National Savings Schemes Form

What is the National Savings Schemes

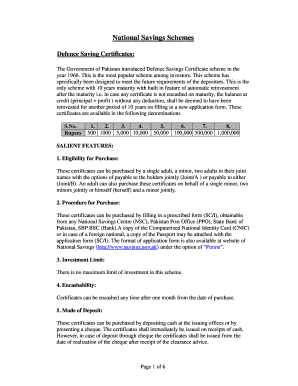

The National Savings Schemes are government-backed savings programs designed to encourage individuals to save money while providing a secure investment option. These schemes typically offer competitive interest rates, tax benefits, and a variety of investment options tailored to meet the needs of different savers. They aim to promote financial literacy and stability among citizens, ensuring that individuals can build a financial cushion for future needs.

How to use the National Savings Schemes

Using the National Savings Schemes involves a straightforward process. First, individuals need to identify the specific scheme that aligns with their financial goals. Once selected, they must complete the necessary application form, which can often be done online or in person. After submitting the application, participants will receive confirmation of their investment and can start contributing to their savings. Regular monitoring of the account is recommended to track growth and ensure that it meets the intended financial objectives.

Steps to complete the National Savings Schemes

Completing the National Savings Schemes involves several key steps:

- Research available schemes to find the best fit for your savings goals.

- Gather required documents, such as identification and proof of address.

- Fill out the application form accurately, ensuring all information is complete.

- Submit the application via the chosen method, whether online, by mail, or in person.

- Receive confirmation of your application and account details.

- Begin making contributions as per the terms of the selected scheme.

Legal use of the National Savings Schemes

The National Savings Schemes are governed by specific regulations that ensure their integrity and security. Participants must adhere to the terms and conditions outlined in the scheme documentation. This includes understanding the implications of tax benefits and any restrictions on withdrawals. Legal compliance is essential to maintain the benefits associated with these savings programs and avoid any potential penalties.

Key elements of the National Savings Schemes

Several key elements define the National Savings Schemes:

- Interest Rates: Competitive rates that may vary based on the type of scheme.

- Tax Benefits: Potential tax deductions or exemptions on earned interest.

- Investment Options: A variety of schemes catering to different financial goals.

- Security: Backed by the government, ensuring the safety of funds.

- Accessibility: Easy application processes and options for online management.

Eligibility Criteria

Eligibility for the National Savings Schemes typically includes factors such as age, residency status, and minimum investment amounts. Most schemes are open to U.S. citizens and legal residents, with some programs specifically designed for certain demographics, such as students or retirees. It is important to review the specific eligibility criteria for each scheme to ensure compliance and maximize benefits.

Quick guide on how to complete national savings schemes

Prepare [SKS] effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as it allows you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to initiate the process.

- Use the tools we provide to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to National Savings Schemes

Create this form in 5 minutes!

How to create an eSignature for the national savings schemes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are National Savings Schemes?

National Savings Schemes are government-backed savings programs designed to encourage individuals to save money while offering attractive interest rates. These schemes often provide a secure way to invest funds with minimal risk, making them an ideal choice for those looking to grow their savings over time.

-

How do National Savings Schemes work?

National Savings Schemes typically involve depositing a certain amount of money for a fixed period, during which it earns interest. The government guarantees the returns, ensuring that your investment is safe and secure, which is a signNow advantage for savers seeking stability.

-

What are the benefits of using National Savings Schemes?

The primary benefits of National Savings Schemes include guaranteed returns, tax advantages, and the security of government backing. These schemes are designed to help individuals save for future goals, such as retirement or education, while providing peace of mind through their low-risk nature.

-

Are there any fees associated with National Savings Schemes?

Most National Savings Schemes do not have hidden fees, making them a cost-effective option for savers. However, it's essential to review the specific terms of each scheme, as some may have penalties for early withdrawal or other conditions that could affect your savings.

-

Can I integrate National Savings Schemes with other financial products?

Yes, many National Savings Schemes can be integrated with other financial products, such as savings accounts or investment portfolios. This flexibility allows you to create a comprehensive financial strategy that maximizes your savings potential while benefiting from the security of government-backed schemes.

-

How do I choose the right National Savings Scheme for me?

Choosing the right National Savings Scheme involves assessing your financial goals, risk tolerance, and the specific features of each scheme. Consider factors such as interest rates, maturity periods, and any associated benefits to find the option that best aligns with your savings objectives.

-

What is the minimum investment required for National Savings Schemes?

The minimum investment for National Savings Schemes varies depending on the specific program. Generally, these schemes are designed to be accessible, with low minimum investment thresholds, allowing a wide range of individuals to participate and benefit from saving.

Get more for National Savings Schemes

Find out other National Savings Schemes

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free