Form W 4P

What is the Form W-4P

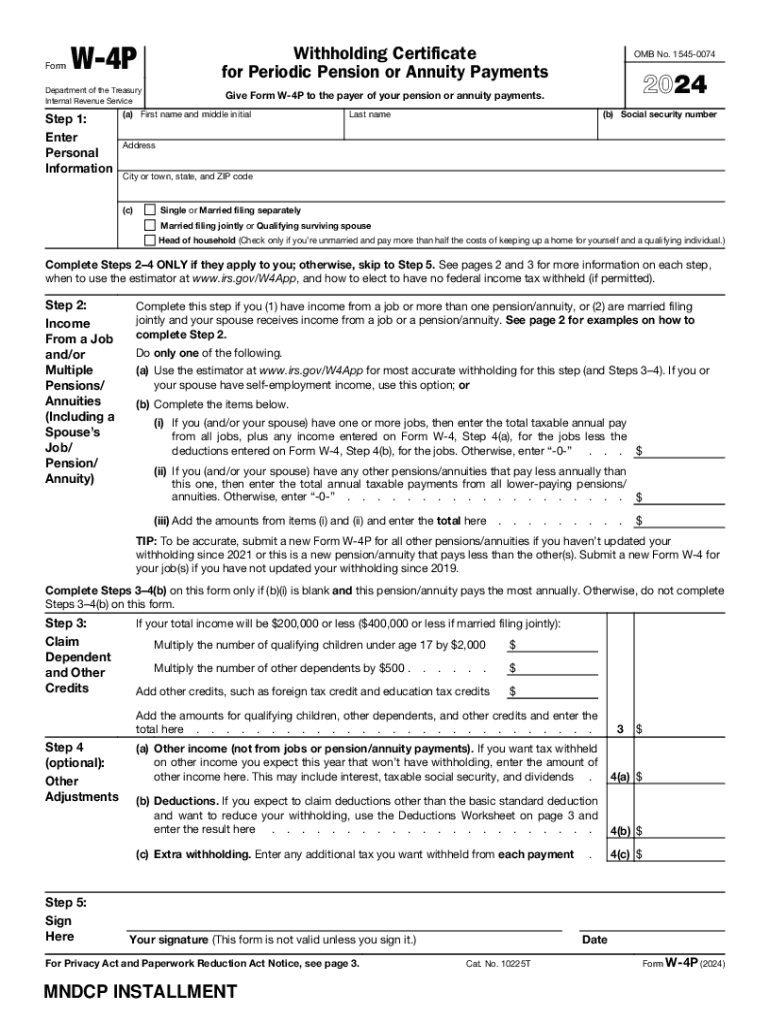

The Form W-4P, also known as the Withholding Certificate for Pension or Annuity Payments, is a tax form used by individuals to specify the amount of federal income tax that should be withheld from their pension or annuity payments. This form is particularly relevant for retirees or individuals receiving retirement benefits. By completing the W-4P, taxpayers can ensure that the correct amount of tax is withheld, helping to avoid underpayment penalties when filing their annual tax return.

How to use the Form W-4P

Using the Form W-4P involves several straightforward steps. First, individuals must obtain the form, which can typically be found on the IRS website or through their pension plan administrator. Once the form is acquired, taxpayers fill out their personal information, including name, address, and Social Security number. Next, they indicate their filing status and any additional withholding amounts they wish to specify. Finally, the completed form should be submitted to the pension plan administrator, who will use the information to adjust the withholding accordingly.

Steps to complete the Form W-4P

Completing the Form W-4P requires careful attention to detail. Here are the steps to follow:

- Obtain the Form W-4P from the IRS or your pension plan provider.

- Fill in your personal details, including your name and Social Security number.

- Select your filing status, which may include options such as single, married, or head of household.

- Indicate any additional amount you want withheld from each payment.

- Sign and date the form to certify the information is accurate.

- Submit the completed form to your pension plan administrator.

Key elements of the Form W-4P

The Form W-4P contains several key elements that are essential for accurate tax withholding. These include:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options for single, married, or head of household.

- Withholding Allowances: The number of allowances claimed affects the amount withheld.

- Additional Withholding: An option to specify any extra amount to be withheld.

IRS Guidelines

The IRS provides specific guidelines for completing the Form W-4P. It is important to refer to the IRS instructions to ensure compliance with current tax laws. The guidelines clarify how to determine the appropriate withholding amount based on individual circumstances, such as other sources of income or tax credits. Staying informed about these guidelines helps taxpayers make informed decisions regarding their withholding preferences.

Form Submission Methods

Once the Form W-4P is completed, it can be submitted through various methods. The most common submission methods include:

- Online: Some pension plan administrators allow electronic submission of the form through their websites.

- Mail: The completed form can be printed and mailed directly to the pension plan administrator.

- In-Person: Individuals may also deliver the form in person at the office of their pension plan provider.

Quick guide on how to complete form w 4p 703238717

Complete Form W 4P seamlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly without interruptions. Manage Form W 4P on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and electronically sign Form W 4P effortlessly

- Locate Form W 4P and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form hunting, or errors that necessitate new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form W 4P and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4p 703238717

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is w4p and how does it work with airSlate SignNow?

The w4p is a specific document format that allows users to easily fill out and sign W-4 forms electronically. With airSlate SignNow, you can seamlessly create, send, and eSign w4p documents, ensuring compliance and efficiency in your HR processes.

-

How much does airSlate SignNow cost for w4p document management?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on w4p document management. You can choose from monthly or annual subscriptions, with options that provide access to essential features for handling w4p forms at a competitive price.

-

What features does airSlate SignNow offer for w4p documents?

airSlate SignNow provides a range of features specifically designed for w4p documents, including customizable templates, automated workflows, and secure eSigning capabilities. These features streamline the process of managing W-4 forms, making it easier for businesses to stay organized and compliant.

-

Can I integrate airSlate SignNow with other tools for w4p processing?

Yes, airSlate SignNow offers integrations with various third-party applications, enhancing your ability to manage w4p documents. You can connect it with popular tools like Google Drive, Salesforce, and more, allowing for a seamless workflow and improved productivity.

-

What are the benefits of using airSlate SignNow for w4p forms?

Using airSlate SignNow for w4p forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your W-4 documents are processed quickly and securely, allowing your team to focus on more important tasks.

-

Is airSlate SignNow user-friendly for managing w4p documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage w4p documents. The intuitive interface allows users to create, send, and eSign W-4 forms without any technical expertise.

-

How secure is airSlate SignNow for handling w4p documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive w4p documents. The platform employs advanced encryption and compliance measures to ensure that your data remains safe and secure throughout the signing process.

Get more for Form W 4P

- Activity permission slip form

- Physicians medical evaluation for assisted living form

- Alton c crews middle school retest plan snappages form

- Aflac claim forms cancer continuing to print

- Request for review form blue cross blue shield of georgia

- Hawaii open door form

- Hawaii food permit form

- Hawaii insurance fraud form

Find out other Form W 4P

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template