Wi Form Epv 2018-2026

What is the Wisconsin Form EPV?

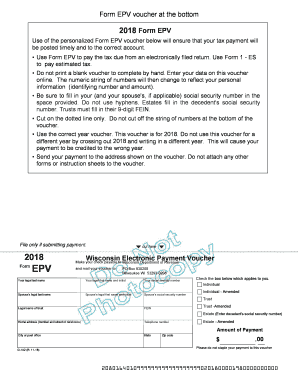

The Wisconsin Form EPV, also known as the Wisconsin Payment Voucher, is a tax form used by individuals and businesses to submit payments to the Wisconsin Department of Revenue. This form is typically utilized for various tax obligations, including income tax and estimated tax payments. It serves as a record of payment and ensures that the funds are properly allocated to the taxpayer's account.

How to Use the Wisconsin Form EPV

Using the Wisconsin Form EPV involves several straightforward steps. First, ensure you have the correct version of the form for the tax year you are filing. Next, fill out the required information, which includes your name, address, and taxpayer identification number. Indicate the amount being paid and the tax period associated with the payment. Finally, submit the form along with your payment to the appropriate address specified by the Wisconsin Department of Revenue.

Steps to Complete the Wisconsin Form EPV

Completing the Wisconsin Form EPV requires careful attention to detail. Follow these steps for accurate submission:

- Obtain the correct form for the tax year from the Wisconsin Department of Revenue.

- Provide your personal information, including your name and address.

- Enter your taxpayer identification number, which could be your Social Security number or Employer Identification Number.

- Specify the amount you are paying and the corresponding tax period.

- Review the form for accuracy and completeness before submission.

Legal Use of the Wisconsin Form EPV

The Wisconsin Form EPV is legally binding when filled out correctly and submitted in accordance with state regulations. It is essential to comply with all relevant tax laws to ensure that your payment is processed without issues. Electronic submissions of the form are accepted, provided they meet the necessary legal requirements for eSignatures and document integrity.

Form Submission Methods

The Wisconsin Form EPV can be submitted through various methods, allowing for flexibility based on your preferences. You can choose to submit the form online, via mail, or in person at designated locations. For online submissions, ensure that you use a secure platform that complies with state regulations. If mailing, use the correct address provided by the Wisconsin Department of Revenue to avoid delays in processing.

Required Documents

When submitting the Wisconsin Form EPV, it is important to have certain documents ready to ensure a smooth process. These may include:

- Your completed Form EPV.

- Any supporting documentation that verifies your payment amount.

- Previous tax returns if applicable, to confirm your tax obligations.

Having these documents on hand can help facilitate the payment process and ensure compliance with state tax regulations.

Quick guide on how to complete form epv generation guidelines software developer specifications

Effortlessly Complete Wi Form Epv on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent sustainable alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, edit, and electronically sign your documents swiftly without any holdups. Manage Wi Form Epv on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Wi Form Epv with Ease

- Locate Wi Form Epv and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your amendments.

- Select your preferred method to deliver your form, either by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or disorganized files, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Wi Form Epv and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form epv generation guidelines software developer specifications

How to generate an eSignature for your Form Epv Generation Guidelines Software Developer Specifications online

How to make an eSignature for your Form Epv Generation Guidelines Software Developer Specifications in Google Chrome

How to make an eSignature for putting it on the Form Epv Generation Guidelines Software Developer Specifications in Gmail

How to generate an electronic signature for the Form Epv Generation Guidelines Software Developer Specifications straight from your smartphone

How to create an electronic signature for the Form Epv Generation Guidelines Software Developer Specifications on iOS devices

How to create an electronic signature for the Form Epv Generation Guidelines Software Developer Specifications on Android OS

People also ask

-

What is the significance of Wisconsin EPV 2019 in document signing?

The Wisconsin EPV 2019 refers to the electronic signature laws in Wisconsin that allow businesses to sign documents electronically. Understanding Wisconsin EPV 2019 is essential for compliance, ensuring that your e-signatures hold legal validity. Utilizing airSlate SignNow can help you navigate these regulations seamlessly.

-

How does airSlate SignNow comply with Wisconsin EPV 2019 regulations?

airSlate SignNow is designed to comply with the Wisconsin EPV 2019 standards for electronic signatures. We ensure that our platform meets all legal requirements, enabling users to eSign documents safely and securely. This compliance helps businesses avoid legal pitfalls while maintaining efficient workflow.

-

What features does airSlate SignNow offer for Wisconsin EPV 2019 users?

Our platform offers a range of features such as customizable templates, real-time tracking, and secure cloud storage that align with Wisconsin EPV 2019 requirements. Additionally, the user-friendly interface makes it easy for anyone to create and eSign documents without technical expertise. These features cater specifically to businesses navigating the Wisconsin EPV 2019 landscape.

-

Is airSlate SignNow a cost-effective solution for businesses in Wisconsin?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes in Wisconsin. With the cost-effective solutions aligned to Wisconsin EPV 2019, you can enhance your document management processes without breaking your budget. We also provide a free trial to help you assess its value before committing.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely, airSlate SignNow supports a wide range of integrations with popular tools and software, helping businesses streamline their document workflows. This flexibility ensures that your operations are enhanced while remaining compliant with Wisconsin EPV 2019 regulations. Our API access allows for easy integration with your existing systems.

-

What benefits does airSlate SignNow offer for remote teams in Wisconsin?

For remote teams in Wisconsin, airSlate SignNow provides a seamless way to eSign documents collaboratively from anywhere, thus supporting the principles of Wisconsin EPV 2019. The platform facilitates real-time collaboration, ensuring all team members can collaborate effectively without geographic constraints. This boosts productivity and accelerates project timelines.

-

How secure is airSlate SignNow for eSigning documents under Wisconsin EPV 2019?

AirSlate SignNow prioritizes document security, employing robust encryption and compliance measures that align with Wisconsin EPV 2019. This level of security ensures that your sensitive documents are protected from unauthorized access. With features like audit trails and secure storage, your data remains safe throughout the signing process.

Get more for Wi Form Epv

- Telephone sale order form forms online

- 3971 ps form fillable

- Condential supplemental information

- Solicitation attachment 2 business associate agreement template form

- What does a wisconsin divorce decree look like form

- State of idaho tcr fillable form tcr state of idaho

- Pharmacy permit application pdf form

- Superior court county of santa clara form

Find out other Wi Form Epv

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy