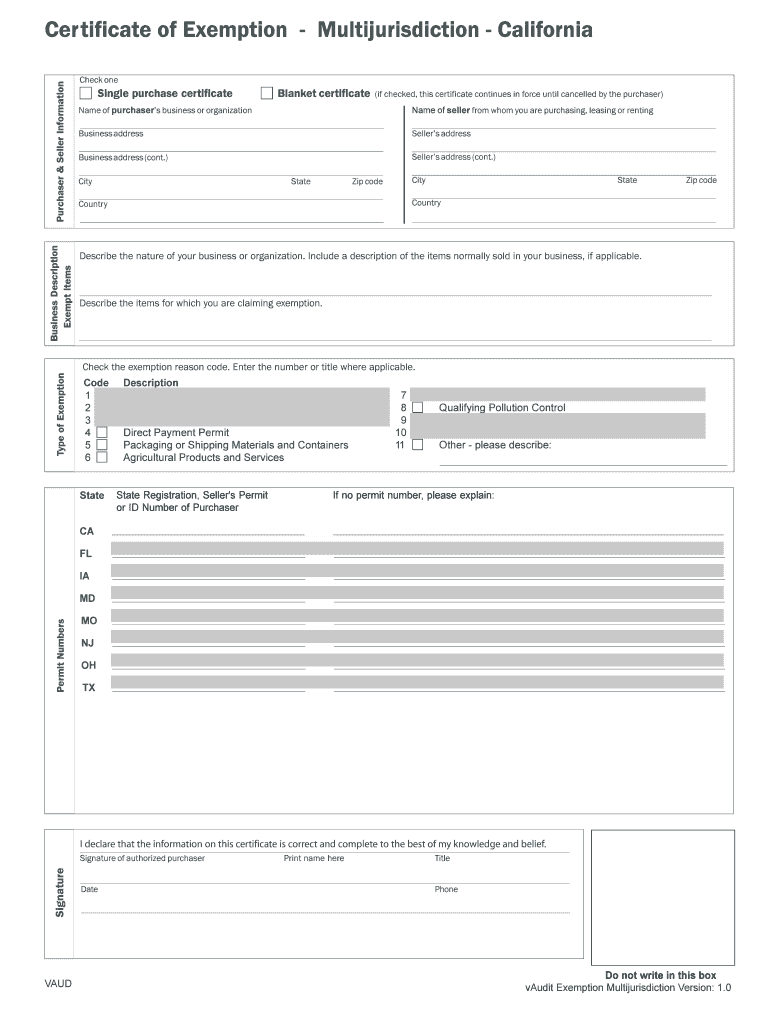

Type of Exemption Form

What is the Type Of Exemption

The Type Of Exemption refers to specific categories that allow individuals or businesses to be exempt from certain tax obligations or requirements. These exemptions can vary based on the nature of the entity, the purpose of the exemption, and the applicable tax laws. Common types include exemptions for non-profit organizations, certain small businesses, and specific income categories. Understanding the Type Of Exemption is crucial for ensuring compliance and maximizing potential savings.

How to obtain the Type Of Exemption

To obtain the Type Of Exemption, individuals or businesses typically need to complete an application process that may involve submitting specific forms to the appropriate tax authority. This process often requires providing documentation that supports the request for exemption, such as proof of non-profit status or financial statements. It is essential to review the requirements set by the IRS or state tax agencies to ensure all necessary information is included in the application.

Steps to complete the Type Of Exemption

Completing the Type Of Exemption involves several key steps:

- Identify the specific Type Of Exemption applicable to your situation.

- Gather required documentation, such as tax returns, proof of income, or organizational status.

- Fill out the necessary forms accurately, ensuring all information is complete.

- Submit the forms to the appropriate tax authority, either online or by mail.

- Keep a copy of the submitted forms and any correspondence for your records.

Legal use of the Type Of Exemption

The legal use of the Type Of Exemption is governed by federal and state tax laws. It is important to understand the legal implications of claiming an exemption, as improper use can lead to penalties or audits. Entities must ensure they meet the eligibility criteria and maintain compliance with all reporting requirements to avoid legal issues.

Key elements of the Type Of Exemption

Key elements of the Type Of Exemption include:

- Eligibility Criteria: Specific conditions that must be met to qualify for the exemption.

- Documentation Requirements: Necessary paperwork to support the exemption claim.

- Application Process: Steps to submit a request for exemption.

- Compliance Obligations: Ongoing responsibilities to maintain the exemption status.

Examples of using the Type Of Exemption

Examples of using the Type Of Exemption include:

- A non-profit organization applying for a tax-exempt status under section 501(c)(3).

- A small business claiming an exemption from sales tax for certain purchases.

- Individuals with specific income levels applying for exemptions on their federal tax returns.

IRS Guidelines

The IRS provides detailed guidelines regarding the Type Of Exemption, outlining eligibility, application procedures, and compliance requirements. It is essential for applicants to refer to these guidelines to ensure they are following the correct processes and submitting the right documentation. Regular updates from the IRS may also affect the status and requirements for exemptions, making it important to stay informed.

Quick guide on how to complete type of exemption

Prepare [SKS] effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It offers a perfect environmentally-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Underline relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Type Of Exemption

Create this form in 5 minutes!

How to create an eSignature for the type of exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Type Of Exemption in the context of airSlate SignNow?

A Type Of Exemption refers to specific conditions under which certain documents or transactions may not require standard compliance measures. In airSlate SignNow, understanding the Type Of Exemption can help businesses streamline their document processes while ensuring they meet legal requirements.

-

How does airSlate SignNow handle different Types Of Exemption?

airSlate SignNow provides customizable templates that can accommodate various Types Of Exemption. This flexibility allows users to create documents that align with their specific needs, ensuring compliance while simplifying the signing process.

-

Are there any additional costs associated with managing Types Of Exemption in airSlate SignNow?

No, airSlate SignNow offers a transparent pricing model that includes all features related to managing Types Of Exemption. Users can access these functionalities without incurring hidden fees, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for handling Types Of Exemption?

airSlate SignNow includes features such as customizable workflows, automated reminders, and secure eSigning, all tailored to accommodate various Types Of Exemption. These tools enhance efficiency and ensure that all documents are processed correctly.

-

Can I integrate airSlate SignNow with other software to manage Types Of Exemption?

Yes, airSlate SignNow offers seamless integrations with popular software platforms, allowing users to manage Types Of Exemption efficiently. This connectivity ensures that your document workflows are streamlined across different applications.

-

What are the benefits of using airSlate SignNow for Types Of Exemption?

Using airSlate SignNow for Types Of Exemption provides businesses with enhanced efficiency, reduced paperwork, and improved compliance. The platform's user-friendly interface makes it easy to manage exemptions without sacrificing security or functionality.

-

Is airSlate SignNow suitable for all business sizes when dealing with Types Of Exemption?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an ideal choice for managing Types Of Exemption. Whether you're a small startup or a large enterprise, the platform scales to meet your needs.

Get more for Type Of Exemption

Find out other Type Of Exemption

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation