- Submit the completed forms to the human resources or payroll department.

- Monitor your pay stubs to ensure that the correct deductions are being applied.

Required Documents for Payroll Deductions

Employees must provide specific documents to facilitate payroll deductions. These typically include:

- Completed W-4 form for federal tax withholding.

- State tax withholding form, if applicable.

- Health insurance enrollment forms, if choosing to participate in employer-sponsored plans.

- Retirement plan enrollment forms for contributions to retirement accounts.

Legal Use of Payroll Deductions

Payroll deductions must comply with federal and state laws. Employers are required to withhold certain taxes, such as federal income tax, Social Security, and Medicare. Additionally, voluntary deductions, such as contributions to retirement plans or health insurance, must be authorized by the employee. Understanding these legal requirements helps ensure that both the university and its employees adhere to applicable laws.

IRS Guidelines for Payroll Deductions

The Internal Revenue Service (IRS) provides guidelines on how payroll deductions should be calculated and reported. Employers must follow these guidelines to ensure accurate withholding of federal taxes. Employees can refer to IRS publications for detailed information on tax brackets, allowable deductions, and reporting requirements to ensure compliance with federal tax laws.

Examples of Payroll Deductions at Queens University of Charlotte

Common examples of payroll deductions include:

- Federal income tax withholding based on the employee's W-4 form.

- State income tax withholding, which varies by state.

- Social Security and Medicare contributions, which are mandatory.

- Health insurance premiums for employer-sponsored plans.

- Retirement contributions to plans such as a 403(b).

Form Submission Methods for Payroll Deductions

Employees can submit their payroll deduction forms through various methods, including:

- Online submission via the university's payroll portal.

- Mailing the forms directly to the human resources department.

- In-person submission at the payroll or human resources office.

Quick guide on how to complete payroll deductions queens university of charlotte

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Handle [SKS] on any device using airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your adjustments.

- Choose your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or disorganized documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] while ensuring seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Payroll Deductions Queens University Of Charlotte

Create this form in 5 minutes!

How to create an eSignature for the payroll deductions queens university of charlotte

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Payroll Deductions at Queens University Of Charlotte?

Payroll deductions at Queens University Of Charlotte refer to the amounts withheld from an employee's paycheck for various purposes, such as taxes, benefits, and retirement contributions. Understanding these deductions is crucial for managing your finances effectively. airSlate SignNow can help streamline the documentation process related to these deductions.

-

How can airSlate SignNow assist with Payroll Deductions at Queens University Of Charlotte?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to Payroll Deductions at Queens University Of Charlotte. With its user-friendly interface, you can easily create, send, and track documents, ensuring that all payroll-related paperwork is handled smoothly and securely.

-

What features does airSlate SignNow offer for Payroll Deductions at Queens University Of Charlotte?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for Payroll Deductions at Queens University Of Charlotte. These features enhance efficiency and reduce the time spent on paperwork, allowing you to focus on more important tasks.

-

Is airSlate SignNow cost-effective for managing Payroll Deductions at Queens University Of Charlotte?

Yes, airSlate SignNow is a cost-effective solution for managing Payroll Deductions at Queens University Of Charlotte. With various pricing plans available, you can choose one that fits your budget while still benefiting from a comprehensive eSigning and document management solution.

-

Can airSlate SignNow integrate with existing payroll systems at Queens University Of Charlotte?

Absolutely! airSlate SignNow can seamlessly integrate with existing payroll systems at Queens University Of Charlotte. This integration ensures that all Payroll Deductions are accurately reflected in your payroll processes, enhancing overall efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for Payroll Deductions at Queens University Of Charlotte?

Using airSlate SignNow for Payroll Deductions at Queens University Of Charlotte offers numerous benefits, including improved accuracy, faster processing times, and enhanced compliance. By digitizing your document management, you can reduce errors and ensure that all payroll deductions are handled in a timely manner.

-

How secure is airSlate SignNow for handling Payroll Deductions at Queens University Of Charlotte?

Security is a top priority for airSlate SignNow. When handling Payroll Deductions at Queens University Of Charlotte, all documents are encrypted and stored securely, ensuring that sensitive information remains protected. You can trust airSlate SignNow to keep your payroll data safe.

Get more for Payroll Deductions Queens University Of Charlotte

Find out other Payroll Deductions Queens University Of Charlotte

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online

- How To eSignature Ohio Mechanic's Lien

- eSign Florida Life-Insurance Quote Form Online

- eSign Louisiana Life-Insurance Quote Form Online

- How To eSign Michigan Life-Insurance Quote Form

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form