The Definition of Dependent Shall Mean an Employees Spouse or Other Dependents as Defined in Section 152 of the Form

Understanding the Definition of Dependent

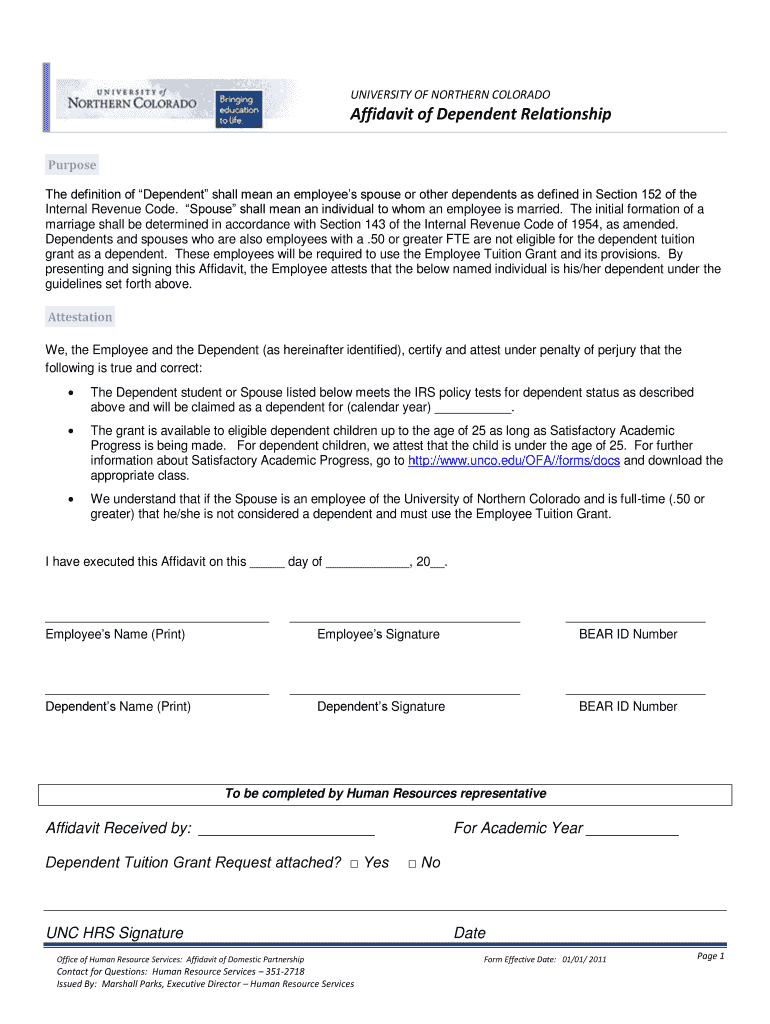

The definition of dependent, as it relates to an employee's spouse or other dependents, is crucial for various legal and tax purposes. According to Section 152 of the Internal Revenue Code, a dependent can include a spouse, children, and other relatives who rely on the employee for financial support. This definition is significant when determining eligibility for tax benefits, health insurance coverage, and other employee benefits.

How to Use the Definition of Dependent

Utilizing the definition of dependent involves understanding how it applies to your specific situation. Employees may need to identify their dependents when filing taxes or applying for benefits. It is essential to gather necessary documentation, such as Social Security numbers and proof of relationship, to support claims of dependency. This information can help ensure accurate tax filings and compliance with employer benefit programs.

Key Elements of the Definition of Dependent

Key elements that define a dependent include:

- Relationship: The individual must be related to the employee, such as a spouse, child, or qualifying relative.

- Residency: The dependent must live with the employee for more than half of the year.

- Financial Support: The employee must provide more than half of the dependent's financial support during the year.

- Age Limitations: For children, there are specific age limits that apply, typically under the age of 19 or 24 if a full-time student.

Examples of Using the Definition of Dependent

Examples of how to apply the definition of dependent include:

- Claiming a spouse as a dependent on tax returns, which may provide additional tax benefits.

- Enrolling children in health insurance plans through an employer, which often requires proof of dependency.

- Applying for government assistance programs that require documentation of dependents for eligibility.

IRS Guidelines on Dependents

The IRS provides specific guidelines for determining who qualifies as a dependent. These guidelines outline the criteria for both qualifying children and qualifying relatives. Understanding these rules can help employees maximize their tax benefits and ensure compliance with tax obligations. It is advisable to consult the IRS website or a tax professional for the most current information and detailed guidance.

Eligibility Criteria for Dependents

Eligibility criteria for dependents under Section 152 include:

- The individual must be a U.S. citizen, national, or resident alien.

- The dependent must not file a joint tax return unless it is solely for a refund.

- There must be a qualifying relationship, such as a child, stepchild, or other qualifying relative.

Quick guide on how to complete the definition of dependent shall mean an employees spouse or other dependents as defined in section 152 of the

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as it allows you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to The Definition Of Dependent Shall Mean An Employees Spouse Or Other Dependents As Defined In Section 152 Of The

Create this form in 5 minutes!

How to create an eSignature for the the definition of dependent shall mean an employees spouse or other dependents as defined in section 152 of the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the definition of dependent in relation to airSlate SignNow?

The definition of dependent shall mean an employee's spouse or other dependents as defined in Section 152 of the Internal Revenue Code. Understanding this definition is crucial for businesses using airSlate SignNow to manage employee-related documents effectively.

-

How does airSlate SignNow help with dependent-related documentation?

airSlate SignNow streamlines the process of sending and eSigning documents related to dependents. By utilizing our platform, businesses can ensure that all necessary forms, including those that define dependents as per Section 152, are completed accurately and efficiently.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that help manage documents related to the definition of dependent shall mean an employee's spouse or other dependents as defined in Section 152 of the Internal Revenue Code.

-

What features does airSlate SignNow offer for managing dependent documentation?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning. These tools are designed to simplify the management of documents that pertain to the definition of dependent shall mean an employee's spouse or other dependents as defined in Section 152 of the Internal Revenue Code.

-

Can airSlate SignNow integrate with other software for managing dependents?

Yes, airSlate SignNow offers integrations with various software solutions that can help manage employee and dependent information. This ensures that all documentation related to the definition of dependent shall mean an employee's spouse or other dependents as defined in Section 152 of the Internal Revenue Code is seamlessly connected.

-

What are the benefits of using airSlate SignNow for dependent-related documents?

Using airSlate SignNow provides businesses with a cost-effective solution to manage dependent-related documents. The platform enhances efficiency, reduces errors, and ensures compliance with the definition of dependent shall mean an employee's spouse or other dependents as defined in Section 152 of the Internal Revenue Code.

-

Is airSlate SignNow secure for handling sensitive dependent information?

Absolutely, airSlate SignNow prioritizes security and compliance. Our platform is designed to protect sensitive information, including documents that define dependents as per Section 152, ensuring that your data remains confidential and secure.

Get more for The Definition Of Dependent Shall Mean An Employees Spouse Or Other Dependents As Defined In Section 152 Of The

Find out other The Definition Of Dependent Shall Mean An Employees Spouse Or Other Dependents As Defined In Section 152 Of The

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF