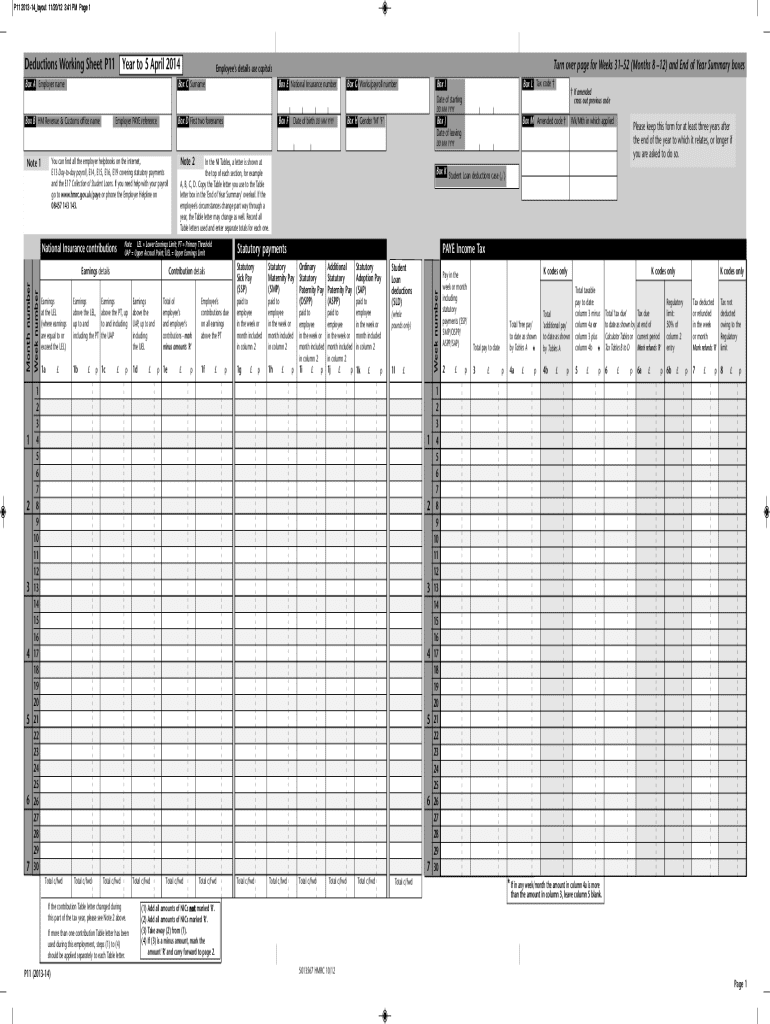

P11 Deduction Working Sheet P11 Deductions Working Sheet P11 Form

What is the P11 Deduction Working Sheet?

The P11 Deduction Working Sheet is a crucial document used in the United States for calculating employee deductions related to income tax withholding. This form provides a structured way for employers to determine the appropriate amount of tax to withhold from an employee's paycheck based on their earnings and applicable deductions. It is essential for ensuring compliance with federal tax regulations and helps both employers and employees understand their tax obligations.

How to Use the P11 Deduction Working Sheet

To effectively use the P11 Deduction Working Sheet, employers should gather all necessary information about the employee, including their salary, filing status, and any applicable deductions or exemptions. The form guides users through a series of calculations, allowing them to accurately determine the total deductions to be withheld. It is important to ensure that all figures are up-to-date and reflect the latest tax regulations to avoid any discrepancies in withholding amounts.

Steps to Complete the P11 Deduction Working Sheet

Completing the P11 Deduction Working Sheet involves several key steps:

- Gather employee information, including their name, Social Security number, and filing status.

- Determine the employee's gross pay for the pay period.

- Identify any deductions or exemptions the employee qualifies for.

- Follow the calculation guidelines provided on the form to compute the total deductions.

- Review the completed sheet for accuracy before submitting it to the payroll department.

Key Elements of the P11 Deduction Working Sheet

The P11 Deduction Working Sheet includes several key elements that are essential for accurate tax withholding:

- Employee Information: Basic details such as name and Social Security number.

- Gross Pay: The total earnings before deductions.

- Deductions and Exemptions: Any applicable deductions that reduce taxable income.

- Calculation Instructions: Step-by-step guidelines for determining the correct withholding amount.

Legal Use of the P11 Deduction Working Sheet

The P11 Deduction Working Sheet is legally recognized as a valid method for calculating employee tax withholdings. Employers are required to use this form to ensure compliance with IRS regulations. Accurate completion of the sheet helps prevent potential legal issues related to under-withholding or over-withholding taxes, which can result in penalties for both employers and employees.

IRS Guidelines

According to IRS guidelines, employers must adhere to specific rules when using the P11 Deduction Working Sheet. This includes keeping the form updated with the latest tax rates and regulations. Employers should also ensure that the information provided by employees is accurate and reflects their current financial situation. Regular training and updates for payroll staff can help maintain compliance with IRS requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p11 deduction working sheet p11 deductions working sheet p11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the P11 Deduction Working Sheet P11 Deductions Working Sheet P11?

The P11 Deduction Working Sheet P11 Deductions Working Sheet P11 is a crucial document used by employers to calculate and report employee deductions for tax purposes. It helps ensure compliance with tax regulations and provides a clear overview of deductions made throughout the tax year.

-

How can airSlate SignNow help with the P11 Deduction Working Sheet P11 Deductions Working Sheet P11?

airSlate SignNow streamlines the process of creating and managing the P11 Deduction Working Sheet P11 Deductions Working Sheet P11 by allowing users to easily eSign and send documents. This ensures that all necessary signatures are obtained quickly, reducing delays in processing and improving overall efficiency.

-

Is there a cost associated with using airSlate SignNow for the P11 Deduction Working Sheet P11 Deductions Working Sheet P11?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides access to features that facilitate the creation and management of the P11 Deduction Working Sheet P11 Deductions Working Sheet P11, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the P11 Deduction Working Sheet P11 Deductions Working Sheet P11?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the P11 Deduction Working Sheet P11 Deductions Working Sheet P11. These features help ensure accuracy and compliance while saving time and resources.

-

Can I integrate airSlate SignNow with other software for managing the P11 Deduction Working Sheet P11 Deductions Working Sheet P11?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and HR software, making it easy to manage the P11 Deduction Working Sheet P11 Deductions Working Sheet P11 alongside your existing systems. This integration helps streamline workflows and enhances data accuracy.

-

What are the benefits of using airSlate SignNow for the P11 Deduction Working Sheet P11 Deductions Working Sheet P11?

Using airSlate SignNow for the P11 Deduction Working Sheet P11 Deductions Working Sheet P11 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly interface makes it easy for businesses to manage their documents effectively.

-

How secure is airSlate SignNow when handling the P11 Deduction Working Sheet P11 Deductions Working Sheet P11?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect sensitive information within the P11 Deduction Working Sheet P11 Deductions Working Sheet P11, ensuring that your data remains confidential and secure.

Get more for P11 Deduction Working Sheet P11 Deductions Working Sheet P11

Find out other P11 Deduction Working Sheet P11 Deductions Working Sheet P11

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free