Payroll Deduction University of Minnesota Duluth D Umn Form

Understanding Payroll Deduction at the University of Minnesota Duluth

The Payroll Deduction at the University of Minnesota Duluth allows employees to automatically allocate a portion of their earnings towards various expenses, such as health insurance premiums, retirement contributions, or tuition payments. This convenient method simplifies financial management by ensuring that payments are made consistently and on time, directly from an employee's paycheck.

How to Use Payroll Deduction at the University of Minnesota Duluth

To utilize Payroll Deduction, employees must first enroll in the program through the university's human resources department. This typically involves completing a form that specifies the amount to be deducted and the purpose of the deduction. Once enrolled, the specified amount will be deducted from each paycheck, and employees can monitor these deductions through their pay stubs.

Steps to Complete the Payroll Deduction Form

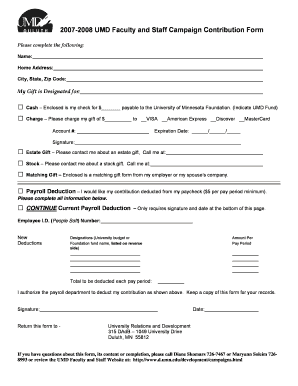

Completing the Payroll Deduction form involves several key steps:

- Obtain the Payroll Deduction form from the university's human resources office or website.

- Fill out the required personal information, including your name, employee ID, and contact details.

- Specify the deduction amount and the purpose, such as health insurance or retirement savings.

- Sign and date the form to authorize the deductions.

- Submit the completed form to the human resources department for processing.

Eligibility Criteria for Payroll Deduction at the University of Minnesota Duluth

Eligibility for Payroll Deduction generally includes being an active employee of the University of Minnesota Duluth. Specific programs or deductions may have additional eligibility requirements, such as enrollment in certain health plans or retirement programs. It is advisable to consult with the human resources department for detailed eligibility information.

Required Documents for Payroll Deduction Enrollment

When enrolling in the Payroll Deduction program, employees may need to provide certain documents, including:

- A completed Payroll Deduction form.

- Proof of enrollment in any applicable programs, such as health insurance or retirement plans.

- Identification, such as a university employee ID or Social Security number.

Legal Use of Payroll Deduction at the University of Minnesota Duluth

The use of Payroll Deduction must comply with federal and state regulations. This includes ensuring that deductions are authorized by employees and that they align with legal guidelines for payroll practices. Employees should be informed of their rights regarding deductions and how to dispute any discrepancies.

Examples of Payroll Deduction Applications

Payroll Deduction can be applied in various ways at the University of Minnesota Duluth, including:

- Health insurance premiums deducted directly from paychecks.

- Contributions to retirement plans, such as a 403(b) or 457(b) plan.

- Tuition payments for employees or their dependents attending the university.

Quick guide on how to complete payroll deduction university of minnesota duluth d umn

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to edit and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and ensure outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Payroll Deduction University Of Minnesota Duluth D Umn

Create this form in 5 minutes!

How to create an eSignature for the payroll deduction university of minnesota duluth d umn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Payroll Deduction at the University of Minnesota Duluth?

Payroll Deduction at the University of Minnesota Duluth (D Umn) allows employees to automatically deduct a portion of their salary for various purposes, such as benefits or contributions to specific funds. This convenient method simplifies financial management for employees, ensuring timely payments without the need for manual transactions.

-

How does airSlate SignNow facilitate Payroll Deduction at D Umn?

airSlate SignNow streamlines the Payroll Deduction process at the University of Minnesota Duluth by providing a user-friendly platform for eSigning and managing documents. This ensures that all payroll-related documents are securely signed and stored, making it easier for employees and HR to handle deductions efficiently.

-

What are the benefits of using airSlate SignNow for Payroll Deduction at D Umn?

Using airSlate SignNow for Payroll Deduction at the University of Minnesota Duluth offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Employees can quickly eSign necessary documents, which speeds up the deduction process and minimizes errors.

-

Is there a cost associated with using airSlate SignNow for Payroll Deduction at D Umn?

Yes, there is a cost associated with using airSlate SignNow for Payroll Deduction at the University of Minnesota Duluth. However, the platform is designed to be cost-effective, providing signNow savings in time and resources compared to traditional methods of document management and payroll processing.

-

What features does airSlate SignNow offer for Payroll Deduction at D Umn?

airSlate SignNow offers a variety of features for Payroll Deduction at the University of Minnesota Duluth, including customizable templates, automated workflows, and secure cloud storage. These features help ensure that all payroll deduction documents are handled efficiently and securely.

-

Can airSlate SignNow integrate with existing payroll systems at D Umn?

Yes, airSlate SignNow can integrate seamlessly with existing payroll systems at the University of Minnesota Duluth. This integration allows for a smooth transition and ensures that all payroll deduction processes are synchronized with the university's current systems.

-

How secure is the Payroll Deduction process using airSlate SignNow at D Umn?

The Payroll Deduction process using airSlate SignNow at the University of Minnesota Duluth is highly secure. The platform employs advanced encryption and security protocols to protect sensitive employee information and ensure that all transactions are safe and compliant with regulations.

Get more for Payroll Deduction University Of Minnesota Duluth D Umn

Find out other Payroll Deduction University Of Minnesota Duluth D Umn

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online