6 K 1 Cbd201003046k1 Form

What is the 6 K 1 Cbd201003046k1

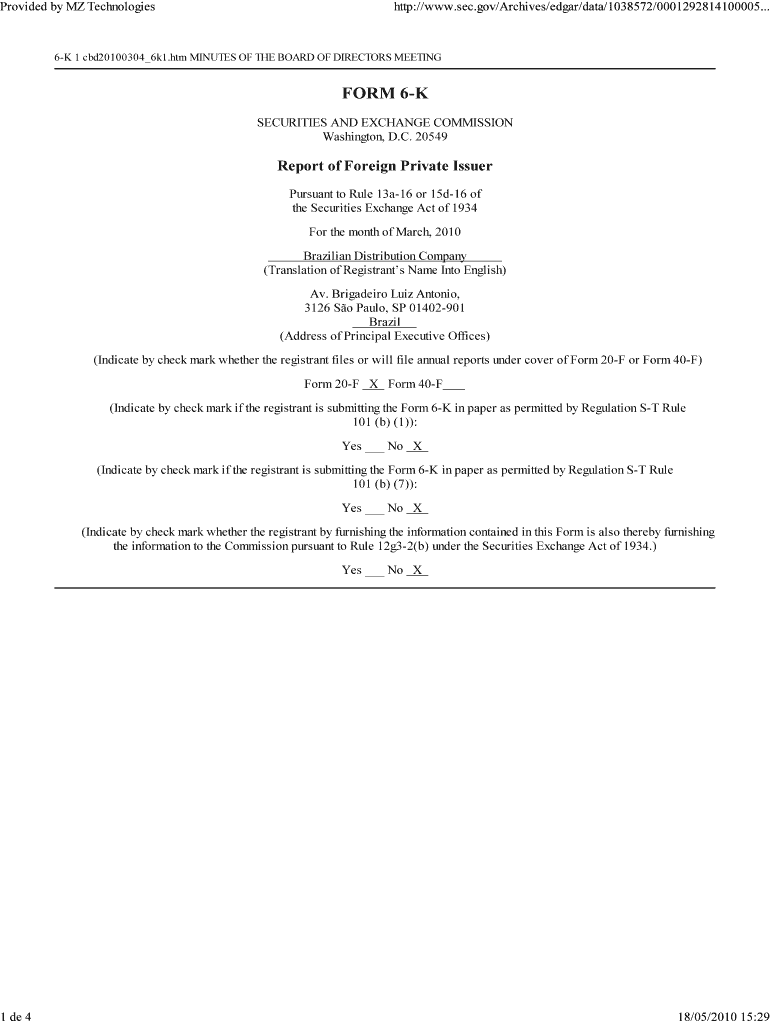

The 6 K 1 Cbd201003046k1 is a specific form used primarily for reporting purposes. It is often associated with tax filings and may be required by certain business entities in the United States. This form helps ensure compliance with federal regulations and provides essential information to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is crucial for accurate reporting and avoiding potential penalties.

How to use the 6 K 1 Cbd201003046k1

Using the 6 K 1 Cbd201003046k1 involves several key steps. First, gather all necessary financial documents and information required for completion. This may include income statements, expense records, and other relevant financial data. Next, carefully fill out the form, ensuring that all entries are accurate and complete. Once completed, the form can be submitted electronically or via mail, depending on the specific guidelines provided by the IRS.

Steps to complete the 6 K 1 Cbd201003046k1

Completing the 6 K 1 Cbd201003046k1 requires a systematic approach:

- Collect necessary documents, including financial statements and tax records.

- Review the instructions associated with the form to understand specific requirements.

- Fill out the form accurately, paying attention to detail.

- Double-check all entries for errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the 6 K 1 Cbd201003046k1

The legal use of the 6 K 1 Cbd201003046k1 is essential for compliance with U.S. tax laws. Businesses must ensure that they are using the correct version of the form and that it is filled out according to the IRS regulations. Failure to comply with these legal requirements can result in penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the 6 K 1 Cbd201003046k1 are crucial for maintaining compliance. Typically, the form must be filed by a specific date each year, often coinciding with tax season. It is important to stay informed about these deadlines to avoid late filing penalties. Marking these dates on a calendar and setting reminders can help ensure timely submission.

Examples of using the 6 K 1 Cbd201003046k1

Examples of using the 6 K 1 Cbd201003046k1 can provide clarity on its application. For instance, a partnership may use this form to report income and deductions to its partners, ensuring that each partner receives the correct information for their individual tax returns. Additionally, corporations may utilize the form to report distributions to shareholders. These examples illustrate the form's importance in various business contexts.

Quick guide on how to complete 6 k 1 cbd201003046k1

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly and without delays. Handle [SKS] on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-oriented process today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 6 k 1 cbd201003046k1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 6 K 1 Cbd201003046k1?

6 K 1 Cbd201003046k1 refers to a specific document or form that can be easily managed and signed using airSlate SignNow. This solution allows users to streamline their document workflows, ensuring that important forms are processed efficiently and securely.

-

How does airSlate SignNow support 6 K 1 Cbd201003046k1?

airSlate SignNow provides a user-friendly platform for managing 6 K 1 Cbd201003046k1 documents. With features like eSignature, document templates, and real-time tracking, users can ensure that their forms are completed accurately and promptly.

-

What are the pricing options for using airSlate SignNow with 6 K 1 Cbd201003046k1?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for handling 6 K 1 Cbd201003046k1 documents. These plans are designed to be cost-effective, providing value for businesses of all sizes.

-

What features does airSlate SignNow offer for 6 K 1 Cbd201003046k1?

Key features of airSlate SignNow for 6 K 1 Cbd201003046k1 include customizable templates, secure eSigning, and automated workflows. These features help businesses save time and reduce errors when managing important documents.

-

Can I integrate airSlate SignNow with other tools for 6 K 1 Cbd201003046k1?

Yes, airSlate SignNow offers integrations with various applications, making it easy to manage 6 K 1 Cbd201003046k1 documents alongside your existing tools. This flexibility enhances productivity and ensures a seamless workflow.

-

What are the benefits of using airSlate SignNow for 6 K 1 Cbd201003046k1?

Using airSlate SignNow for 6 K 1 Cbd201003046k1 provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Businesses can focus on their core operations while ensuring that their document processes are streamlined.

-

Is airSlate SignNow secure for handling 6 K 1 Cbd201003046k1 documents?

Absolutely! airSlate SignNow employs advanced security measures to protect 6 K 1 Cbd201003046k1 documents. With features like encryption and secure access controls, users can trust that their sensitive information is safe.

Get more for 6 K 1 Cbd201003046k1

- Fundamental basketball camp two fun filled barry university barry form

- Guantnamos legacy reflections on a decade of detention barry form

- Important deadlines for thesesprojects form

- Accentra credit union direct deposit form

- Yabanc kimlik no sorgulama form

- Grant agreement instructions minnesota gov form

- Authorization for self administration of prescribed medication at schools within the county of riverside form

- Bop guidelines for forensic evaluations fd org form

Find out other 6 K 1 Cbd201003046k1

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online