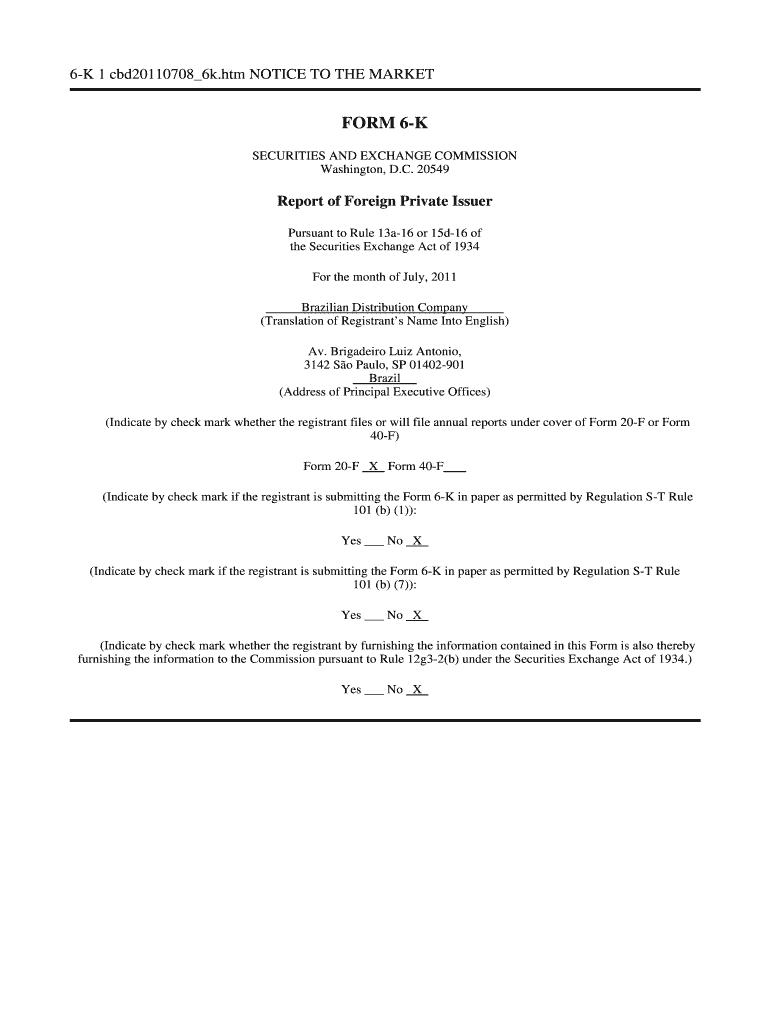

6 K 1 Cbd201107086k Form

What is the 6 K 1 Cbd201107086k

The 6 K 1 Cbd201107086k is a specific tax form used primarily for reporting income, deductions, and credits for partnerships and certain types of businesses. This form is essential for ensuring accurate tax reporting and compliance with Internal Revenue Service (IRS) regulations. It provides detailed information on each partner's share of income, which is crucial for individual tax returns.

How to use the 6 K 1 Cbd201107086k

To effectively use the 6 K 1 Cbd201107086k, individuals must first ensure they receive the form from the partnership or business entity they are involved with. Once obtained, it is important to review the information provided, including income, deductions, and credits. This information should then be accurately reported on the individual's tax return, typically on Schedule E of Form 1040. Proper use of this form helps in avoiding discrepancies with the IRS.

Steps to complete the 6 K 1 Cbd201107086k

Completing the 6 K 1 Cbd201107086k involves several key steps:

- Obtain the form from the relevant partnership or business entity.

- Review the form for accuracy, ensuring all income and deductions are correctly reported.

- Fill out the necessary sections, including your share of income and any deductions.

- Submit the completed form with your tax return, ensuring it aligns with your overall tax filing.

Legal use of the 6 K 1 Cbd201107086k

The legal use of the 6 K 1 Cbd201107086k is governed by IRS regulations, which require accurate reporting of all income and deductions associated with partnerships. Failure to use this form correctly can lead to penalties or audits. It is essential for taxpayers to understand their rights and responsibilities regarding this form to remain compliant with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 6 K 1 Cbd201107086k typically align with the overall tax filing deadlines for partnerships. Generally, partnerships must file their tax returns by March 15 each year. However, individual partners should ensure they receive their K-1 forms in time to include the information on their personal tax returns, which are due on April 15. Awareness of these dates is crucial for timely and accurate filing.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 6 K 1 Cbd201107086k. These guidelines detail the necessary information to be reported, the format for submission, and the importance of accuracy in reporting. Taxpayers should refer to the IRS website or the instructions accompanying the form for the most current regulations and requirements.

Quick guide on how to complete 6 k 1 cbd201107086k

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would like to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced papers, tedious form searching, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 6 k 1 cbd201107086k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 6 K 1 Cbd201107086k?

6 K 1 Cbd201107086k is a unique identifier for a specific product or service offered by airSlate SignNow. It represents a streamlined solution for businesses looking to enhance their document signing processes. By utilizing 6 K 1 Cbd201107086k, users can efficiently manage their eSigning needs.

-

How does 6 K 1 Cbd201107086k benefit my business?

The 6 K 1 Cbd201107086k solution offers numerous benefits, including increased efficiency and reduced turnaround times for document signing. By adopting this solution, businesses can save time and resources, allowing them to focus on core operations. Additionally, 6 K 1 Cbd201107086k enhances security and compliance in document management.

-

What features are included with 6 K 1 Cbd201107086k?

6 K 1 Cbd201107086k includes features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to simplify the eSigning process and improve user experience. With 6 K 1 Cbd201107086k, businesses can also integrate with other tools for seamless workflows.

-

Is 6 K 1 Cbd201107086k cost-effective?

Yes, 6 K 1 Cbd201107086k is designed to be a cost-effective solution for businesses of all sizes. By reducing the need for paper and physical signatures, it helps lower operational costs. Investing in 6 K 1 Cbd201107086k can lead to signNow savings over time.

-

Can I integrate 6 K 1 Cbd201107086k with other software?

Absolutely! 6 K 1 Cbd201107086k offers integration capabilities with various software applications, enhancing your existing workflows. This flexibility allows businesses to connect their eSigning processes with CRM systems, project management tools, and more. Integrating 6 K 1 Cbd201107086k can streamline operations and improve productivity.

-

How secure is the 6 K 1 Cbd201107086k solution?

The 6 K 1 Cbd201107086k solution prioritizes security, employing advanced encryption and authentication measures. This ensures that all documents signed through 6 K 1 Cbd201107086k are protected against unauthorized access. Businesses can trust that their sensitive information is safe with 6 K 1 Cbd201107086k.

-

What types of documents can I sign with 6 K 1 Cbd201107086k?

With 6 K 1 Cbd201107086k, you can sign a wide variety of documents, including contracts, agreements, and forms. The solution supports multiple file formats, making it versatile for different business needs. Whether you need to sign legal documents or internal memos, 6 K 1 Cbd201107086k has you covered.

Get more for 6 K 1 Cbd201107086k

Find out other 6 K 1 Cbd201107086k

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter