Health Savings Account Salary Reduction Agreement Wright State Form

Understanding the Health Savings Account Salary Reduction Agreement at Wright State

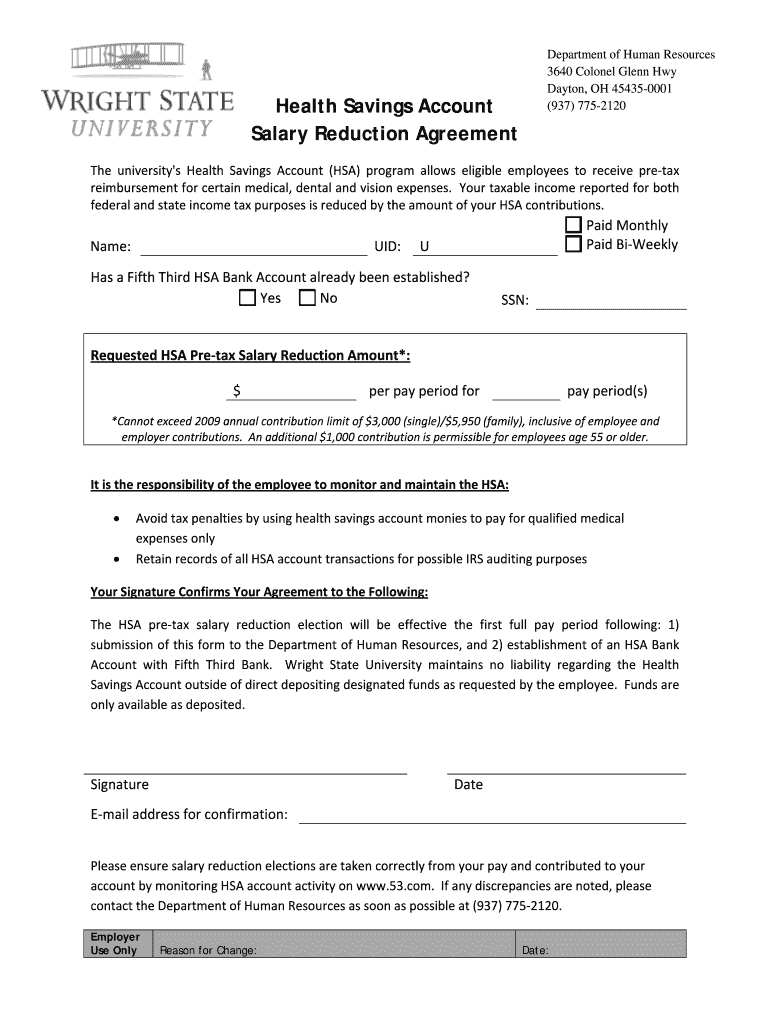

The Health Savings Account Salary Reduction Agreement at Wright State is a formal document that allows employees to allocate a portion of their salary to a Health Savings Account (HSA). This agreement is essential for those who wish to take advantage of the tax benefits associated with HSAs. By contributing pre-tax dollars, employees can reduce their taxable income while saving for qualified medical expenses. Understanding the terms and conditions of this agreement is crucial for maximizing its benefits.

Steps to Complete the Health Savings Account Salary Reduction Agreement

Completing the Health Savings Account Salary Reduction Agreement involves several straightforward steps:

- Review the eligibility criteria for contributing to an HSA.

- Obtain the salary reduction agreement form from the Wright State human resources department or their online portal.

- Fill out the required personal information, including your name, employee ID, and the amount you wish to contribute.

- Sign and date the agreement to confirm your consent.

- Submit the completed form to your HR representative for processing.

Key Elements of the Health Savings Account Salary Reduction Agreement

Several key elements define the Health Savings Account Salary Reduction Agreement:

- Contribution Amount: Specifies the percentage or dollar amount of salary to be contributed to the HSA.

- Effective Date: Indicates when the salary reduction will begin.

- Revocation Terms: Outlines how and when an employee can revoke or change their contribution.

- Compliance with IRS Guidelines: Ensures that contributions adhere to federal regulations regarding HSAs.

Legal Use of the Health Savings Account Salary Reduction Agreement

The Health Savings Account Salary Reduction Agreement is legally binding, meaning that both the employee and employer must adhere to its terms. It is essential to ensure that the agreement complies with IRS regulations, as improper use can lead to penalties. Employees should keep a copy of the signed agreement for their records and to ensure compliance with tax reporting requirements.

Eligibility Criteria for the Health Savings Account Salary Reduction Agreement

To participate in the Health Savings Account Salary Reduction Agreement, employees must meet specific eligibility criteria. Generally, individuals must be enrolled in a high-deductible health plan (HDHP) to qualify for an HSA. Additionally, they should not be covered by any other health plan that is not an HDHP, and they must not be enrolled in Medicare. Reviewing these criteria is vital for ensuring compliance and maximizing the benefits of the HSA.

How to Obtain the Health Savings Account Salary Reduction Agreement

Obtaining the Health Savings Account Salary Reduction Agreement is a straightforward process. Employees can typically access the form through the Wright State human resources department or their official website. It may also be available in employee onboarding materials. If there are difficulties in locating the form, employees are encouraged to reach out directly to HR for assistance.

Quick guide on how to complete health savings account salary reduction agreement wright state

Complete [SKS] effortlessly on any device

Online document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the health savings account salary reduction agreement wright state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Health Savings Account Salary Reduction Agreement Wright State?

A Health Savings Account Salary Reduction Agreement Wright State is a formal arrangement that allows employees to allocate a portion of their salary to a Health Savings Account (HSA). This agreement helps employees save on taxes while setting aside funds for qualified medical expenses. By participating, employees can maximize their healthcare savings and benefit from tax advantages.

-

How does the Health Savings Account Salary Reduction Agreement Wright State work?

The Health Savings Account Salary Reduction Agreement Wright State works by allowing employees to choose a specific amount of their salary to be deducted pre-tax and deposited into their HSA. This reduces their taxable income, leading to potential tax savings. The funds can then be used for eligible medical expenses, making healthcare more affordable.

-

What are the benefits of using a Health Savings Account Salary Reduction Agreement Wright State?

The benefits of using a Health Savings Account Salary Reduction Agreement Wright State include tax savings, increased control over healthcare spending, and the ability to save for future medical expenses. Additionally, HSAs can earn interest and grow tax-free, providing long-term financial advantages. This agreement also promotes healthier financial planning for medical costs.

-

Are there any fees associated with the Health Savings Account Salary Reduction Agreement Wright State?

Typically, there are no direct fees associated with setting up a Health Savings Account Salary Reduction Agreement Wright State. However, some financial institutions may charge maintenance fees for the HSA itself. It's important to review the terms and conditions of your chosen HSA provider to understand any potential costs involved.

-

Can I change my Health Savings Account Salary Reduction Agreement Wright State contributions?

Yes, you can change your contributions to the Health Savings Account Salary Reduction Agreement Wright State, usually during open enrollment periods or qualifying life events. Adjusting your contributions allows you to better align your savings with your healthcare needs. Always consult with your HR department for specific procedures regarding changes.

-

How does airSlate SignNow facilitate the Health Savings Account Salary Reduction Agreement Wright State?

airSlate SignNow simplifies the process of managing the Health Savings Account Salary Reduction Agreement Wright State by providing an easy-to-use platform for document signing and management. With airSlate SignNow, businesses can efficiently send, eSign, and store agreements securely. This streamlines the administrative tasks associated with HSAs, saving time and reducing errors.

-

What features does airSlate SignNow offer for Health Savings Account Salary Reduction Agreement Wright State?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows for the Health Savings Account Salary Reduction Agreement Wright State. These features enhance efficiency and ensure compliance with legal requirements. Additionally, the platform provides tracking and reporting tools to monitor agreement statuses.

Get more for Health Savings Account Salary Reduction Agreement Wright State

- The art of persuasion aristotles rhetoric for everybody pdf form

- Cellular respiration crossword puzzle answer key pdf form

- Village of lombard contractor registration form

- Ihss pay stub example 100383466 form

- Form 14 ica sample

- Accessdata ace exam answers form

- Affidavit of unemployment 26350600 form

- Hpd online 11928819 form

Find out other Health Savings Account Salary Reduction Agreement Wright State

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease