ChildcareExpensesUCM11 DOC Form

What is the ChildcareExpensesUCM11 doc

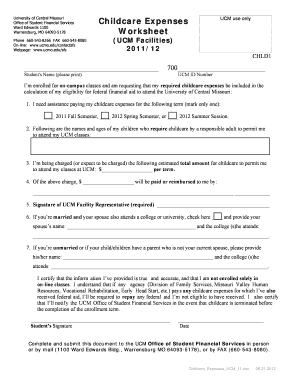

The ChildcareExpensesUCM11 doc is a specific form used to document and claim childcare expenses for tax purposes in the United States. This form is essential for parents and guardians who wish to receive tax credits or deductions related to childcare costs incurred while they work or seek employment. The form captures detailed information about the childcare provider, the amount spent, and the period during which the expenses were incurred, ensuring that families can accurately report their childcare expenses to the IRS.

How to use the ChildcareExpensesUCM11 doc

Using the ChildcareExpensesUCM11 doc involves several straightforward steps. First, gather all necessary documentation, including receipts from childcare providers and any relevant identification numbers. Next, fill out the form by providing detailed information about the childcare provider, such as their name, address, and taxpayer identification number. Ensure that you accurately report the total amount spent on childcare during the tax year. Once completed, the form should be submitted along with your tax return to the IRS to claim any eligible credits or deductions.

Steps to complete the ChildcareExpensesUCM11 doc

Completing the ChildcareExpensesUCM11 doc requires careful attention to detail. Follow these steps:

- Gather all receipts and documentation related to childcare expenses.

- Obtain the ChildcareExpensesUCM11 doc from the appropriate source.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the childcare provider, including their name, address, and taxpayer identification number.

- Report the total amount spent on childcare for the tax year.

- Review the form for accuracy before submission.

- Attach the completed form to your tax return when filing.

Legal use of the ChildcareExpensesUCM11 doc

The ChildcareExpensesUCM11 doc is legally recognized for reporting childcare expenses to the IRS. It is crucial to use this form correctly to ensure compliance with tax laws. Accurate reporting of childcare expenses can lead to significant tax credits, such as the Child and Dependent Care Credit. Misreporting or failing to use the form appropriately may result in penalties or denial of tax benefits. Therefore, it is essential to understand the legal implications of the information provided on this form.

Eligibility Criteria

To utilize the ChildcareExpensesUCM11 doc effectively, certain eligibility criteria must be met. Primarily, the taxpayer must have incurred childcare expenses while working or looking for work. The children for whom the expenses are claimed must be under the age of thirteen or be physically or mentally incapable of self-care. Additionally, the childcare provider must meet specific requirements, such as being a licensed facility or an individual who is not a relative. Meeting these criteria is vital for successfully claiming tax benefits associated with childcare expenses.

Filing Deadlines / Important Dates

Filing deadlines for the ChildcareExpensesUCM11 doc align with the general tax filing schedule in the United States. Typically, individual tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to tax deadlines and ensure that the ChildcareExpensesUCM11 doc is submitted on time to avoid penalties and ensure eligibility for tax credits.

Quick guide on how to complete childcareexpensesucm11 doc

Complete [SKS] effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The simplest way to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns of misplaced or lost documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and maintain exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ChildcareExpensesUCM11 doc

Create this form in 5 minutes!

How to create an eSignature for the childcareexpensesucm11 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ChildcareExpensesUCM11 doc and how can it benefit my business?

The ChildcareExpensesUCM11 doc is a specialized document designed to streamline the management of childcare expenses. By using this document, businesses can easily track and manage expenses related to childcare, ensuring compliance and simplifying financial reporting. This can lead to signNow time savings and improved accuracy in your financial records.

-

How much does the ChildcareExpensesUCM11 doc cost?

The pricing for the ChildcareExpensesUCM11 doc varies based on the subscription plan you choose with airSlate SignNow. We offer flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your investment. For detailed pricing information, please visit our pricing page.

-

Can I customize the ChildcareExpensesUCM11 doc to fit my specific needs?

Yes, the ChildcareExpensesUCM11 doc is fully customizable to meet your unique business requirements. You can easily modify fields, add your branding, and adjust the layout to ensure it aligns with your operational processes. This flexibility allows you to create a document that truly reflects your business needs.

-

What features does the ChildcareExpensesUCM11 doc offer?

The ChildcareExpensesUCM11 doc includes features such as electronic signatures, document tracking, and automated reminders. These features enhance the efficiency of managing childcare expenses, making it easier to obtain approvals and keep all stakeholders informed. Additionally, the document is secure and compliant with industry standards.

-

Is the ChildcareExpensesUCM11 doc easy to integrate with other software?

Absolutely! The ChildcareExpensesUCM11 doc can seamlessly integrate with various business applications, including accounting and project management tools. This integration helps streamline your workflow and ensures that all your data is synchronized across platforms, enhancing overall productivity.

-

How does using the ChildcareExpensesUCM11 doc improve compliance?

Using the ChildcareExpensesUCM11 doc helps ensure compliance with financial regulations by providing a structured format for documenting childcare expenses. This reduces the risk of errors and omissions, making it easier to prepare for audits and maintain accurate records. Compliance is crucial for any business, and this document supports that goal.

-

What are the benefits of using airSlate SignNow for the ChildcareExpensesUCM11 doc?

airSlate SignNow offers a user-friendly platform that simplifies the process of sending and eSigning the ChildcareExpensesUCM11 doc. The cost-effective solution not only saves time but also enhances collaboration among team members. With robust security features, you can trust that your sensitive information is protected.

Get more for ChildcareExpensesUCM11 doc

Find out other ChildcareExpensesUCM11 doc

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe