Form 500 for Virginia 2007-2026

What is the Form 500 for Virginia

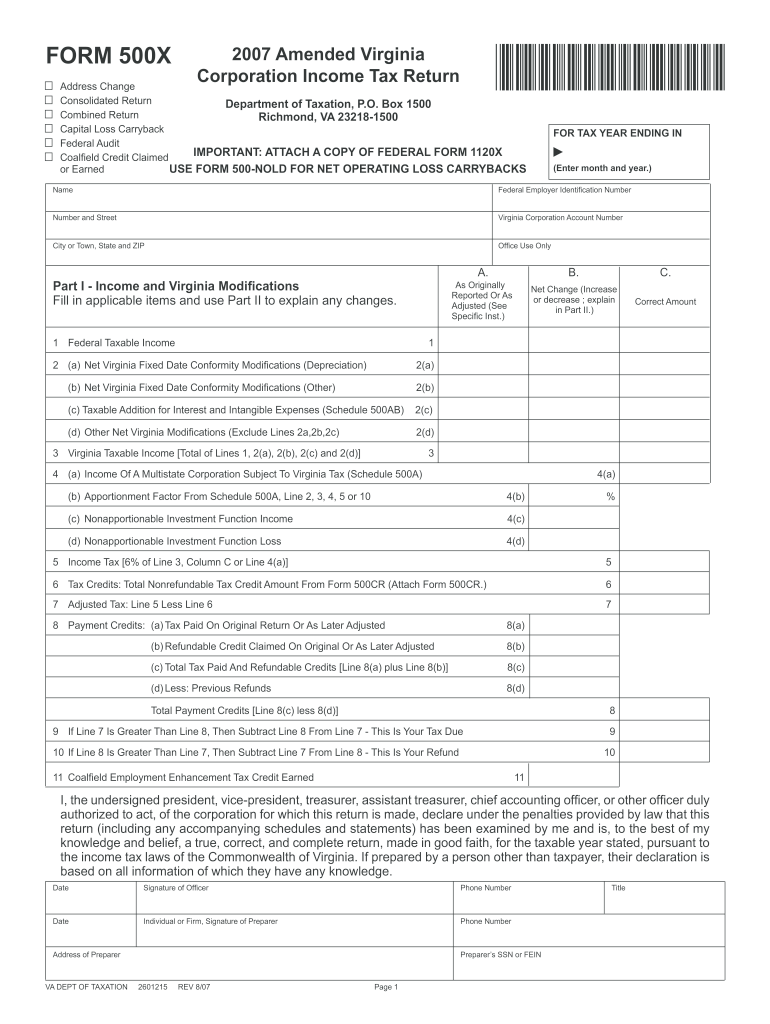

The Form 500 is a state tax form used by businesses in Virginia to report their income and calculate the amount of taxes owed to the state. This form is essential for corporations and partnerships operating within Virginia, as it ensures compliance with state tax regulations. The Form 500 is specifically designed for corporate income tax filings, and it includes various sections that capture essential financial information, such as gross receipts, deductions, and credits.

How to use the Form 500 for Virginia

Using the Form 500 involves several key steps that ensure accurate reporting of your business's financial activity. First, gather all necessary financial documents, including profit and loss statements and balance sheets. Next, complete each section of the form, paying close attention to the calculations required for taxable income and tax liability. After filling out the form, review it for accuracy and completeness before submission. It is advisable to consult with a tax professional if you have questions regarding specific entries or calculations.

Steps to complete the Form 500 for Virginia

Completing the Form 500 involves the following steps:

- Collect all relevant financial documents for the tax year.

- Fill in the business information section, including your business name and identification number.

- Report total income, including gross receipts and any other income sources.

- Deduct allowable expenses, such as operating costs and other deductions specific to Virginia tax laws.

- Calculate the taxable income by subtracting total deductions from total income.

- Determine the tax owed based on the taxable income and applicable rates.

- Sign and date the form before submitting it to the Virginia Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 500 can vary based on the business's fiscal year. Generally, the form is due on the fifteenth day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the deadline is April 15. It is crucial to be aware of these deadlines to avoid penalties and interest on late filings. Additionally, extensions may be available, but they must be requested prior to the original due date.

Penalties for Non-Compliance

Failing to file the Form 500 on time can result in significant penalties. Virginia imposes a late filing penalty, which is typically a percentage of the unpaid tax amount. Additionally, interest accrues on any unpaid taxes from the due date until payment is made. Businesses that consistently fail to comply with filing requirements may face further legal consequences, including audits or additional fines. It is essential to stay informed about filing obligations to mitigate these risks.

Form Submission Methods (Online / Mail / In-Person)

The Form 500 can be submitted through several methods to accommodate different preferences. Businesses may file the form online using the Virginia Department of Taxation's e-filing system, which provides a secure and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate tax office, ensuring it is postmarked by the due date. In-person submissions are also accepted at designated tax offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete 15 94virginia tax virginia department of taxation

Effortlessly Complete Form 500 For Virginia on Any Gadget

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, since you can access the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Form 500 For Virginia on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to Modify and eSign Form 500 For Virginia with Ease

- Obtain Form 500 For Virginia and click on Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 500 For Virginia to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 15 94virginia tax virginia department of taxation

How to create an electronic signature for the 15 94virginia Tax Virginia Department Of Taxation in the online mode

How to generate an eSignature for your 15 94virginia Tax Virginia Department Of Taxation in Google Chrome

How to generate an eSignature for putting it on the 15 94virginia Tax Virginia Department Of Taxation in Gmail

How to create an eSignature for the 15 94virginia Tax Virginia Department Of Taxation right from your smartphone

How to create an electronic signature for the 15 94virginia Tax Virginia Department Of Taxation on iOS devices

How to make an eSignature for the 15 94virginia Tax Virginia Department Of Taxation on Android devices

People also ask

-

What is involved in the corporation filing process?

Corporation filing involves submitting essential documents, such as articles of incorporation, to the appropriate state authority. This process is crucial to legally establish your business entity. airSlate SignNow streamlines this process, allowing you to eSign and send necessary documents quickly and efficiently.

-

How much does airSlate SignNow cost for corporation filing?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. The fees offer superior value for your corporation filing needs, providing an easy-to-use platform for eSigning and managing documents without hidden costs.

-

Can I track the progress of my corporation filing documents?

Yes, airSlate SignNow allows you to track the status of your corporation filing documents in real-time. This feature ensures you are always informed about your document’s progress, so you can follow up promptly if needed.

-

What features does airSlate SignNow offer for corporation filing?

The platform provides a variety of features tailored for corporation filing, including document templates, bulk sending, and eSignature functionality. With these tools, you can efficiently prepare and submit your corporation filing documents, ensuring compliance with state regulations.

-

Is airSlate SignNow compliant with legal standards for corporation filing?

Absolutely! airSlate SignNow adheres to the highest legal standards and ensures that all eSignatures are compliant with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This compliance assures peace of mind when managing your corporation filing process.

-

Can I integrate airSlate SignNow with other applications for corporation filing?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your corporation filing process. Whether you use accounting software or customer relationship management (CRM) systems, these integrations simplify document management and streamline workflows.

-

What are the benefits of using airSlate SignNow for corporation filing?

Using airSlate SignNow for corporation filing enables you to save time and reduce errors associated with traditional filing methods. The platform simplifies the process of sending and signing documents, making it ideal for businesses looking for an efficient and cost-effective solution.

Get more for Form 500 For Virginia

- Pdf 57589548 form

- Number identification assessment form

- Mathematics book 2 pdf download form

- Get the job note taking guide answer key form

- Glasgow pain score dogs pdf form

- Solar installation checklist pdf 79833226 form

- Mv 82al prdoret pr t regjistruar automjete pr t rinovuar regjistrimin e automjeteve pr t ndryshuar ose pr t krkuar nj dublikat form

Find out other Form 500 For Virginia

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF