Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report Information and Instructions

Understanding the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report

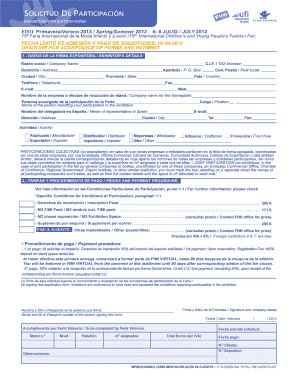

The Solicitud FIMI JULIO FH11 05 399 is a specific form used for reporting franchise taxes in the United States. This form is essential for businesses that are subject to franchise tax obligations, which can vary by state. The form provides detailed instructions on how to report income, deductions, and other relevant financial information necessary for compliance with state tax regulations. It is crucial for businesses to accurately complete this form to avoid penalties and ensure proper tax assessment.

Steps to Complete the Solicitud FIMI JULIO FH11 05 399

Completing the Solicitud FIMI JULIO FH11 05 399 involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Review the specific instructions provided with the form to understand the requirements for your business type.

- Fill out the form accurately, ensuring all sections are completed and calculations are correct.

- Double-check your entries for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Legal Use of the Solicitud FIMI JULIO FH11 05 399

The Solicitud FIMI JULIO FH11 05 399 is legally binding once submitted and accepted by the relevant state tax authority. It must be completed in accordance with state laws governing franchise taxation. Businesses must ensure that all information provided is truthful and accurate, as any discrepancies can lead to audits or legal repercussions. Understanding the legal implications of this form is essential for maintaining compliance and protecting your business interests.

Filing Deadlines and Important Dates

Timely filing of the Solicitud FIMI JULIO FH11 05 399 is crucial to avoid late fees and penalties. Each state may have different deadlines, so it is important to check the specific due dates for your jurisdiction. Typically, franchise tax reports are due annually, and businesses should mark their calendars to ensure they meet these deadlines. Staying informed about any changes in filing dates is also important for compliance.

Required Documents for Submission

To successfully complete the Solicitud FIMI JULIO FH11 05 399, businesses must gather several key documents:

- Financial statements, including profit and loss statements.

- Previous year’s tax return, if applicable.

- Documentation of any deductions or credits claimed.

- Identification information for the business entity, such as Employer Identification Number (EIN).

Form Submission Methods

The Solicitud FIMI JULIO FH11 05 399 can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online filing through the state’s tax website, which may offer a streamlined process.

- Mailing a paper copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, which may provide immediate confirmation of receipt.

Quick guide on how to complete solicitud fimi julio fh11 05 399 franchise tax report information and instructions

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to commence.

- Take advantage of the tools we offer to complete your form.

- Emphasize critical sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to secure your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report Information And Instructions

Create this form in 5 minutes!

How to create an eSignature for the solicitud fimi julio fh11 05 399 franchise tax report information and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report Information And Instructions?

The Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report Information And Instructions is a comprehensive guide designed to help businesses understand the requirements for filing their franchise tax reports. It provides essential information on deadlines, necessary documentation, and filing procedures to ensure compliance with tax regulations.

-

How can airSlate SignNow assist with the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report?

airSlate SignNow streamlines the process of preparing and submitting the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report by allowing users to eSign documents securely and efficiently. Our platform simplifies document management, ensuring that all necessary forms are completed accurately and submitted on time.

-

What are the pricing options for using airSlate SignNow for the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions ensure that you can manage your Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report without breaking the bank, with options for monthly or annual subscriptions.

-

What features does airSlate SignNow provide for managing the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools make it easier to manage the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report, ensuring that you have everything you need at your fingertips.

-

Are there any integrations available with airSlate SignNow for the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow for the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report. This allows you to connect with tools you already use, making document management even more efficient.

-

What are the benefits of using airSlate SignNow for the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report?

Using airSlate SignNow for the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on your business.

-

Is airSlate SignNow user-friendly for completing the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and complete the Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report. Our intuitive interface ensures that you can quickly find the tools you need without any hassle.

Get more for Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report Information And Instructions

- Application for subdivision approval bureau of environmental health form

- Request to have a critical area line established request to have a critical area line established dhec 3902 form

- Blue ridge ecoregion aquatic habitats form

- Action oriented students making a difference in the environment dnr sc form

- Take one make one take one make one waiver and dnr sc form

- Disclosure form south carolina department of natural resources

- Mercy housing management group form

- Georgetown womens golf questionnaire form

Find out other Solicitud FIMI JULIO FH11 05 399 Franchise Tax Report Information And Instructions

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT