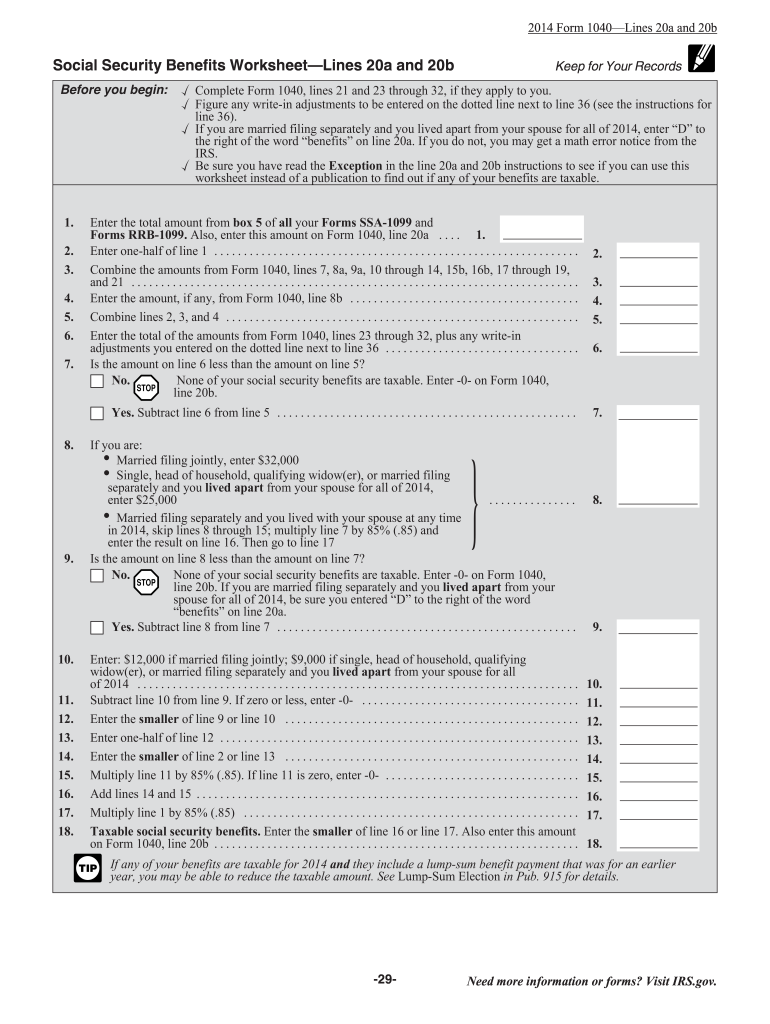

Social Security Benefits Worksheet 2014-2026

What makes the 1040 social security worksheet 2014 2018 form legally valid?

Finding samples is not the hard portion when it comes to web document management; making them valid is.

The first task is to examine the current relevance of your template you plan using. Official inctitutions can't accept out-of-date documents, so it's essential to use only forms that are current and up to date.

Next, make sure you input all the required information. Check required areas, the list of attachments, and supplementary documents carefully. File all the papers in one bundle to prevent misunderstandings and increase the speed of the procedure of processing your documents.

Finally, pay attention to the submitting approaches required. Find out if you're capable to send documents using web services, and if you are, consider utilizing safe services to fill the 1040 social security worksheet 2014 2018 form, electronically sign, and send.

How you can protect your 1040 social security worksheet 2014 2018 form when completing it online

In case the institution the 1040 social security worksheet 2014 2018 form will be delivered to allows you to do it on the web, stick to secure document management by following the guidelines below:

- Look for a safe service. Consider looking at airSlate SignNow. We store info encrypted on reliable servers.

- Check the platform's compliance. Discover more regarding a service's acceptance in other countries. As an example, airSlate SignNow eSignatures are accepted in most countries around the world.

- Pay attention to the software and hardware. Encoded connections and protected servers mean absolutely nothing when you have malware on your computer or utilize public Wi-Fi in public places.

- Include additional security levels. Turn on two-factor authentications and create locked folders to protect delicate details.

- Count on possible hacking from anywhere. Remember that fraudsters can mask behind your family and co-workers, or official institutions. Check analyze and links you get via email or in messengers.

Quick guide on how to complete 1040 social security worksheet 2014 2018 form

Discover the simplest method to complete and endorse your Social Security Benefits Worksheet

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow provides a superior alternative to complete and endorse your Social Security Benefits Worksheet and similar forms for public services. Our advanced electronic signature solution supplies you with all the necessary tools to handle documents swiftly and according to official standards - comprehensive PDF editing, management, protection, signing, and sharing functionalities all available within an intuitive interface.

Only a few steps are needed to finish filling out and signing your Social Security Benefits Worksheet:

- Insert the editable template into the editor using the Get Form option.

- Verify what details you must include in your Social Security Benefits Worksheet.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize important elements or Obscure fields that are no longer relevant.

- Click on Sign to generate a legally valid electronic signature using your preferred method.

- Include the Date beside your signature and conclude your task with the Done button.

Store your finalized Social Security Benefits Worksheet in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our service also offers flexible form distribution. There's no need to print your documents when you need to submit them to the appropriate public office - share them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct 1040 social security worksheet 2014 2018 form

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

Is there a way for you to outsource sensitive tasks securely? For instance, calling the bank, or filling out a loan application form that includes your social security number?

You might benefit from compartmentalizing your sensitive information. Realtors often use custom-purpose sticky notes to help people navigate paperwork, like a little yellow arrow that says “signNow” or a blue flag that says “review these options.” Perhaps your assistant could fill out the entire form for you, except where your SSN needs to be provided, and call those lines out to you with a little sticky arrow.When calling the bank, you may have to initiate the call and then allow your assistant to take over. That way, you’d provide the sensitive data to the bank and satisfy their identity verification, then you’d authorize your assistant to speak on your behalf about the account, and let them take it from there.If you have any tasks that require sensitive data to actually conduct the business - say, moving funds between several bank accounts, which would require constant access to account numbers and other info - then you’ll have to give that task to someone you trust with that info. If you’re the only one you trust, you’re the only one who can do the task.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

Create this form in 5 minutes!

How to create an eSignature for the 1040 social security worksheet 2014 2018 form

How to make an eSignature for your 1040 Social Security Worksheet 2014 2018 Form in the online mode

How to generate an electronic signature for your 1040 Social Security Worksheet 2014 2018 Form in Chrome

How to create an eSignature for putting it on the 1040 Social Security Worksheet 2014 2018 Form in Gmail

How to create an electronic signature for the 1040 Social Security Worksheet 2014 2018 Form straight from your smart phone

How to generate an electronic signature for the 1040 Social Security Worksheet 2014 2018 Form on iOS devices

How to generate an electronic signature for the 1040 Social Security Worksheet 2014 2018 Form on Android devices

People also ask

-

What is the taxable social security worksheet 2024 printable used for?

The taxable social security worksheet 2024 printable is designed to help individuals calculate the taxable portion of their social security benefits. This worksheet simplifies the process by allowing users to input their income details and determine their tax obligations accurately. Utilizing this template can lead to more accurate tax filings and potentially lower liabilities.

-

Where can I find the taxable social security worksheet 2024 printable?

You can access the taxable social security worksheet 2024 printable on the airSlate SignNow website. It is readily available for download and can be printed for your convenience. This ensures that you can easily have a physical copy on hand for your calculations.

-

Is the taxable social security worksheet 2024 printable free to use?

Yes, the taxable social security worksheet 2024 printable is available for free on our platform. You can download and print it without any fees, making it an economical choice for individuals looking to simplify their tax preparation process. This aligns with our goal of providing cost-effective solutions for businesses and individuals alike.

-

What are the key features of the taxable social security worksheet 2024 printable?

The taxable social security worksheet 2024 printable includes sections for inputting various income types, such as retirement benefits and pensions. It also features clear instructions that guide users through the tax calculation process. These features make it user-friendly, even for those who may not have extensive tax knowledge.

-

Can I integrate the taxable social security worksheet 2024 printable with other tools?

While the taxable social security worksheet 2024 printable is a standalone document, it can be easily used alongside tax preparation software and tools. Many users choose to print the worksheet and input information digitally afterward for a comprehensive tax solution. This flexibility makes it a versatile resource for organizing your financial documents.

-

How does using the taxable social security worksheet 2024 printable benefit me?

Using the taxable social security worksheet 2024 printable can save you time and reduce errors on your tax filings. It provides a structured format for organizing your income information, ensuring you account for all taxable benefits. Ultimately, this helps you navigate your tax responsibilities more effectively.

-

Can the taxable social security worksheet 2024 printable be used for previous tax years?

The taxable social security worksheet 2024 printable is specifically designed for the current tax year and may not reflect past tax rules. For previous years, you should seek the corresponding worksheets applicable to those years to ensure accuracy in your calculations. This is important for maintaining compliance with tax regulations.

Get more for Social Security Benefits Worksheet

Find out other Social Security Benefits Worksheet

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online