APPLICATION to DO BUSINESS under the FOREIGN Form

What is the APPLICATION TO DO BUSINESS UNDER THE FOREIGN

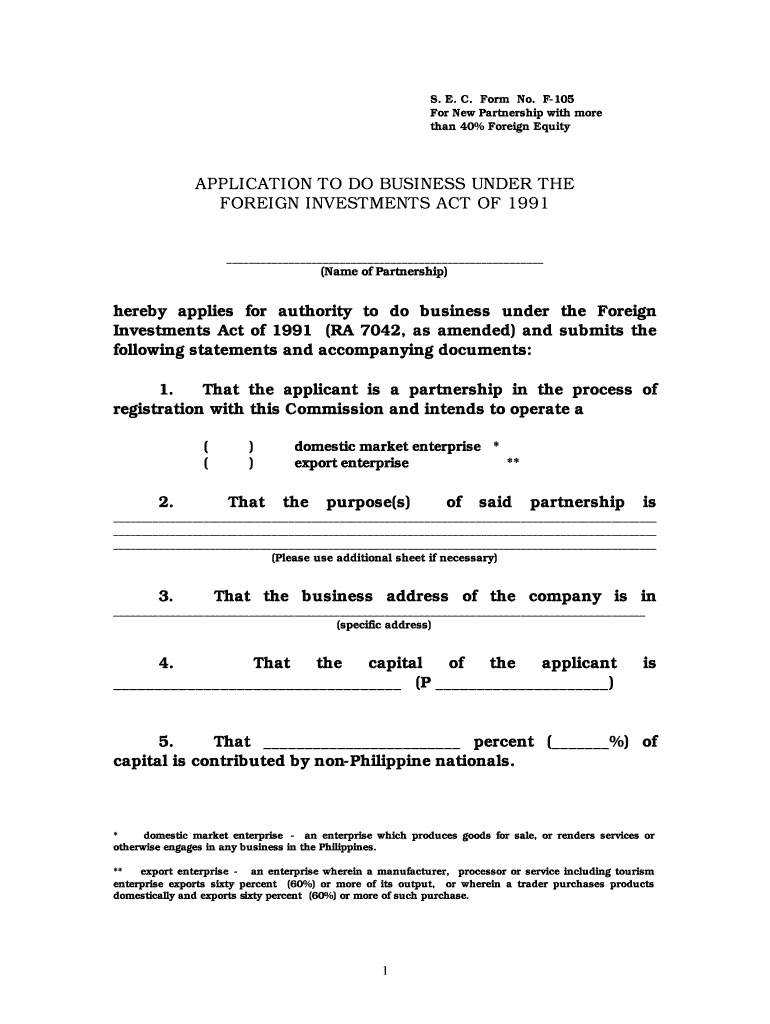

The APPLICATION TO DO BUSINESS UNDER THE FOREIGN is a legal document that allows foreign entities to operate within the United States. This application is essential for businesses based outside the U.S. that wish to establish a presence, conduct transactions, or engage in business activities in American states. It typically requires the foreign entity to register with the appropriate state authorities, ensuring compliance with local laws and regulations.

Steps to complete the APPLICATION TO DO BUSINESS UNDER THE FOREIGN

Completing the APPLICATION TO DO BUSINESS UNDER THE FOREIGN involves several key steps:

- Determine eligibility: Ensure your foreign entity qualifies to do business in the U.S.

- Gather necessary documents: Collect required information such as your business name, formation documents, and proof of good standing from your home country.

- Fill out the application form: Accurately complete the application, providing all requested details.

- Submit the application: File the completed application with the appropriate state agency, either online or by mail.

- Pay applicable fees: Include any required filing fees as part of your submission.

Required Documents

To successfully submit the APPLICATION TO DO BUSINESS UNDER THE FOREIGN, you will typically need to provide several key documents:

- Certificate of good standing from your home jurisdiction.

- Copy of your entity's formation documents, such as articles of incorporation or organization.

- Identification of the registered agent in the state where you plan to do business.

- Details about the business activities intended in the U.S.

Legal use of the APPLICATION TO DO BUSINESS UNDER THE FOREIGN

Using the APPLICATION TO DO BUSINESS UNDER THE FOREIGN legally establishes your foreign entity's right to operate in the U.S. This registration helps protect your business by ensuring compliance with state laws, which can vary significantly. It also provides legal recognition, allowing your business to enter contracts, open bank accounts, and engage with customers legally.

Eligibility Criteria

To be eligible for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN, a foreign entity must meet specific criteria:

- Be legally formed in its home country.

- Intend to conduct business activities within the U.S.

- Have a registered agent in the state of application who can receive legal documents.

- Comply with any state-specific requirements, which may include additional documentation or fees.

Form Submission Methods

The APPLICATION TO DO BUSINESS UNDER THE FOREIGN can typically be submitted through various methods, depending on the state:

- Online: Many states offer an online portal for submitting the application.

- By mail: You can send a physical copy of the application and required documents to the state agency.

- In-person: Some states allow you to file the application directly at their office.

Quick guide on how to complete application to do business under the foreign

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained immense popularity among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centric operation today.

The Easiest Way to Modify and Electrically Sign [SKS] Effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important parts of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for these tasks.

- Generate your electronic signature using the Sign tool, which takes seconds and has the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your edits.

- Choose how you wish to share your form: via email, SMS, invitation link, or download it to your PC.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to APPLICATION TO DO BUSINESS UNDER THE FOREIGN

Create this form in 5 minutes!

How to create an eSignature for the application to do business under the foreign

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the APPLICATION TO DO BUSINESS UNDER THE FOREIGN?

The APPLICATION TO DO BUSINESS UNDER THE FOREIGN is a legal document that allows foreign entities to operate within a specific jurisdiction. This application ensures compliance with local laws and regulations, enabling businesses to expand their operations internationally.

-

How can airSlate SignNow assist with the APPLICATION TO DO BUSINESS UNDER THE FOREIGN?

airSlate SignNow simplifies the process of completing and submitting the APPLICATION TO DO BUSINESS UNDER THE FOREIGN. Our platform allows users to easily fill out, sign, and send documents electronically, ensuring a smooth and efficient application process.

-

What are the costs associated with using airSlate SignNow for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN?

airSlate SignNow offers competitive pricing plans that cater to various business needs. By using our platform for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN, you can save on printing and mailing costs while benefiting from our user-friendly eSignature features.

-

What features does airSlate SignNow provide for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN. These tools streamline the documentation process, making it easier for businesses to manage their applications efficiently.

-

Are there any benefits to using airSlate SignNow for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN?

Using airSlate SignNow for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our solution helps businesses focus on growth while ensuring compliance with legal requirements.

-

Can airSlate SignNow integrate with other software for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the APPLICATION TO DO BUSINESS UNDER THE FOREIGN. This integration allows for better data management and collaboration across different platforms.

-

Is airSlate SignNow secure for handling the APPLICATION TO DO BUSINESS UNDER THE FOREIGN?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to the APPLICATION TO DO BUSINESS UNDER THE FOREIGN are protected. Our platform uses advanced encryption and security protocols to safeguard your sensitive information.

Get more for APPLICATION TO DO BUSINESS UNDER THE FOREIGN

Find out other APPLICATION TO DO BUSINESS UNDER THE FOREIGN

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document