Credit Claim Form 2016-2026

What is the Credit Claim Form

The credit claim form is a crucial document used by individuals and businesses to request tax credits or refunds from the government. This form is often associated with various tax credits available at the federal or state level, including those related to housing, education, and business expenses. By accurately completing this form, taxpayers can ensure they receive the financial benefits they are entitled to, which can significantly impact their overall tax liability.

Steps to Complete the Credit Claim Form

Completing the credit claim form requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary documentation, such as income statements, previous tax returns, and any relevant receipts that support your claim.

- Fill out the form with accurate personal and financial information, ensuring that all sections are completed as required.

- Double-check the information for accuracy, including Social Security numbers and financial figures.

- Sign and date the form to validate your claim, as electronic signatures may be accepted depending on submission methods.

- Submit the form according to the specified method, whether online, by mail, or in person.

How to Obtain the Credit Claim Form

The credit claim form can typically be obtained through several channels. Most commonly, it can be downloaded from the official government tax website or the specific state tax authority's website. Additionally, physical copies may be available at local tax offices or community centers. It is essential to ensure that you are using the most current version of the form to avoid any issues during processing.

Eligibility Criteria

Eligibility for using the credit claim form varies depending on the specific tax credit being claimed. Generally, individuals must meet certain income thresholds, residency requirements, and other criteria outlined by the IRS or state tax authorities. It is important to review these requirements carefully before submitting the form to ensure that you qualify for the credit you are claiming.

Form Submission Methods

There are multiple methods for submitting the credit claim form, allowing for flexibility based on individual preferences. Common submission methods include:

- Online Submission: Many forms can be submitted electronically through the tax authority's website, which often provides instant confirmation of receipt.

- Mail: Completed forms can be printed and mailed to the appropriate tax office. Ensure that you send it to the correct address based on your state and the type of credit.

- In-Person: Some individuals may prefer to submit their forms in person at local tax offices, where they can receive assistance if needed.

Required Documents

To successfully complete the credit claim form, certain documents are typically required to substantiate your claim. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Receipts or documentation supporting the expenses related to the credit.

- Previous tax returns, which may be necessary for reference or verification purposes.

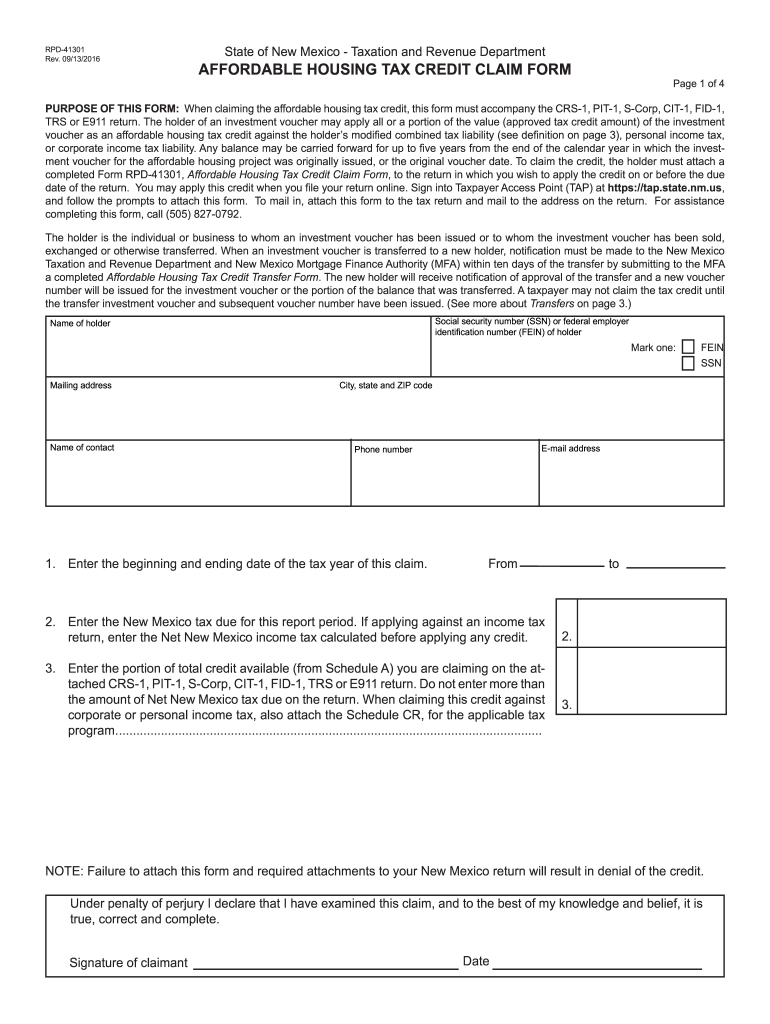

Key Elements of the Credit Claim Form

The credit claim form consists of several key elements that must be completed accurately. Important sections typically include:

- Personal Information: This includes your name, address, and Social Security number.

- Income Information: Details regarding your income sources and amounts.

- Claim Details: Specific information about the credit being claimed, including calculations and relevant dates.

Quick guide on how to complete nm rpd 41301 form

Prepare Credit Claim Form effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Credit Claim Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign Credit Claim Form with ease

- Find Credit Claim Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form hunts, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your chosen device. Edit and eSign Credit Claim Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nm rpd 41301 form

How to make an electronic signature for your Nm Rpd 41301 Form online

How to create an eSignature for your Nm Rpd 41301 Form in Google Chrome

How to create an eSignature for putting it on the Nm Rpd 41301 Form in Gmail

How to create an electronic signature for the Nm Rpd 41301 Form right from your smart phone

How to generate an eSignature for the Nm Rpd 41301 Form on iOS

How to make an eSignature for the Nm Rpd 41301 Form on Android OS

People also ask

-

What is a credit claim form?

A credit claim form is a document used to request a refund or adjustment on a financial transaction. This form is essential for ensuring that any discrepancies in billing or service charges are addressed efficiently. Utilizing airSlate SignNow, you can quickly create and send your credit claim form for eSignature.

-

How does airSlate SignNow help with credit claim forms?

airSlate SignNow simplifies the process of generating and signing credit claim forms. With our easy-to-use platform, you can customize, send, and track your forms to ensure a smooth claims process. We provide templates that can help streamline your workflow and enhance your document management.

-

Are there any costs associated with using the credit claim form feature?

While airSlate SignNow offers a variety of pricing plans, using the credit claim form feature is often included in our standard packages. Our pricing is designed to be cost-effective for businesses of all sizes. You can start with a free trial to explore how it fits your needs without any upfront commitment.

-

Can I integrate airSlate SignNow with other applications for processing credit claim forms?

Yes, airSlate SignNow offers integrations with numerous applications to enhance the processing of credit claim forms. You can connect with platforms like Salesforce, Google Drive, and more for seamless workflow management. This integration capability allows you to centralize your data and improve operational efficiency.

-

How does electronic signing improve the credit claim form process?

Electronic signing signNowly accelerates the approval process for credit claim forms. With airSlate SignNow, you can eSign documents from anywhere, reducing turnaround time and eliminating the need for physical signatures. This efficiency leads to quicker resolutions of claims and improved customer satisfaction.

-

What features does airSlate SignNow offer for managing credit claim forms?

airSlate SignNow provides various features to manage your credit claim forms, including customizable templates, real-time tracking, and secure storage. You can also set reminders for signers and receive notifications when forms are completed. These features ensure that your claims are handled promptly and efficiently.

-

Can I customize my credit claim form within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your credit claim form to meet your specific business needs. You can add your branding, modify fields, and include any necessary instructions to ensure clarity for recipients. This flexibility enhances user experience and professionalism.

Get more for Credit Claim Form

- Rhb credit card application form

- Trinidad and tobago immigration arrival card 433352862 form

- Seaman book bahamas form

- Guam child support state disbursement unit fill online form

- Uas pilot operator qualification form aig

- Jkkp 8 i iv register of accident dangerous occurrence form

- Ahi pa breceipt formbai america hears

- Drive thru shop checklist form

Find out other Credit Claim Form

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed