Illinois Attorney General Charitable Trust 2019-2026

Understanding the Illinois Attorney General Charitable Trust

The Illinois Attorney General Charitable Trust is a legal framework designed to oversee and regulate charitable organizations within the state of Illinois. This trust ensures that charitable entities operate in compliance with state laws and uphold their fiduciary responsibilities to the public. It is essential for organizations to adhere to the guidelines set forth by the Attorney General to maintain transparency and accountability in their operations.

Steps to Complete the Illinois Attorney General Charitable Trust

Completing the Illinois Attorney General Charitable Trust involves several key steps:

- Gather necessary documentation, including your organization’s bylaws and financial statements.

- Complete the required forms accurately, ensuring all information is current and correct.

- Submit the forms along with any required fees to the appropriate office of the Illinois Attorney General.

- Maintain copies of all submitted documents for your records.

Legal Use of the Illinois Attorney General Charitable Trust

The legal use of the Illinois Attorney General Charitable Trust encompasses the proper management of charitable assets and adherence to state regulations. Organizations must use the trust to ensure that funds are allocated for their intended charitable purposes. Misuse of these funds can result in legal repercussions, including penalties or loss of charitable status.

Required Documents for the Illinois Attorney General Charitable Trust

To successfully complete the Illinois Attorney General Charitable Trust, organizations must prepare several key documents:

- Articles of incorporation or organization

- Bylaws governing the organization

- Financial statements for the previous fiscal year

- List of current board members and their roles

Filing Deadlines and Important Dates

Organizations must be aware of specific filing deadlines associated with the Illinois Attorney General Charitable Trust. Typically, annual reports and financial disclosures are due within six months of the end of the fiscal year. It is crucial to stay informed about any changes in deadlines to avoid penalties.

Eligibility Criteria for the Illinois Attorney General Charitable Trust

Eligibility for the Illinois Attorney General Charitable Trust generally includes organizations that are recognized as charitable under state law. This includes non-profits that provide public benefits and comply with the regulations set forth by the Attorney General. Organizations must demonstrate their commitment to charitable purposes and maintain proper governance to qualify.

Examples of Using the Illinois Attorney General Charitable Trust

Organizations can utilize the Illinois Attorney General Charitable Trust in various ways, such as:

- Establishing a trust fund to support specific charitable initiatives.

- Ensuring compliance with state regulations during fundraising activities.

- Providing transparency to donors regarding the use of funds.

Quick guide on how to complete illinois attorney general charitable trust

Accomplish Illinois Attorney General Charitable Trust seamlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files quickly without delays. Handle Illinois Attorney General Charitable Trust on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Illinois Attorney General Charitable Trust effortlessly

- Obtain Illinois Attorney General Charitable Trust and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Illinois Attorney General Charitable Trust to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois attorney general charitable trust

Create this form in 5 minutes!

How to create an eSignature for the illinois attorney general charitable trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

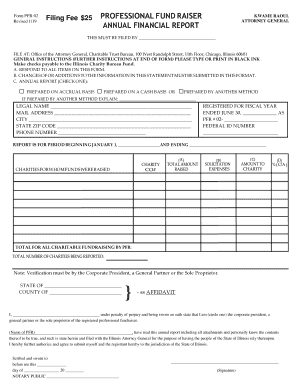

What is the form pfr 02 and why is it important?

The form pfr 02 is a crucial document used for various administrative purposes. It helps businesses streamline their processes by ensuring compliance with regulatory requirements. Understanding its significance can enhance your operational efficiency.

-

How can airSlate SignNow help with the form pfr 02?

airSlate SignNow simplifies the process of filling out and signing the form pfr 02. Our platform allows users to easily create, edit, and eSign documents, ensuring that your form pfr 02 is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the form pfr 02?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the completion of the form pfr 02, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing the form pfr 02?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the form pfr 02. These tools enhance user experience and ensure that your documents are handled with care and precision.

-

Can I integrate airSlate SignNow with other applications for the form pfr 02?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the form pfr 02 alongside your existing tools. This integration capability enhances workflow efficiency and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for the form pfr 02?

Using airSlate SignNow for the form pfr 02 provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are processed quickly and securely, allowing you to focus on your core business activities.

-

Is airSlate SignNow user-friendly for completing the form pfr 02?

Yes, airSlate SignNow is designed with user experience in mind. The intuitive interface makes it easy for anyone to navigate and complete the form pfr 02 without extensive training or technical knowledge.

Get more for Illinois Attorney General Charitable Trust

Find out other Illinois Attorney General Charitable Trust

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe