Enterprise Zone Hiring Tax Credit Voucher Application 1 Form

What is the Enterprise Zone Hiring Tax Credit Voucher Application 1

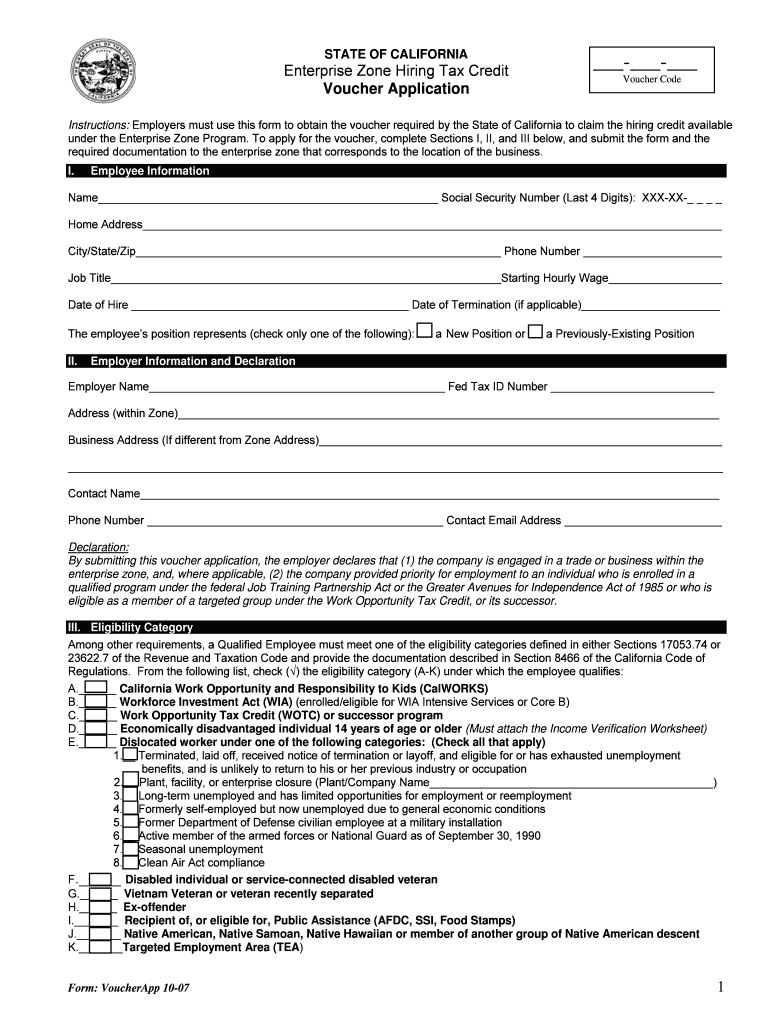

The Enterprise Zone Hiring Tax Credit Voucher Application 1 is a form used by businesses to apply for tax credits associated with hiring employees from designated enterprise zones. These zones are areas identified by state and local governments to stimulate economic growth by providing various incentives, including tax credits, to encourage businesses to hire local residents. The application serves as a formal request to receive a voucher that can be redeemed for tax credits, helping businesses reduce their overall tax liability while promoting job creation in economically disadvantaged areas.

How to use the Enterprise Zone Hiring Tax Credit Voucher Application 1

To effectively use the Enterprise Zone Hiring Tax Credit Voucher Application 1, businesses must first ensure they meet the eligibility criteria outlined by their state. Once eligibility is confirmed, the business should fill out the application with accurate information regarding the employees hired from the enterprise zone. This includes details such as the employee's name, Social Security number, and the date of hire. After completing the form, it should be submitted to the appropriate state agency for processing. Upon approval, the business will receive a voucher that can be applied to their tax filings.

Steps to complete the Enterprise Zone Hiring Tax Credit Voucher Application 1

Completing the Enterprise Zone Hiring Tax Credit Voucher Application 1 involves several key steps:

- Gather necessary information: Collect details about the employees hired from the enterprise zone, including personal identification and employment dates.

- Fill out the application: Enter the required information accurately on the form, ensuring all sections are completed.

- Review the application: Double-check the form for any errors or omissions that could delay processing.

- Submit the application: Send the completed form to the designated state agency, either online or via mail, as specified by state guidelines.

Eligibility Criteria

Eligibility for the Enterprise Zone Hiring Tax Credit Voucher Application 1 typically includes several criteria that businesses must meet. Generally, businesses must operate within a designated enterprise zone and hire employees who are residents of that zone. Additionally, the employees must meet specific qualifications, such as being unemployed or underemployed prior to hiring. Some states may have additional requirements, such as the business being a certain type of entity or having a minimum number of employees. It is important for businesses to review their state's specific eligibility requirements before applying.

Required Documents

When applying for the Enterprise Zone Hiring Tax Credit Voucher, businesses may need to provide several key documents. These often include:

- Proof of business registration and operation within the enterprise zone.

- Employee documentation, such as Social Security cards and identification for each hired employee.

- Payroll records indicating employment dates and wages for the employees in question.

- Any additional forms or documentation specified by the state agency overseeing the tax credit program.

Form Submission Methods

The Enterprise Zone Hiring Tax Credit Voucher Application 1 can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission: Many states offer an online portal where businesses can fill out and submit the application electronically.

- Mail: Businesses may also choose to print the completed form and send it via postal mail to the appropriate state agency.

- In-person submission: Some states allow businesses to submit the form in person at designated offices, providing an opportunity for immediate feedback.

Quick guide on how to complete enterprise zone hiring tax credit voucher application 1

Finalizing [SKS] effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Enterprise Zone Hiring Tax Credit Voucher Application 1

Create this form in 5 minutes!

How to create an eSignature for the enterprise zone hiring tax credit voucher application 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Enterprise Zone Hiring Tax Credit Voucher Application 1?

The Enterprise Zone Hiring Tax Credit Voucher Application 1 is a program designed to incentivize businesses to hire employees from designated enterprise zones. By completing this application, businesses can access tax credits that reduce their overall tax liability, making it a valuable tool for cost savings.

-

How can airSlate SignNow assist with the Enterprise Zone Hiring Tax Credit Voucher Application 1?

airSlate SignNow streamlines the process of completing and submitting the Enterprise Zone Hiring Tax Credit Voucher Application 1 by providing an easy-to-use platform for eSigning and document management. This ensures that your application is submitted quickly and efficiently, reducing delays in receiving your tax credits.

-

What are the benefits of using airSlate SignNow for the Enterprise Zone Hiring Tax Credit Voucher Application 1?

Using airSlate SignNow for the Enterprise Zone Hiring Tax Credit Voucher Application 1 offers numerous benefits, including enhanced security, faster processing times, and the ability to track document status in real-time. This helps businesses stay organized and ensures that they do not miss out on potential tax savings.

-

Is there a cost associated with using airSlate SignNow for the Enterprise Zone Hiring Tax Credit Voucher Application 1?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. The pricing plans are flexible, allowing you to choose the one that best fits your needs while ensuring you can efficiently manage your Enterprise Zone Hiring Tax Credit Voucher Application 1.

-

What features does airSlate SignNow offer for the Enterprise Zone Hiring Tax Credit Voucher Application 1?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically tailored for the Enterprise Zone Hiring Tax Credit Voucher Application 1. These features simplify the application process and enhance collaboration among team members.

-

Can airSlate SignNow integrate with other software for the Enterprise Zone Hiring Tax Credit Voucher Application 1?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing for a smooth workflow when handling the Enterprise Zone Hiring Tax Credit Voucher Application 1. This integration capability ensures that your existing systems work harmoniously with our platform.

-

How does airSlate SignNow ensure the security of the Enterprise Zone Hiring Tax Credit Voucher Application 1?

airSlate SignNow prioritizes security by employing advanced encryption methods and compliance with industry standards to protect your data during the submission of the Enterprise Zone Hiring Tax Credit Voucher Application 1. This commitment to security helps safeguard sensitive information and builds trust with our users.

Get more for Enterprise Zone Hiring Tax Credit Voucher Application 1

- Report of mastercard activity depauw form

- Devry university39s addison campus ticket order form

- Peditech money back guarantee claim form amends

- F9pass flyfrontier com form

- Withdrawal from interlock mn form

- Transaction formbullion nuggets amp

- Help using this veterans uk pdf form about this fo

- Arc request form pdf google sites

Find out other Enterprise Zone Hiring Tax Credit Voucher Application 1

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document