APPLICATION to Qualify for the Foreign Exemption, Employees Must Spend All Form

What is the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All

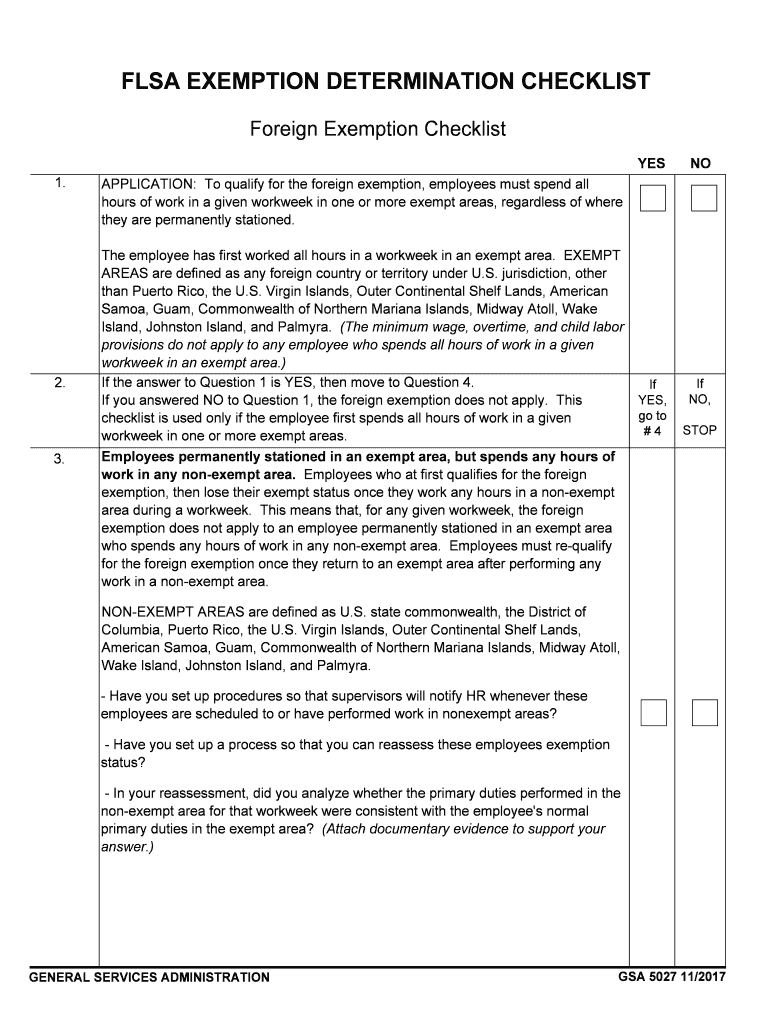

The APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All is a crucial document for employees seeking to claim a foreign tax exemption. This application allows individuals to demonstrate that they meet specific criteria set forth by the Internal Revenue Service (IRS) regarding their time spent working outside the United States. By completing this form, employees can potentially reduce their tax liabilities based on foreign income, which is particularly beneficial for those working in international roles.

Eligibility Criteria

To qualify for the foreign exemption, employees must meet several eligibility criteria outlined by the IRS. Key factors include:

- Employees must have spent a significant portion of the tax year outside the United States.

- The foreign work must be for a qualified employer, such as a foreign corporation or government.

- Employees must provide documentation proving their physical presence in the foreign location during the specified time frame.

Understanding these criteria is essential for employees to ensure their application is valid and increases the likelihood of approval.

Steps to complete the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All

Completing the APPLICATION To Qualify For The Foreign Exemption requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including proof of foreign employment and travel records.

- Fill out the application form accurately, ensuring all personal information is correct.

- Attach supporting documents that substantiate your claims regarding time spent abroad.

- Review the application for completeness and accuracy before submission.

- Submit the application through the appropriate channels, whether online or via mail.

Following these steps can help streamline the application process and improve the chances of a successful exemption claim.

Legal use of the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All

The legal use of this application is governed by IRS regulations, which outline the requirements for claiming a foreign tax exemption. It is essential for employees to ensure that their application complies with these regulations to avoid penalties or denial. The application must be filled out truthfully, and all claims made within it should be supported by adequate documentation. Misrepresentation or failure to provide necessary information can lead to legal consequences.

Required Documents

When submitting the APPLICATION To Qualify For The Foreign Exemption, employees must provide several key documents to support their claims. These may include:

- Proof of employment with a foreign entity, such as a contract or letter from the employer.

- Travel itineraries or boarding passes that verify time spent outside the United States.

- Tax returns from the foreign country, if applicable, to demonstrate foreign income.

Having these documents ready can facilitate a smoother application process and enhance the credibility of the claims made.

Form Submission Methods (Online / Mail / In-Person)

The APPLICATION To Qualify For The Foreign Exemption can be submitted through various methods, depending on the specific requirements set by the IRS. Employees may choose to:

- Submit the application online through the IRS portal, if available.

- Mail the completed application form along with supporting documents to the designated IRS address.

- In some cases, individuals may be able to deliver the application in person at local IRS offices.

Choosing the right submission method can impact the processing time and overall efficiency of the application.

Quick guide on how to complete application to qualify for the foreign exemption employees must spend all

Effortlessly Prepare APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All with Ease

- Obtain APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal confidential information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that result in reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and electronically sign APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All while ensuring exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application to qualify for the foreign exemption employees must spend all

How to generate an electronic signature for the Application To Qualify For The Foreign Exemption Employees Must Spend All online

How to generate an eSignature for your Application To Qualify For The Foreign Exemption Employees Must Spend All in Chrome

How to generate an electronic signature for signing the Application To Qualify For The Foreign Exemption Employees Must Spend All in Gmail

How to make an electronic signature for the Application To Qualify For The Foreign Exemption Employees Must Spend All right from your smart phone

How to create an electronic signature for the Application To Qualify For The Foreign Exemption Employees Must Spend All on iOS devices

How to generate an electronic signature for the Application To Qualify For The Foreign Exemption Employees Must Spend All on Android

People also ask

-

What is the process for submitting an APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All?

To submit an APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All, you will need to gather the required documentation and complete the application form available on our platform. Once everything is ready, you can upload your documents directly through airSlate SignNow. After submission, our team will review it to ensure compliance with the relevant guidelines.

-

What features does airSlate SignNow offer to assist with the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All?

airSlate SignNow provides features such as document templates, real-time collaboration, and customizable workflows that simplify the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All process. Our easy-to-use tools help ensure that all required forms are filled out correctly and efficiently, saving you valuable time.

-

Is there a cost associated with using airSlate SignNow for my APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, including options that are suitable for managing processes like the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All. You can choose between monthly or annual subscriptions, making it a cost-effective solution for businesses of all sizes.

-

How does airSlate SignNow ensure the security of my APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All data?

Security is a top priority at airSlate SignNow. We employ industry-leading security measures, including encryption and secure access controls, to protect your sensitive data related to the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All. This ensures that your information is handled with the highest level of security throughout the entire process.

-

What are the main benefits of using airSlate SignNow for the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All?

Using airSlate SignNow for the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All offers signNow benefits, including streamlined document management, fast eSigning capabilities, and enhanced team collaboration. These features empower your organization to complete exemption applications more quickly and efficiently, helping you focus on your core business activities.

-

Can airSlate SignNow integrate with other software I use for managing the APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All?

Absolutely! airSlate SignNow seamlessly integrates with numerous popular platforms, enabling you to manage your APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All alongside your existing software. This connectivity enhances workflow efficiency and reduces the complexity of handling multiple tools.

-

Is there customer support available for assistance with my APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All?

Yes, airSlate SignNow provides dedicated customer support to help with any questions or concerns regarding your APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All. Our team is available through various channels to ensure you get the assistance you need as quickly as possible.

Get more for APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All

- Home owner permit affidavit form

- Spring lake public schoolsbig enough to challenge small enough to care form

- Carla nixon direct cumberland public library form

- Signage awning permit application checklist city of portland maine form

- For manufactured structures repossessed under oregon law form

- Co signer form chinook properties

- Request to revert services from tenant to landlord form

- Rent security deposit dispositiondoc form

Find out other APPLICATION To Qualify For The Foreign Exemption, Employees Must Spend All

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple