St 123 2014-2026

What is the form ST-123?

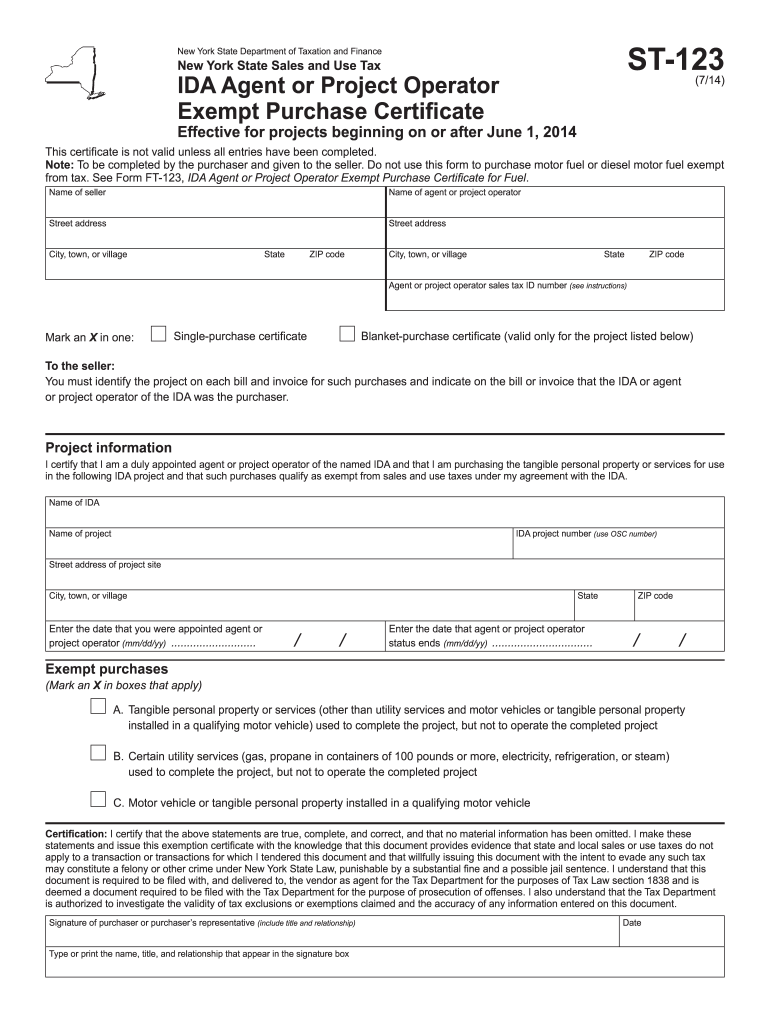

The form ST-123, commonly referred to as the "Sales Tax Exempt Certificate," is a document used in New York State to allow certain organizations and individuals to make purchases without paying sales tax. This form is typically utilized by exempt organizations, such as nonprofit entities, government agencies, and certain educational institutions. By presenting the ST-123, the buyer certifies that the purchase is exempt from sales tax under specific provisions of the New York State Tax Law.

How to use the form ST-123

To effectively use the form ST-123, the buyer must complete the document accurately. This includes providing essential information such as the name and address of the purchaser, the reason for the exemption, and the signature of an authorized representative. The completed form should be presented to the seller at the time of purchase. It is important to keep a copy of the ST-123 for record-keeping purposes, as sellers may require documentation to substantiate the tax-exempt status of the transaction.

Steps to complete the form ST-123

Completing the form ST-123 involves several straightforward steps:

- Obtain the form ST-123 from a reliable source, such as the New York State Department of Taxation and Finance website.

- Fill in the purchaser's name and address accurately.

- Indicate the specific reason for the exemption by checking the appropriate box.

- Provide the signature of an authorized representative of the exempt organization.

- Date the form to validate the transaction.

Once completed, the form should be presented to the seller during the purchase transaction.

Legal use of the form ST-123

The legal use of the form ST-123 hinges on compliance with New York State tax laws. The form must be used solely for qualifying purchases that are exempt from sales tax. Misuse of the form, such as using it for personal purchases or for items that do not qualify for exemption, can lead to legal consequences, including penalties and back taxes owed. It is crucial for organizations to understand the specific criteria that qualify for tax exemption to avoid any legal complications.

Examples of using the form ST-123

There are several scenarios in which the form ST-123 may be used:

- A nonprofit organization purchasing supplies for an event that supports its charitable mission.

- A government agency acquiring equipment necessary for public service functions.

- An educational institution buying textbooks for students enrolled in a degree program.

In each case, the purchaser must ensure that the items being bought are eligible for tax exemption under New York State law.

Who issues the form ST-123?

The form ST-123 is issued by the New York State Department of Taxation and Finance. This agency provides the necessary guidelines and instructions for completing the form and understanding the eligibility criteria for tax-exempt purchases. It is important for users to refer to the official resources provided by the department to ensure compliance with current regulations and to obtain the most recent version of the form.

Quick guide on how to complete form 123 2014 2019

Complete St 123 effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage St 123 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign St 123 with ease

- Find St 123 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or blackout sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign St 123 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 123 2014 2019

How to create an eSignature for your Form 123 2014 2019 online

How to make an electronic signature for your Form 123 2014 2019 in Google Chrome

How to generate an eSignature for signing the Form 123 2014 2019 in Gmail

How to generate an eSignature for the Form 123 2014 2019 right from your smartphone

How to create an eSignature for the Form 123 2014 2019 on iOS

How to create an electronic signature for the Form 123 2014 2019 on Android devices

People also ask

-

What is St 123 and how does it relate to airSlate SignNow?

St 123 is a feature within airSlate SignNow that enables users to streamline their document signing process. This innovative tool simplifies the way businesses send and eSign documents, ensuring a quick and efficient workflow. By leveraging St 123, companies can enhance their operational efficiency while maintaining compliance.

-

How much does airSlate SignNow with St 123 cost?

The pricing for airSlate SignNow varies depending on the features you choose, including the St 123 functionality. We offer flexible subscription plans that cater to different business needs, ensuring that you get the best value. To find the most accurate pricing, visit our website to explore the options available for St 123.

-

What features does St 123 offer within airSlate SignNow?

St 123 includes a range of features designed to enhance the eSigning experience, such as automated workflows, customizable templates, and real-time tracking. These features allow users to manage their documents efficiently while ensuring that all signatures are collected securely. Additionally, St 123 integrates seamlessly with other tools, making it easier to incorporate into your existing processes.

-

Can I integrate St 123 with other applications?

Yes, St 123 can be integrated with various applications, enhancing the functionality of airSlate SignNow. This integration allows users to connect with popular tools like CRM systems, project management software, and more. By using St 123, businesses can create a cohesive workflow that improves productivity and efficiency.

-

What are the benefits of using St 123 for document signing?

The primary benefits of using St 123 include improved speed, enhanced security, and streamlined workflows for document signing. With airSlate SignNow's St 123 feature, businesses can send documents for eSignature quickly, reducing turnaround time. Moreover, the secure environment ensures that sensitive information remains protected throughout the signing process.

-

Is St 123 suitable for businesses of all sizes?

Absolutely! St 123 is designed to cater to businesses of all sizes, from small startups to large enterprises. Its user-friendly interface and scalable features make it an ideal solution for any organization looking to improve their document signing process. Regardless of your business size, St 123 can help optimize your workflow.

-

How does St 123 ensure the security of signed documents?

St 123 employs industry-leading security protocols to protect all signed documents within airSlate SignNow. This includes encryption, secure cloud storage, and audit trails to track document activity. By using St 123, businesses can confidently manage their sensitive documents knowing that security is a top priority.

Get more for St 123

- Ordering express cash for a corporate card american express form

- D d m y m y d d m y m y d d m y m y american express form

- Cs colorband 285 american express corporate services form

- Amxtk form

- Apply for an american express credit card form

- Qantas american express supplementary business credit card form

- Americanexpresscomauincreaselimit form

- P11 deduction working sheet p11 deductions working sheet p11 form

Find out other St 123

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement