2796 Application for SRETT Refund Application for SRETT Refund Form

What is the 2796 Application For SRETT Refund

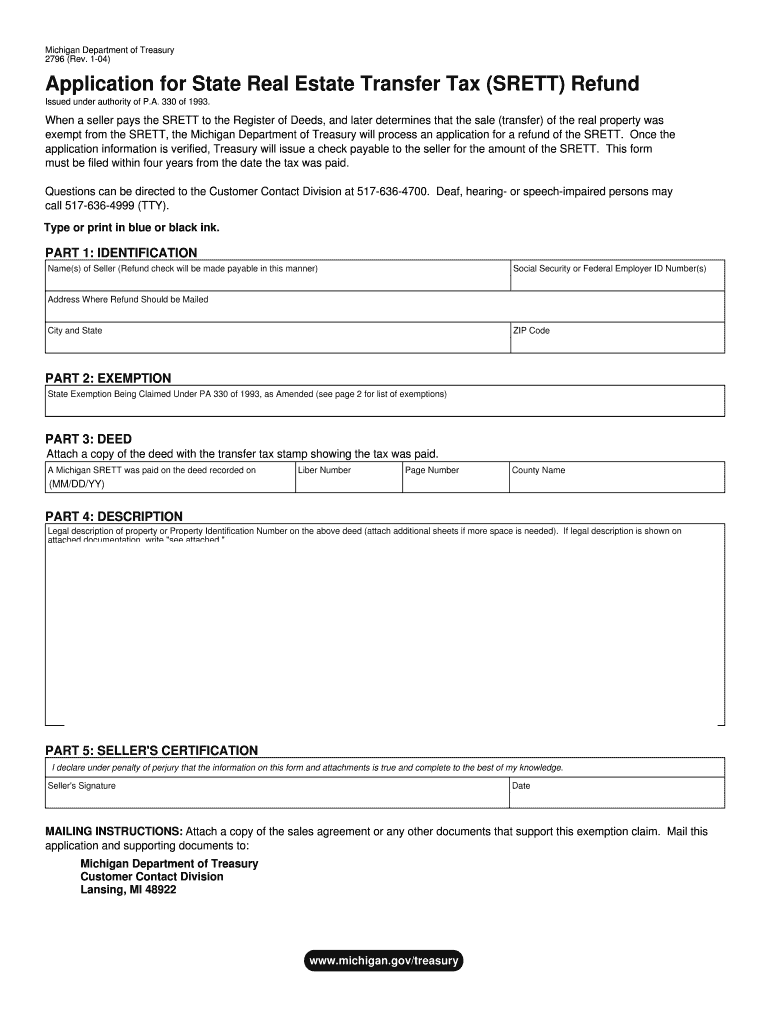

The 2796 Application For SRETT Refund is a specific form used to request a refund of the State Revenue Equitable Tax Transfer (SRETT). This application is essential for individuals or businesses who have overpaid or incorrectly assessed their SRETT obligations. Understanding this form is crucial for ensuring compliance with state tax regulations and for recovering any excess payments made to the state.

How to obtain the 2796 Application For SRETT Refund

The 2796 Application For SRETT Refund can typically be obtained from the official state revenue department's website. It may also be available at local tax offices or through authorized tax professionals. Ensure that you are accessing the most current version of the form to avoid any issues during the submission process.

Steps to complete the 2796 Application For SRETT Refund

Completing the 2796 Application For SRETT Refund involves several key steps:

- Gather necessary documentation, including proof of payment and any relevant tax records.

- Fill out the application form accurately, ensuring all required fields are completed.

- Double-check the information for accuracy to prevent delays in processing.

- Submit the application according to the specified submission methods, which may include online, mail, or in-person options.

Required Documents

To successfully submit the 2796 Application For SRETT Refund, you will need to include specific documents. These may include:

- Proof of SRETT payments made, such as receipts or bank statements.

- Previous tax returns that reflect the SRETT obligations.

- Any correspondence received from the state regarding your SRETT account.

Eligibility Criteria

Eligibility for the 2796 Application For SRETT Refund typically includes individuals or businesses that have overpaid their SRETT obligations. Specific criteria may vary by state, but generally, applicants must demonstrate that a refund is warranted based on their tax filings and payments. It is advisable to review state-specific guidelines to ensure compliance.

Form Submission Methods

The 2796 Application For SRETT Refund can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state revenue department's portal.

- Mailing the completed form to the designated address provided on the application.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete 2796 application for srett refund application for srett refund

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the instruments you need to create, modify, and electronically sign your documents rapidly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Modify and Electronically Sign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Make use of our tools to complete your form.

- Emphasize important parts of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 2796 Application For SRETT Refund Application For SRETT Refund

Create this form in 5 minutes!

How to create an eSignature for the 2796 application for srett refund application for srett refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2796 Application For SRETT Refund Application For SRETT Refund?

The 2796 Application For SRETT Refund Application For SRETT Refund is a form used to request a refund for the State Revenue and Economic Taxation Trust (SRETT). This application is essential for businesses seeking to reclaim overpaid taxes. Understanding how to properly fill out this application can streamline the refund process.

-

How can airSlate SignNow assist with the 2796 Application For SRETT Refund Application For SRETT Refund?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the 2796 Application For SRETT Refund Application For SRETT Refund. Our solution simplifies document management, ensuring that your application is completed and submitted efficiently. With our platform, you can track the status of your application in real-time.

-

What are the pricing options for using airSlate SignNow for the 2796 Application For SRETT Refund Application For SRETT Refund?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while allowing you to manage the 2796 Application For SRETT Refund Application For SRETT Refund effectively. Our cost-effective solution ensures you get the best value for your investment.

-

What features does airSlate SignNow offer for the 2796 Application For SRETT Refund Application For SRETT Refund?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all designed to enhance your experience with the 2796 Application For SRETT Refund Application For SRETT Refund. These features help streamline the application process, ensuring that you can focus on your business while we handle the paperwork.

-

Are there any integrations available with airSlate SignNow for the 2796 Application For SRETT Refund Application For SRETT Refund?

Yes, airSlate SignNow integrates seamlessly with various business applications, making it easier to manage the 2796 Application For SRETT Refund Application For SRETT Refund. Whether you use CRM systems, cloud storage, or other productivity tools, our integrations ensure that your workflow remains uninterrupted and efficient.

-

What are the benefits of using airSlate SignNow for the 2796 Application For SRETT Refund Application For SRETT Refund?

Using airSlate SignNow for the 2796 Application For SRETT Refund Application For SRETT Refund offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform allows you to manage documents from anywhere, ensuring that you can submit your application promptly and securely.

-

Is airSlate SignNow secure for handling the 2796 Application For SRETT Refund Application For SRETT Refund?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When handling sensitive documents like the 2796 Application For SRETT Refund Application For SRETT Refund, you can trust that your information is safe and secure with us.

Get more for 2796 Application For SRETT Refund Application For SRETT Refund

Find out other 2796 Application For SRETT Refund Application For SRETT Refund

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors