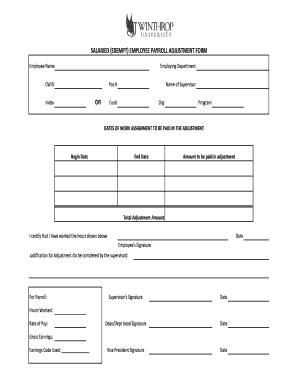

SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM

What is the Salaried Exempt Employee Payroll Adjustment Form

The Salaried Exempt Employee Payroll Adjustment Form is a crucial document used by employers to make necessary payroll adjustments for salaried exempt employees. This form allows businesses to document changes in salary, bonuses, or other compensation adjustments that may affect an employee's pay. It is essential for ensuring compliance with labor laws and maintaining accurate payroll records.

How to Use the Salaried Exempt Employee Payroll Adjustment Form

To effectively use the Salaried Exempt Employee Payroll Adjustment Form, employers should first gather all relevant information, including the employee's current salary, the proposed adjustments, and any necessary supporting documentation. The form should be completed with accurate details, including the employee's name, position, and the specific adjustments being made. Once filled out, the form should be reviewed for accuracy and then submitted to the appropriate payroll department for processing.

Steps to Complete the Salaried Exempt Employee Payroll Adjustment Form

Completing the Salaried Exempt Employee Payroll Adjustment Form involves several key steps:

- Gather necessary employee information, including name, position, and current salary.

- Detail the specific payroll adjustments, including any increases or decreases in salary.

- Include the effective date of the changes.

- Attach any supporting documentation, such as performance reviews or approval emails.

- Review the form for accuracy before submission.

Key Elements of the Salaried Exempt Employee Payroll Adjustment Form

Important elements of the Salaried Exempt Employee Payroll Adjustment Form include:

- Employee Information: Full name, job title, and department.

- Adjustment Details: Clear description of the changes being made, including salary adjustments and effective dates.

- Approval Signatures: Required signatures from relevant supervisors or HR personnel to validate the adjustments.

Legal Use of the Salaried Exempt Employee Payroll Adjustment Form

The Salaried Exempt Employee Payroll Adjustment Form must be used in accordance with federal and state labor laws. Employers are responsible for ensuring that any adjustments comply with the Fair Labor Standards Act (FLSA) and other relevant regulations. Proper documentation helps protect against potential legal issues related to employee compensation and ensures transparency in payroll practices.

Form Submission Methods

The completed Salaried Exempt Employee Payroll Adjustment Form can typically be submitted through various methods, including:

- Online Submission: Many companies have digital payroll systems that allow for electronic submission of forms.

- Mail: The form can be printed and sent via postal service to the payroll department.

- In-Person: Employees may also choose to deliver the form directly to HR or payroll offices.

Quick guide on how to complete salaried exempt employee payroll adjustment form

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the necessary format and securely store it online. airSlate SignNow provides all the tools you need to rapidly create, modify, and eSign your documents without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select how you would like to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the stress of losing or misplacing files, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM

Create this form in 5 minutes!

How to create an eSignature for the salaried exempt employee payroll adjustment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM?

A SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM is a document used to make changes to the payroll of salaried exempt employees. This form helps ensure that any adjustments, such as bonuses or deductions, are accurately reflected in payroll processing. Utilizing airSlate SignNow simplifies the creation and signing of this form, making it efficient for HR departments.

-

How can airSlate SignNow help with the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM. With customizable templates and a user-friendly interface, businesses can streamline their payroll adjustment processes. This ensures that all necessary changes are documented and approved quickly.

-

Is there a cost associated with using airSlate SignNow for payroll adjustment forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost depends on the features and number of users required. Investing in airSlate SignNow for managing the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM can lead to signNow time savings and improved accuracy in payroll management.

-

What features does airSlate SignNow offer for payroll adjustment forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows for the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM. These features enhance efficiency and ensure compliance with payroll regulations. Additionally, users can track the status of documents in real-time.

-

Can I integrate airSlate SignNow with other payroll systems?

Yes, airSlate SignNow offers integrations with various payroll systems, allowing for seamless data transfer. This means that once the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM is completed, it can be easily synced with your existing payroll software. This integration helps reduce manual entry errors and saves time.

-

What are the benefits of using airSlate SignNow for payroll adjustments?

Using airSlate SignNow for the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that all documents are stored securely and can be accessed easily. This leads to a more organized payroll process and better compliance.

-

How secure is the information on the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive information on the SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM. Users can trust that their data is safe from unauthorized access. Regular security audits further ensure compliance with industry standards.

Get more for SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM

Find out other SALARIED EXEMPT EMPLOYEE PAYROLL ADJUSTMENT FORM

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History