Credit Card Payments, Division of Corporations, Business and Form

Understanding Credit Card Payments in Business Context

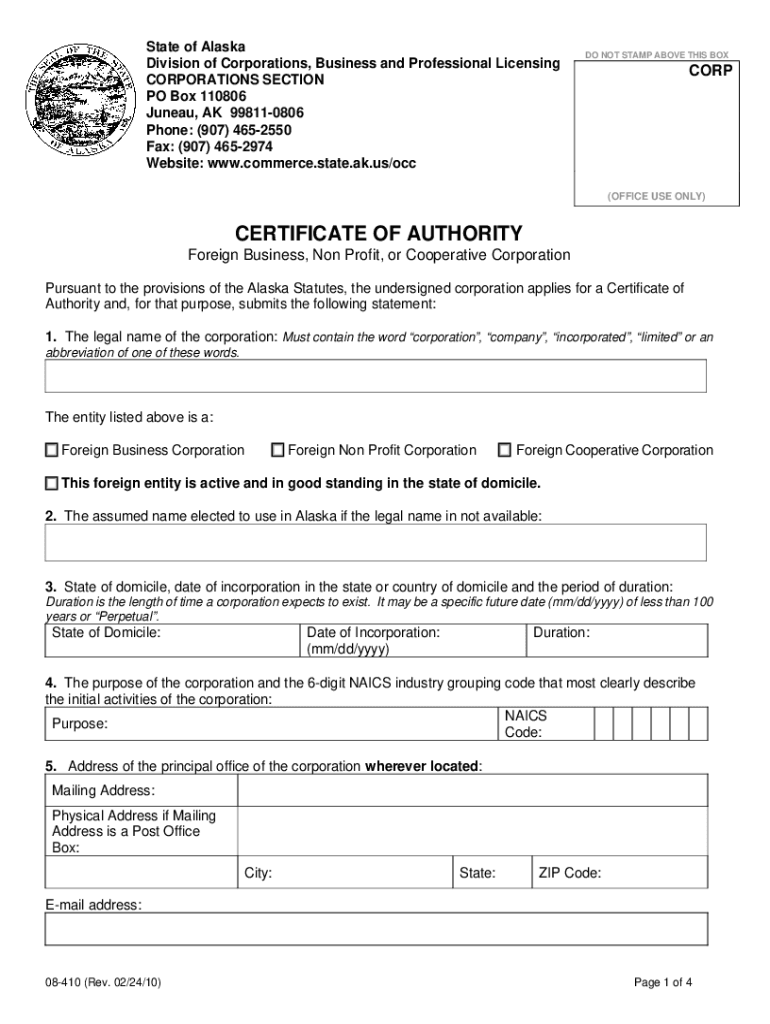

The Credit Card Payments, Division of Corporations, Business And form is essential for businesses that accept credit card transactions. This form is typically used to report and manage credit card payments made to corporations. It ensures that businesses comply with state regulations and maintain accurate records of their transactions. Understanding this form is crucial for businesses to avoid penalties and ensure smooth financial operations.

Steps to Complete the Credit Card Payments Form

Completing the Credit Card Payments, Division of Corporations, Business And form involves several key steps:

- Gather necessary business information, including the legal name, address, and tax identification number.

- Detail all credit card transactions, including amounts and dates.

- Ensure accurate categorization of each transaction to comply with IRS guidelines.

- Review the completed form for accuracy before submission.

Legal Use of the Credit Card Payments Form

This form must be used in accordance with state and federal regulations. Businesses are legally required to report credit card payments accurately to ensure compliance with tax obligations. Misreporting can lead to legal penalties, including fines and interest on unpaid taxes. It is advisable for businesses to consult with a tax professional to ensure proper use of the form.

Required Documents for Submission

To successfully submit the Credit Card Payments, Division of Corporations, Business And form, businesses need to prepare the following documents:

- Proof of business registration and tax identification.

- Records of all credit card transactions for the reporting period.

- Any previous forms or documentation related to credit card payments.

Filing Deadlines and Important Dates

Businesses must adhere to specific deadlines when filing the Credit Card Payments form. Generally, the form should be submitted by the end of the fiscal year or as specified by the state’s Division of Corporations. Missing these deadlines can result in penalties, making it crucial for businesses to stay informed about important dates.

Examples of Using the Credit Card Payments Form

Businesses in various sectors utilize the Credit Card Payments, Division of Corporations, Business And form. For instance:

- Retail businesses report daily credit card sales to track revenue accurately.

- Service providers use the form to document payments received from clients via credit card.

These examples illustrate the form's importance in maintaining transparent financial records and compliance.

Quick guide on how to complete credit card payments division of corporations business and

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, alter, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and electronically sign [SKS] to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit Card Payments, Division Of Corporations, Business And

Create this form in 5 minutes!

How to create an eSignature for the credit card payments division of corporations business and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for Credit Card Payments, Division Of Corporations, Business And?

Using airSlate SignNow for Credit Card Payments, Division Of Corporations, Business And offers numerous benefits, including streamlined document management and enhanced security. Our platform allows businesses to easily send and eSign documents, ensuring a faster transaction process. Additionally, it helps in maintaining compliance with industry regulations, making it a reliable choice for corporations.

-

How does airSlate SignNow integrate with existing systems for Credit Card Payments, Division Of Corporations, Business And?

airSlate SignNow seamlessly integrates with various business applications, enhancing the efficiency of Credit Card Payments, Division Of Corporations, Business And. This integration allows users to automate workflows and synchronize data across platforms, reducing manual entry errors. Our API and pre-built connectors make it easy to connect with your existing systems.

-

What pricing plans are available for airSlate SignNow regarding Credit Card Payments, Division Of Corporations, Business And?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling Credit Card Payments, Division Of Corporations, Business And. Our plans range from basic to advanced features, ensuring that you only pay for what you need. Additionally, we provide a free trial to help you assess the platform's suitability for your business.

-

Is airSlate SignNow secure for handling Credit Card Payments, Division Of Corporations, Business And?

Yes, airSlate SignNow prioritizes security for Credit Card Payments, Division Of Corporations, Business And. We utilize advanced encryption protocols and comply with industry standards to protect sensitive information. Our platform also includes features like two-factor authentication to further enhance security for your business transactions.

-

Can airSlate SignNow help with compliance for Credit Card Payments, Division Of Corporations, Business And?

Absolutely! airSlate SignNow is designed to assist businesses in maintaining compliance for Credit Card Payments, Division Of Corporations, Business And. Our platform includes features that help you adhere to legal requirements and industry regulations, ensuring that your documents are legally binding and secure.

-

What features does airSlate SignNow offer for Credit Card Payments, Division Of Corporations, Business And?

airSlate SignNow provides a variety of features tailored for Credit Card Payments, Division Of Corporations, Business And, including customizable templates, automated workflows, and real-time tracking. These features enhance the efficiency of document management and eSigning processes, allowing businesses to operate smoothly. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

How can airSlate SignNow improve the efficiency of Credit Card Payments, Division Of Corporations, Business And?

By using airSlate SignNow, businesses can signNowly improve the efficiency of Credit Card Payments, Division Of Corporations, Business And. Our platform automates repetitive tasks, reduces paperwork, and speeds up the signing process. This leads to quicker turnaround times and allows your team to focus on more strategic initiatives.

Get more for Credit Card Payments, Division Of Corporations, Business And

Find out other Credit Card Payments, Division Of Corporations, Business And

- How To Sign Pennsylvania Car Dealer Presentation

- How Do I Sign Pennsylvania Car Dealer Presentation

- How Do I Sign Pennsylvania Car Dealer Form

- Help Me With Sign Pennsylvania Car Dealer Presentation

- How To Sign Pennsylvania Car Dealer Presentation

- How Can I Sign Pennsylvania Car Dealer Presentation

- Can I Sign Pennsylvania Car Dealer Presentation

- How Do I Sign Pennsylvania Car Dealer Presentation

- Help Me With Sign Pennsylvania Car Dealer Form

- How To Sign Pennsylvania Car Dealer Presentation

- Help Me With Sign Pennsylvania Car Dealer Presentation

- How Can I Sign Pennsylvania Car Dealer Form

- How Do I Sign Pennsylvania Car Dealer Presentation

- Help Me With Sign Pennsylvania Car Dealer Presentation

- How Can I Sign Pennsylvania Car Dealer Presentation

- How Can I Sign Pennsylvania Car Dealer Presentation

- Can I Sign Pennsylvania Car Dealer Presentation

- Can I Sign Pennsylvania Car Dealer Form

- Can I Sign Pennsylvania Car Dealer Presentation

- How To Sign Pennsylvania Car Dealer Presentation