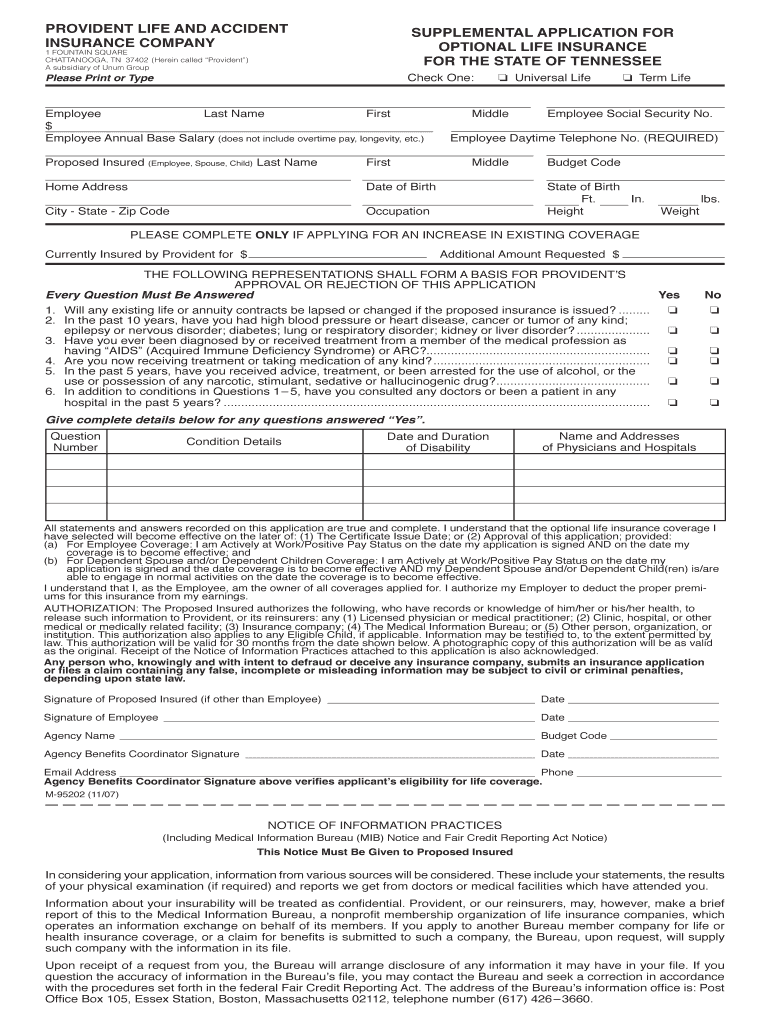

Optional Life Insurance Form

What is Optional Life Insurance

Optional life insurance is a type of life insurance policy that individuals can choose to purchase in addition to any basic life insurance coverage provided by their employer or other sources. This policy allows individuals to secure additional financial protection for their beneficiaries in the event of their untimely death. The coverage amount and premium can vary based on the individual's needs and circumstances, providing flexibility in planning for future financial security.

How to Obtain Optional Life Insurance

To obtain optional life insurance, individuals typically need to follow a straightforward process. First, they should assess their insurance needs, considering factors such as dependents, debts, and future financial obligations. Next, they can research various insurance providers to compare policy options, coverage amounts, and premiums. Once they select a provider, they will need to complete an application, which may require personal and health information. After submitting the application, the insurer will review it and may conduct a medical exam before finalizing the policy.

Steps to Complete the Optional Life Insurance

Completing the optional life insurance application involves several key steps:

- Assess your needs: Determine how much coverage you require based on your financial situation.

- Research providers: Compare different insurance companies and their offerings.

- Fill out the application: Provide necessary personal and health information accurately.

- Submit the application: Send your completed application to the chosen insurance company.

- Undergo medical evaluation: Be prepared for a potential medical exam as part of the underwriting process.

- Review policy terms: Once approved, carefully read the policy details before finalizing your coverage.

Key Elements of Optional Life Insurance

When considering optional life insurance, several key elements should be understood:

- Coverage amount: The total amount paid to beneficiaries upon the policyholder's death.

- Premiums: The regular payments made to maintain the policy, which can vary based on coverage and individual risk factors.

- Beneficiaries: Individuals or entities designated to receive the death benefit.

- Policy terms: The specific conditions and provisions outlined in the insurance contract.

- Exclusions: Situations or conditions under which the policy will not pay out.

Legal Use of Optional Life Insurance

Optional life insurance operates under specific legal frameworks that vary by state. Generally, these policies must comply with state insurance regulations, which govern aspects such as policy language, consumer protections, and claims handling. It is essential for policyholders to understand their rights and obligations under the law, including the process for filing claims and any potential tax implications associated with the death benefit.

Eligibility Criteria

Eligibility for optional life insurance typically depends on several factors, including age, health status, and sometimes occupation. Insurers may require applicants to provide medical history and undergo a health assessment to determine insurability. Additionally, some policies may have specific age limits or restrictions based on lifestyle choices, such as smoking or high-risk activities.

Quick guide on how to complete optional life insurance

Prepare [SKS] effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Optional Life Insurance

Create this form in 5 minutes!

How to create an eSignature for the optional life insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Optional Life Insurance?

Optional Life Insurance is a type of insurance policy that provides additional coverage beyond standard life insurance. It allows policyholders to choose the amount of coverage they need, ensuring financial security for their loved ones in case of unforeseen events. This flexibility makes Optional Life Insurance an attractive option for many individuals.

-

How does Optional Life Insurance work?

Optional Life Insurance works by allowing individuals to select a coverage amount that suits their financial needs. Policyholders pay a premium based on their chosen coverage, and in the event of their passing, beneficiaries receive the death benefit. This type of insurance can be added to existing policies or purchased separately.

-

What are the benefits of Optional Life Insurance?

The primary benefit of Optional Life Insurance is the peace of mind it provides, knowing that loved ones will be financially protected. Additionally, it offers flexibility in coverage amounts and can be tailored to fit individual financial situations. Optional Life Insurance can also serve as a financial tool for estate planning.

-

How much does Optional Life Insurance cost?

The cost of Optional Life Insurance varies based on several factors, including age, health, and the amount of coverage selected. Generally, premiums are affordable, and many providers offer competitive rates. It's advisable to compare quotes from different insurers to find the best deal on Optional Life Insurance.

-

Can I customize my Optional Life Insurance policy?

Yes, Optional Life Insurance policies are highly customizable. Policyholders can choose the coverage amount, premium payment frequency, and additional riders for enhanced benefits. This customization ensures that the policy aligns with individual needs and financial goals.

-

Is Optional Life Insurance available for businesses?

Absolutely! Optional Life Insurance can be offered as part of employee benefits packages in businesses. This not only helps attract and retain talent but also provides employees with valuable financial protection, enhancing overall job satisfaction and loyalty.

-

How does Optional Life Insurance integrate with other financial products?

Optional Life Insurance can seamlessly integrate with other financial products, such as health insurance and retirement plans. This integration allows for a comprehensive financial strategy that addresses various aspects of financial security. Many providers offer bundled options for added convenience.

Get more for Optional Life Insurance

Find out other Optional Life Insurance

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement