Oregon Department of Revenue Withholding and Payroll Tax Form

Understanding the Oregon Department of Revenue Withholding and Payroll Tax

The Oregon Department of Revenue manages withholding and payroll taxes, which are essential for businesses operating within the state. This tax is deducted from employees' wages and is used to fund various state services. Employers are responsible for withholding the correct amount from their employees’ paychecks and remitting it to the state. Understanding this tax is crucial for compliance and ensuring that employees' tax obligations are met.

Steps to Complete the Oregon Department of Revenue Withholding and Payroll Tax

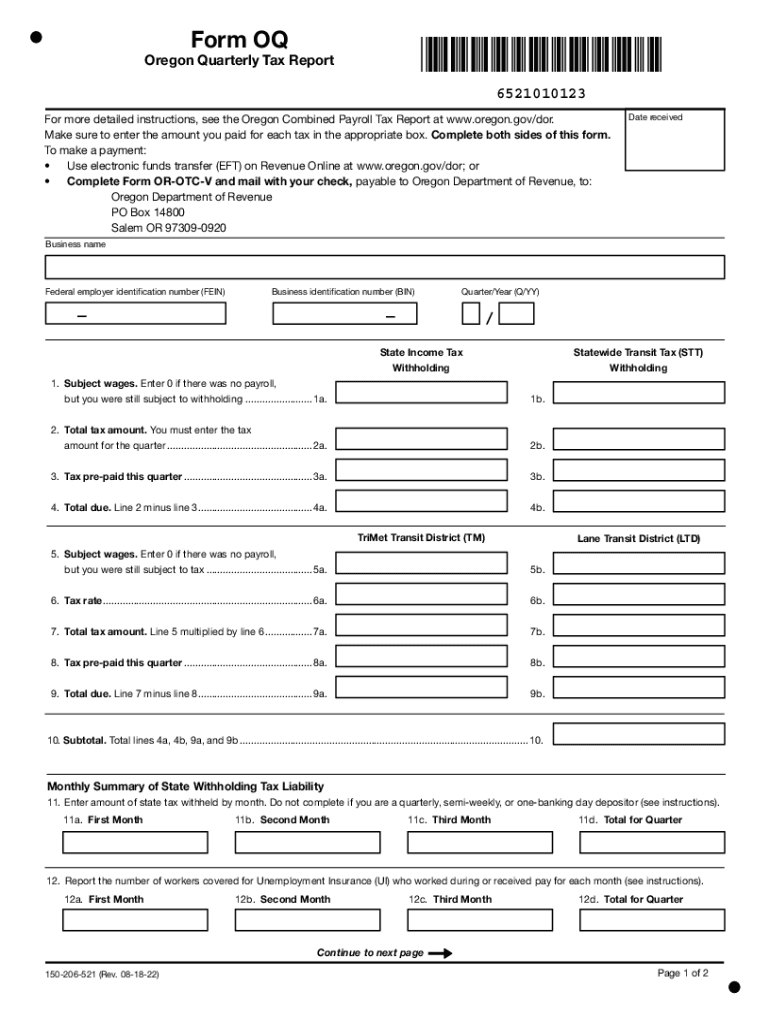

Completing the Oregon Department of Revenue withholding and payroll tax involves several key steps:

- Determine the correct withholding amount based on employee wages and filing status.

- Use the appropriate tax tables provided by the Oregon Department of Revenue to calculate the withholding.

- Ensure that all payroll records are accurately maintained, including employee information and withholding amounts.

- File the required forms, including the 150 206 521, by the designated deadlines.

Following these steps helps ensure compliance and avoids potential penalties.

Filing Deadlines and Important Dates

It is crucial for businesses to be aware of filing deadlines related to the Oregon withholding and payroll tax. Typically, employers must submit their withholding tax returns quarterly or annually, depending on the amount withheld. Key dates include:

- Quarterly returns are due on the last day of the month following the end of each quarter.

- Annual returns must be filed by January thirty-first of the following year.

Staying informed about these deadlines helps businesses avoid late fees and penalties.

Form Submission Methods

Employers can submit the Oregon withholding and payroll tax forms through various methods, ensuring flexibility and convenience. The options include:

- Online Submission: Many employers prefer to file electronically through the Oregon Department of Revenue's online portal.

- Mail: Forms can be printed and mailed to the appropriate address provided by the Oregon Department of Revenue.

- In-Person Submission: Employers may also choose to submit forms in person at designated state offices.

Selecting the right submission method can streamline the filing process and ensure timely compliance.

Legal Use of the Oregon Department of Revenue Withholding and Payroll Tax

The withholding and payroll tax is legally mandated for all employers in Oregon, making compliance essential. Employers must ensure they are withholding the correct amounts and remitting them on time to avoid legal repercussions. Failure to comply can result in penalties, interest charges, and potential audits by the Oregon Department of Revenue. Understanding the legal requirements helps protect businesses from unnecessary complications.

Penalties for Non-Compliance

Non-compliance with the Oregon withholding and payroll tax regulations can lead to significant penalties for businesses. Common consequences include:

- Late Filing Penalties: Businesses may incur fines for failing to file their tax returns by the due date.

- Interest Charges: Unpaid taxes may accrue interest, increasing the total amount owed.

- Audit Risks: Non-compliance can trigger audits by the Oregon Department of Revenue, leading to further scrutiny.

Understanding these penalties emphasizes the importance of timely and accurate tax filings.

Quick guide on how to complete oregon department of revenue withholding and payroll tax

Prepare Oregon Department Of Revenue Withholding And Payroll Tax seamlessly on any device

Digital document handling has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to discover the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Oregon Department Of Revenue Withholding And Payroll Tax on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Oregon Department Of Revenue Withholding And Payroll Tax effortlessly

- Locate Oregon Department Of Revenue Withholding And Payroll Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Oregon Department Of Revenue Withholding And Payroll Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon department of revenue withholding and payroll tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the number 150 206 521 in relation to airSlate SignNow?

The number 150 206 521 is associated with a specific feature set within airSlate SignNow that enhances document management. This feature allows users to streamline their eSigning processes, making it easier to send and sign documents securely. Understanding this number can help businesses leverage the full potential of airSlate SignNow.

-

How does airSlate SignNow pricing compare to other eSignature solutions?

airSlate SignNow offers competitive pricing that is designed to be cost-effective for businesses of all sizes. With plans that cater to different needs, including the unique features tied to 150 206 521, users can find a solution that fits their budget. This affordability, combined with robust features, makes it a preferred choice for many.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow includes a variety of features such as customizable templates, automated workflows, and secure cloud storage. The integration of the 150 206 521 feature enhances these capabilities, allowing for seamless document tracking and management. These features collectively improve efficiency and reduce turnaround times.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The 150 206 521 feature specifically helps businesses manage their signing processes more effectively. This results in faster transactions and improved customer satisfaction.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow supports integrations with various software tools, enhancing its functionality. The integration capabilities, including those related to the 150 206 521 feature, allow users to connect with CRM systems, cloud storage, and more. This flexibility ensures that businesses can tailor their workflows to meet specific needs.

-

Is airSlate SignNow suitable for small businesses?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. The cost-effective pricing and features like the 150 206 521 make it an ideal choice for small enterprises looking to streamline their document processes. This accessibility helps small businesses compete effectively in their markets.

-

How secure is the eSigning process with airSlate SignNow?

The eSigning process with airSlate SignNow is highly secure, employing advanced encryption and authentication measures. The 150 206 521 feature adds an extra layer of security, ensuring that all documents are protected during transmission and storage. Users can trust that their sensitive information remains confidential.

Get more for Oregon Department Of Revenue Withholding And Payroll Tax

- Medication profile home health form

- Allianz claim form s2219 02

- Genworth forms

- Colonial life universal claim form

- The american society of diagnostic asdin form

- Geisinger health plan register form online

- Keystone stars continuous quality improvement plan form

- Ohio it 1140 pass through entity and trust form

Find out other Oregon Department Of Revenue Withholding And Payroll Tax

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now