Wi Tax Forms 2018-2026

What are the Wisconsin Tax Forms?

The Wisconsin tax forms, including the 2018 WI Form 1, are essential documents used by residents to report their income and calculate their state tax obligations. These forms are designed to ensure compliance with Wisconsin tax laws and provide a structured way for taxpayers to disclose their financial information to the state. The 2018 WI Form 1 specifically pertains to individual income tax filings for that tax year, detailing income sources, deductions, and credits applicable to Wisconsin taxpayers.

Steps to Complete the Wisconsin Tax Forms

Completing the Wisconsin tax forms, such as the 2018 WI Form 1, involves several key steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and records of other income.

- Understand Your Filing Status: Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill Out the Form: Carefully enter your income, deductions, and credits on the form. Ensure accuracy to avoid penalties.

- Review Your Entries: Double-check all information for accuracy, including Social Security numbers and financial figures.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and ensure it is sent by the filing deadline.

Legal Use of the Wisconsin Tax Forms

The legal use of Wisconsin tax forms, including the 2018 WI Form 1, is crucial for ensuring compliance with state tax regulations. These forms must be filled out accurately and submitted on time to avoid legal repercussions. E-signatures are accepted, provided they meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing secure electronic filing methods can enhance the legal validity of your submission.

Filing Deadlines / Important Dates

For the 2018 tax year, the filing deadline for the Wisconsin income tax return using the 2018 WI Form 1 was typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions available for filing, as well as deadlines for estimated tax payments and other related obligations.

Required Documents

To complete the 2018 WI Form 1, taxpayers need to gather several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductions, such as mortgage interest statements

- Proof of any tax credits claimed

- Identification numbers, including Social Security numbers

Form Submission Methods

Taxpayers can submit the 2018 WI Form 1 through various methods:

- Online: Using approved e-filing services that comply with Wisconsin state regulations.

- By Mail: Sending a completed paper form to the appropriate Wisconsin Department of Revenue address.

- In-Person: Delivering the form directly to a local Department of Revenue office, if preferred.

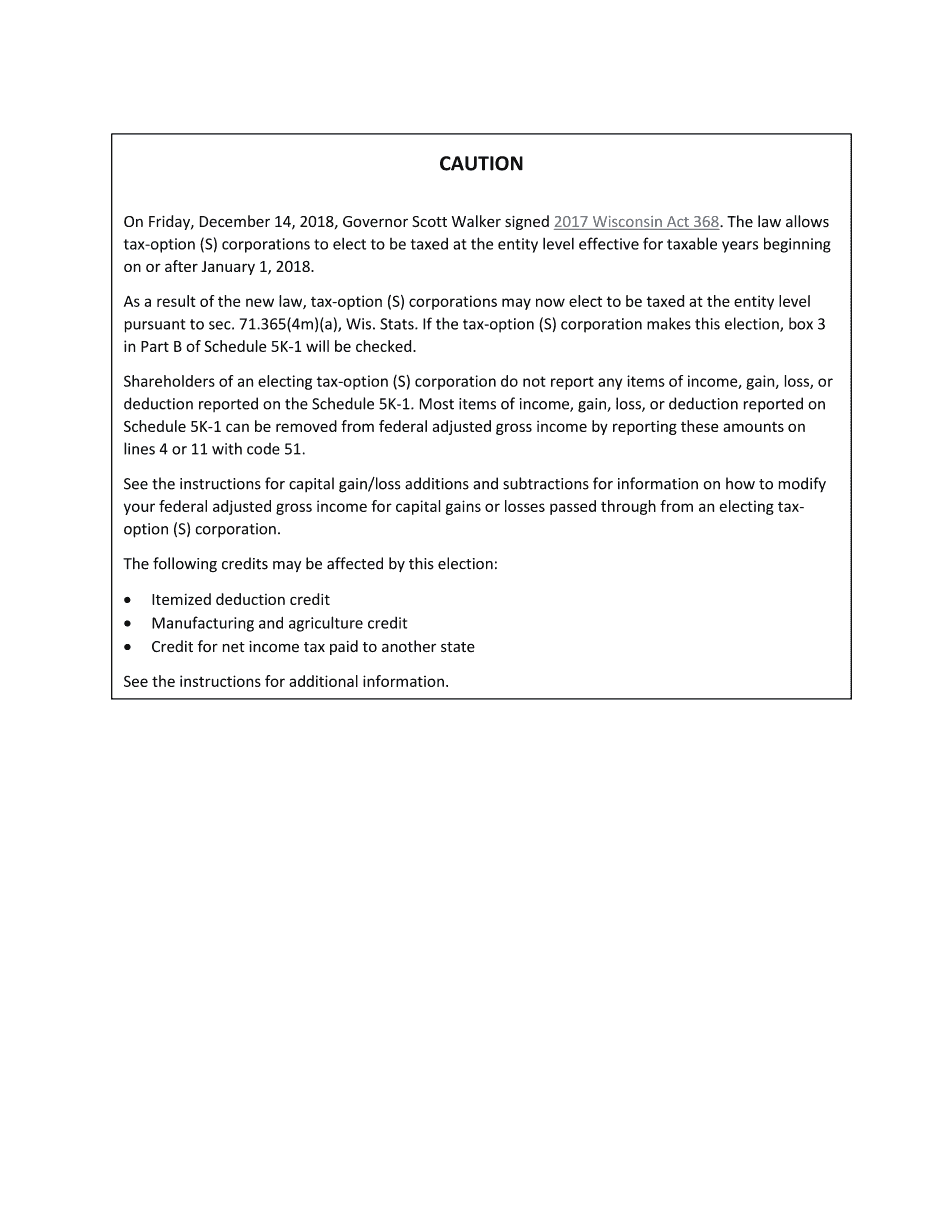

Quick guide on how to complete on friday december 14 2018 governor scott walker signed 2017 wisconsin act 368

Effortlessly Create Wi Tax Forms on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Wi Tax Forms on any device with the airSlate SignNow apps for Android or iOS and simplify your document processes today.

The easiest way to modify and electronically sign Wi Tax Forms with ease

- Find Wi Tax Forms and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all information and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Wi Tax Forms to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the on friday december 14 2018 governor scott walker signed 2017 wisconsin act 368

How to create an eSignature for your On Friday December 14 2018 Governor Scott Walker Signed 2017 Wisconsin Act 368 online

How to make an electronic signature for the On Friday December 14 2018 Governor Scott Walker Signed 2017 Wisconsin Act 368 in Chrome

How to make an electronic signature for signing the On Friday December 14 2018 Governor Scott Walker Signed 2017 Wisconsin Act 368 in Gmail

How to create an electronic signature for the On Friday December 14 2018 Governor Scott Walker Signed 2017 Wisconsin Act 368 straight from your mobile device

How to make an eSignature for the On Friday December 14 2018 Governor Scott Walker Signed 2017 Wisconsin Act 368 on iOS

How to generate an eSignature for the On Friday December 14 2018 Governor Scott Walker Signed 2017 Wisconsin Act 368 on Android devices

People also ask

-

What are the main features of airSlate SignNow relevant to the 2018 wi form 1 instructions?

airSlate SignNow offers a range of features that streamline the signing process for important documents, including the 2018 wi form 1 instructions. Users can easily send, eSign, and store documents in a secure environment. Additionally, the platform supports templates, enabling users to quickly fill out recurring forms like the 2018 wi form 1 instructions with minimal effort.

-

How does airSlate SignNow simplify the completion of the 2018 wi form 1 instructions?

With airSlate SignNow, the completion of the 2018 wi form 1 instructions is straightforward. The platform allows users to upload their forms, add fields for signatures, and share them with others for fast eSigning. This reduces the time and hassle traditionally associated with filling out forms like the 2018 wi form 1 instructions.

-

Are there any costs associated with using airSlate SignNow for the 2018 wi form 1 instructions?

Yes, airSlate SignNow offers a cost-effective solution for managing documents, including the 2018 wi form 1 instructions. Pricing is tiered to meet the needs of different users, with flexible plans available that cater to businesses of all sizes. This ensures that users can find a plan that fits their budget while still getting access to essential features.

-

What benefits can I expect from using airSlate SignNow with the 2018 wi form 1 instructions?

By using airSlate SignNow for the 2018 wi form 1 instructions, users can enjoy increased efficiency and accuracy in the document signing process. The platform minimizes errors through intuitive design and guided workflows. Additionally, it enhances collaboration by allowing multiple parties to sign documents remotely and securely.

-

Can I integrate airSlate SignNow with other applications when working with the 2018 wi form 1 instructions?

Absolutely! airSlate SignNow offers seamless integrations with various applications that businesses commonly use, making it easier to manage the 2018 wi form 1 instructions alongside your other workflows. This connectivity can streamline your operations further, allowing for efficient data transfer and improved workflow management.

-

Is it easy to find the specific information needed for filling out the 2018 wi form 1 instructions on airSlate SignNow?

Yes, airSlate SignNow provides accessible resources and user-friendly tools to assist with filling out forms like the 2018 wi form 1 instructions. The platform includes helpful tips and support documentation to guide users in completing their forms accurately. This ensures that even those with minimal experience can navigate the process with confidence.

-

How secure is my information when using airSlate SignNow for the 2018 wi form 1 instructions?

airSlate SignNow prioritizes the security of your documents, including the 2018 wi form 1 instructions. The platform uses advanced encryption methods and complies with industry-standard security protocols. This ensures that all information you input and share is protected from unauthorized access.

Get more for Wi Tax Forms

- Handout x ray identification form

- Superior court of california county of riverside 489391335 form

- Npdes permit modification request section 301g form

- Form a2 to be completed by the reserve bank of india

- Birthdatechildsgendermalefemale form

- Hdfc bank deposit slip v we understand your worl form

- Instructions this log will be maintained for each refrigerator and zer both walk in and reach in units in form

- Anf 2a application form for issuemodification in

Find out other Wi Tax Forms

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation