Has Maryland Mw506r Form Been Released for yet 2019-2026

Understanding the Maryland Form MW506R

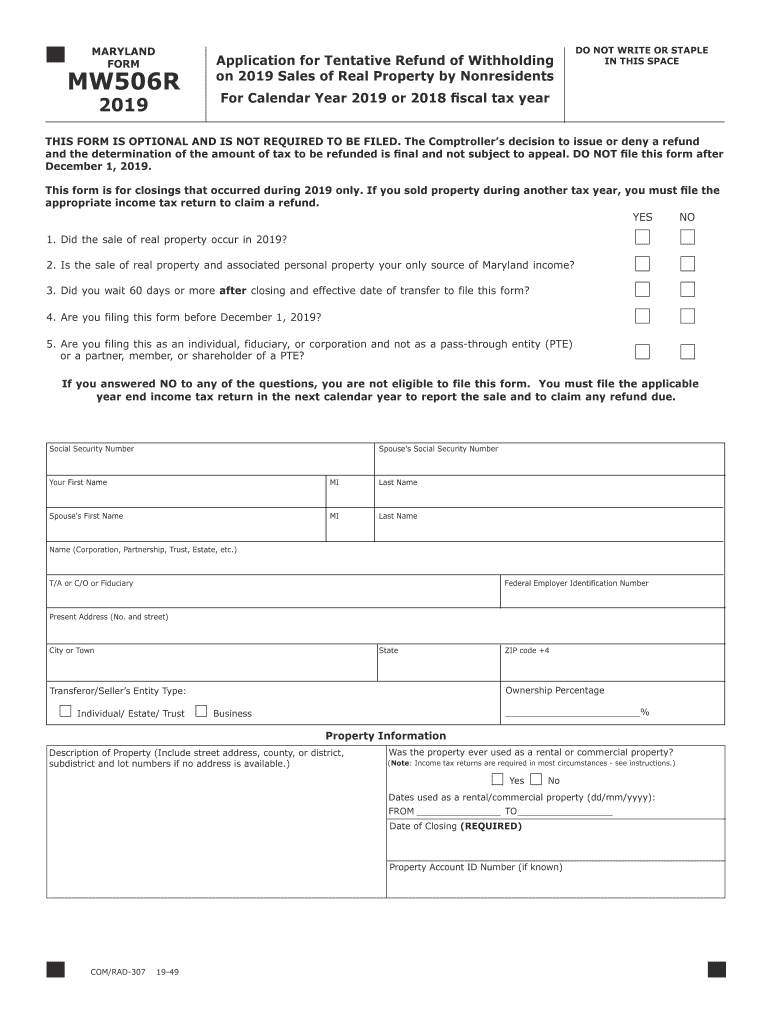

The Maryland Form MW506R is a crucial document for employers in the state who need to report income tax withheld from non-resident employees. This form is specifically designed to ensure compliance with Maryland tax regulations. It is essential for employers to accurately complete this form to avoid potential penalties and ensure that the correct amount of tax is remitted to the state. The MW506R form must be submitted annually, detailing the total income tax withheld for the year from non-resident employees.

Steps to Complete the Maryland Form MW506R

Completing the Maryland Form MW506R involves several key steps:

- Gather all necessary information, including the total wages paid to non-resident employees and the amount of tax withheld.

- Fill out the form accurately, ensuring that all fields are completed, including the employer's information and the total tax withheld.

- Review the form for accuracy to prevent any errors that could lead to penalties.

- Submit the form by the required deadline, which is typically January 31 of the following year for the previous tax year.

Legal Use of the Maryland Form MW506R

The Maryland Form MW506R is legally binding and must be filed in accordance with state tax laws. It serves to report income tax withheld from non-resident employees, ensuring that the employer complies with Maryland's tax obligations. Failure to file this form accurately and on time can result in penalties and interest charges. Therefore, it is vital for employers to understand the legal implications of this form and to maintain accurate records of all transactions related to non-resident employee wages.

Filing Deadlines for the Maryland Form MW506R

Employers must be aware of the filing deadlines associated with the Maryland Form MW506R to avoid penalties. The form is due annually by January 31 for the previous calendar year. Employers should ensure that they complete and submit the form by this date to remain compliant with state regulations. Additionally, if the deadline falls on a weekend or holiday, it may be prudent to submit the form early to avoid any last-minute issues.

Required Documents for Completing the Maryland Form MW506R

To complete the Maryland Form MW506R, employers need to gather specific documentation, including:

- Payroll records that detail wages paid to non-resident employees.

- Records of the income tax withheld from these wages.

- Employer identification information, such as the Federal Employer Identification Number (FEIN).

Having these documents readily available will streamline the completion process and ensure accuracy in reporting.

Form Submission Methods for the Maryland Form MW506R

The Maryland Form MW506R can be submitted through various methods:

- Online submission via the Maryland Comptroller's website, which is often the quickest method.

- Mailing a paper copy of the form to the appropriate state tax authority.

- In-person submission at designated state offices, if preferred.

Employers should choose the submission method that best suits their needs while ensuring compliance with state requirements.

Quick guide on how to complete arizona department of revenue releases important 2019 taxpayer

Complete Has Maryland Mw506r Form Been Released For Yet effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle Has Maryland Mw506r Form Been Released For Yet on any platform using airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

The most efficient way to edit and electronically sign Has Maryland Mw506r Form Been Released For Yet with ease

- Locate Has Maryland Mw506r Form Been Released For Yet and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive data with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or disorganized files, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Has Maryland Mw506r Form Been Released For Yet while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona department of revenue releases important 2019 taxpayer

How to generate an eSignature for the Arizona Department Of Revenue Releases Important 2019 Taxpayer online

How to generate an electronic signature for your Arizona Department Of Revenue Releases Important 2019 Taxpayer in Google Chrome

How to make an electronic signature for signing the Arizona Department Of Revenue Releases Important 2019 Taxpayer in Gmail

How to create an electronic signature for the Arizona Department Of Revenue Releases Important 2019 Taxpayer from your smartphone

How to make an electronic signature for the Arizona Department Of Revenue Releases Important 2019 Taxpayer on iOS devices

How to make an eSignature for the Arizona Department Of Revenue Releases Important 2019 Taxpayer on Android

People also ask

-

What is the Maryland Form MW506R?

The Maryland Form MW506R is an important document used for reporting income tax withheld from certain payments made to non-residents. Businesses operating in Maryland need to ensure proper submission of this form, as it helps them comply with state tax regulations.

-

How can airSlate SignNow help with the Maryland Form MW506R?

airSlate SignNow streamlines the process of sending and eSigning the Maryland Form MW506R. With our user-friendly interface, businesses can easily complete and submit this form electronically, ensuring quick and secure compliance with Maryland tax requirements.

-

What are the pricing options for using airSlate SignNow for Maryland Form MW506R?

airSlate SignNow offers several pricing plans to accommodate businesses of all sizes. Our cost-effective solutions ensure that you can manage your Maryland Form MW506R and other documents without breaking the bank while enjoying robust features tailored to your needs.

-

Are there any notable features of airSlate SignNow that assist with the Maryland Form MW506R?

Yes, airSlate SignNow includes features such as customizable templates and secure eSigning that are perfect for handling the Maryland Form MW506R. These tools streamline the document preparation process, saving you time and reducing the risk of errors.

-

What benefits does airSlate SignNow offer for handling the Maryland Form MW506R?

Using airSlate SignNow for the Maryland Form MW506R offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are both accessible and protected, making tax reporting simpler.

-

Can airSlate SignNow integrate with other software for processing the Maryland Form MW506R?

Yes, airSlate SignNow offers integration capabilities with various software applications that can assist in processing the Maryland Form MW506R. This flexibility allows you to seamlessly connect your existing tools, improving workflow and data management.

-

Is the airSlate SignNow platform suitable for small businesses managing Maryland Form MW506R?

Absolutely! airSlate SignNow is designed with small businesses in mind, providing an easy-to-use, affordable solution for managing the Maryland Form MW506R. Our platform helps you focus on your business while we take care of your document management needs.

Get more for Has Maryland Mw506r Form Been Released For Yet

- 60 month form

- Tax form 8858 for owners of foreign disregarded entities

- Centrelink advice of lump sum payments form

- Data breach reporting template form

- Work first eligibility and income requirements form

- Department of the air force af form

- Mcpon retirement letter request form instructions

- Spill reporting information form template gov bc ca

Find out other Has Maryland Mw506r Form Been Released For Yet

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT