Important Information to Cover with Your Independent Employer

Understanding the Important Information To Cover With Your Independent Employer

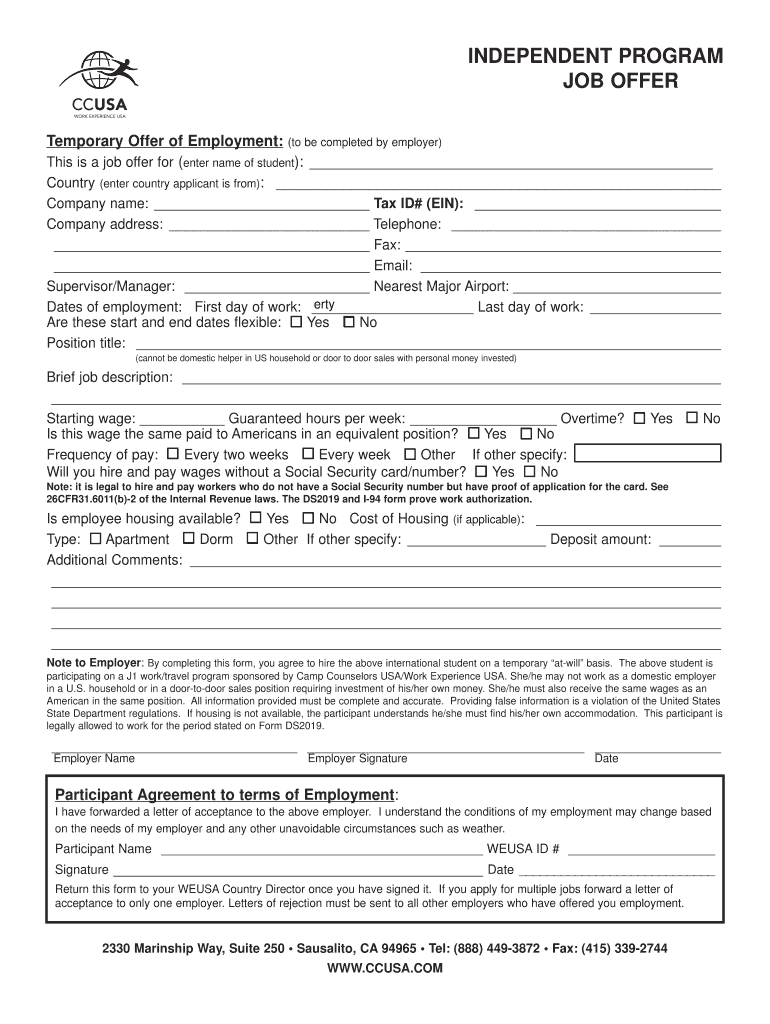

The Important Information To Cover With Your Independent Employer is essential for establishing clear communication and expectations between you and your employer. This document typically includes details about job responsibilities, payment terms, and any specific requirements related to your role. It is crucial to ensure that both parties are aligned on these points to avoid misunderstandings.

Key areas to focus on include:

- Job Description: Clearly outline your responsibilities and tasks.

- Payment Terms: Specify how and when you will be compensated.

- Work Schedule: Discuss expected hours and flexibility.

- Confidentiality Agreements: Address any sensitive information you may handle.

Steps to Complete the Important Information To Cover With Your Independent Employer

Completing the Important Information To Cover With Your Independent Employer involves several straightforward steps. Begin by gathering all necessary information regarding your role and responsibilities. Next, draft the document, ensuring that all critical elements are included. Once drafted, review it with your employer to confirm agreement on all points.

The following steps can help guide you through the process:

- Gather Information: Collect details about your job role, payment, and other relevant information.

- Draft the Document: Write a clear and comprehensive outline of the information.

- Review with Employer: Schedule a meeting to discuss and finalize the document.

- Sign and Store: Both parties should sign the document and keep a copy for records.

Legal Use of the Important Information To Cover With Your Independent Employer

Understanding the legal implications of the Important Information To Cover With Your Independent Employer is vital. This document serves as a formal agreement that outlines the terms of your working relationship. It can protect both you and your employer in case of disputes or misunderstandings.

Key legal considerations include:

- Contractual Obligations: Ensure that the document reflects the agreed-upon terms accurately.

- Compliance with Labor Laws: Review relevant state and federal labor laws that may apply.

- Dispute Resolution: Consider including a clause outlining how disputes will be handled.

Required Documents for the Important Information To Cover With Your Independent Employer

When preparing the Important Information To Cover With Your Independent Employer, certain documents may be necessary to support the information provided. These documents help to clarify roles, responsibilities, and expectations.

Commonly required documents include:

- Identification Documents: Such as a driver's license or Social Security card.

- Tax Forms: Like the W-9 form for tax identification purposes.

- Previous Employment Records: To verify experience and qualifications.

- Confidentiality Agreements: If applicable, to protect sensitive information.

Examples of Using the Important Information To Cover With Your Independent Employer

Utilizing the Important Information To Cover With Your Independent Employer can take various forms depending on the nature of your work. Here are a few examples of how this document can be applied:

- Freelance Work: A freelance graphic designer might outline project timelines and payment schedules.

- Consulting Services: A consultant could detail the scope of work and deliverables expected from the engagement.

- Part-Time Employment: A part-time employee may specify their work hours and job duties.

Eligibility Criteria for the Important Information To Cover With Your Independent Employer

Eligibility for the Important Information To Cover With Your Independent Employer generally applies to individuals engaged in independent work or contractual agreements. Understanding the criteria can help ensure that you are adequately prepared.

Common eligibility criteria include:

- Independent Contractor Status: You must be classified as an independent contractor rather than an employee.

- Agreement on Terms: Both parties must agree to the terms outlined in the document.

- Compliance with Local Laws: Ensure that you meet any local or state requirements for independent work.

Quick guide on how to complete important information to cover with your independent employer

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals. It presents an excellent eco-friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Important Information To Cover With Your Independent Employer

Create this form in 5 minutes!

How to create an eSignature for the important information to cover with your independent employer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the most important information to cover with your independent employer regarding document signing?

When discussing important information to cover with your independent employer, ensure you address the types of documents that require signatures, the timeline for signing, and any specific compliance requirements. Clear communication about these aspects can streamline the signing process and prevent delays.

-

How does airSlate SignNow help with important information to cover with your independent employer?

airSlate SignNow simplifies the process of sharing important information to cover with your independent employer by providing a user-friendly platform for eSigning documents. This ensures that both parties can easily access, review, and sign necessary documents without the hassle of physical paperwork.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it easy to find a solution that fits your budget. Understanding the pricing structure is important information to cover with your independent employer to ensure transparency and alignment on costs.

-

What features should I highlight when discussing airSlate SignNow with my independent employer?

Key features to highlight include the ability to create templates, track document status, and integrate with other tools. These features are essential pieces of important information to cover with your independent employer, as they enhance efficiency and collaboration.

-

Can airSlate SignNow integrate with other software I use?

Yes, airSlate SignNow offers integrations with various software applications, which can streamline your workflow. Discussing these integrations is important information to cover with your independent employer, as they can enhance productivity and reduce manual tasks.

-

What are the benefits of using airSlate SignNow for independent contractors?

Using airSlate SignNow provides independent contractors with a secure and efficient way to manage document signing. Highlighting these benefits is important information to cover with your independent employer, as it can lead to faster project completion and improved client satisfaction.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is highly secure, employing encryption and compliance with industry standards. This aspect is crucial and should be part of the important information to cover with your independent employer to ensure trust and confidentiality.

Get more for Important Information To Cover With Your Independent Employer

- School of human sciences hms 300 502 leadership in human sfasu form

- Natural resources economics sfasu form

- Applying for a summer program or graduate school form

- Request to extend a j 1 scholar stetson form

- Home health medical record audit form palmetto gba

- Massachusetts subpoena form

- Shop drawing transmittal sheet submittal date new form

- First assembly of god mustard seed kidz preschool form

Find out other Important Information To Cover With Your Independent Employer

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form