TRIP Earned Income and Incremental Annual Distribution Options Form

What is the TRIP Earned Income And Incremental Annual Distribution Options

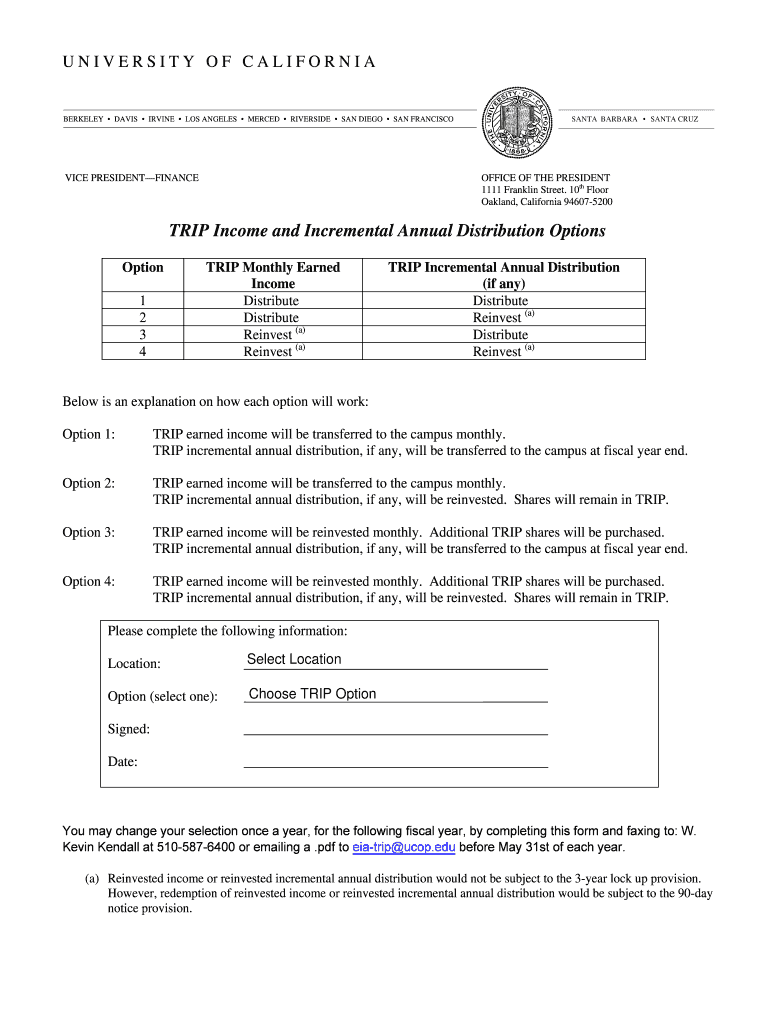

The TRIP Earned Income And Incremental Annual Distribution Options is a structured financial tool designed to assist individuals and businesses in managing their earned income and distributions effectively. This form outlines the various options available for reporting earned income and determining annual distributions, which can be critical for tax planning and financial forecasting. Understanding this form is essential for ensuring compliance with IRS regulations and optimizing financial performance.

How to use the TRIP Earned Income And Incremental Annual Distribution Options

Using the TRIP Earned Income And Incremental Annual Distribution Options involves several steps to ensure accurate reporting. First, gather all relevant financial documents, including income statements and previous tax returns. Next, fill out the form by detailing your earned income and selecting the appropriate distribution options. It is important to review the instructions carefully to ensure all sections are completed accurately. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the TRIP Earned Income And Incremental Annual Distribution Options

Completing the TRIP Earned Income And Incremental Annual Distribution Options requires a systematic approach:

- Collect necessary documentation, such as W-2s, 1099s, and any other income-related records.

- Review the form's instructions to understand the required information.

- Fill in your personal information and details about your earned income.

- Select your preferred incremental annual distribution options based on your financial goals.

- Double-check all entries for accuracy before submission.

Legal use of the TRIP Earned Income And Incremental Annual Distribution Options

The TRIP Earned Income And Incremental Annual Distribution Options is legally recognized by the IRS and must be used in accordance with federal tax laws. Accurate completion of this form ensures compliance with reporting requirements and helps avoid potential penalties. It is crucial to maintain records of submitted forms and any supporting documentation in case of an audit or review by tax authorities.

Key elements of the TRIP Earned Income And Incremental Annual Distribution Options

Key elements of the TRIP Earned Income And Incremental Annual Distribution Options include:

- Personal identification details, including name and Social Security number.

- Comprehensive reporting of all sources of earned income.

- Selection of distribution options that align with financial planning.

- Signature and date to validate the information provided.

Eligibility Criteria

To utilize the TRIP Earned Income And Incremental Annual Distribution Options, individuals must meet specific eligibility criteria. Generally, this includes being a U.S. taxpayer with earned income from employment or self-employment. Additionally, individuals should ensure they have the necessary documentation to support their income claims and distribution choices. Understanding these criteria helps streamline the application process and ensures compliance with IRS regulations.

Quick guide on how to complete trip earned income and incremental annual distribution options

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without interruptions. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to modify and eSign [SKS] without any hassle

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to TRIP Earned Income And Incremental Annual Distribution Options

Create this form in 5 minutes!

How to create an eSignature for the trip earned income and incremental annual distribution options

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TRIP Earned Income And Incremental Annual Distribution Options?

TRIP Earned Income And Incremental Annual Distribution Options refer to financial strategies that allow businesses to optimize their income and manage distributions effectively. These options provide flexibility in how earnings are utilized, ensuring that companies can maximize their financial potential while maintaining compliance with regulations.

-

How can airSlate SignNow help with TRIP Earned Income And Incremental Annual Distribution Options?

airSlate SignNow offers a streamlined platform for managing documents related to TRIP Earned Income And Incremental Annual Distribution Options. By enabling easy eSigning and document management, businesses can efficiently handle agreements and contracts that pertain to these financial strategies.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow provides various pricing plans tailored to different business needs, ensuring that you can find a solution that fits your budget. Each plan includes features that support the management of TRIP Earned Income And Incremental Annual Distribution Options, allowing for cost-effective document handling.

-

What features does airSlate SignNow offer for managing financial documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning, all of which are essential for managing financial documents related to TRIP Earned Income And Incremental Annual Distribution Options. These tools enhance efficiency and accuracy in document processing.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your ability to manage TRIP Earned Income And Incremental Annual Distribution Options. These integrations allow for a more cohesive workflow, connecting your financial tools with document management.

-

What are the benefits of using airSlate SignNow for TRIP Earned Income And Incremental Annual Distribution Options?

Using airSlate SignNow for TRIP Earned Income And Incremental Annual Distribution Options provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced compliance. The platform simplifies the document signing process, allowing businesses to focus on their financial strategies.

-

Is airSlate SignNow secure for handling sensitive financial documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive financial documents related to TRIP Earned Income And Incremental Annual Distribution Options. You can trust that your information is safe while using our platform.

Get more for TRIP Earned Income And Incremental Annual Distribution Options

Find out other TRIP Earned Income And Incremental Annual Distribution Options

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast