Tax Form 8858 for Owners of Foreign Disregarded Entities

What is the Tax Form 8858 For Owners Of Foreign Disregarded Entities

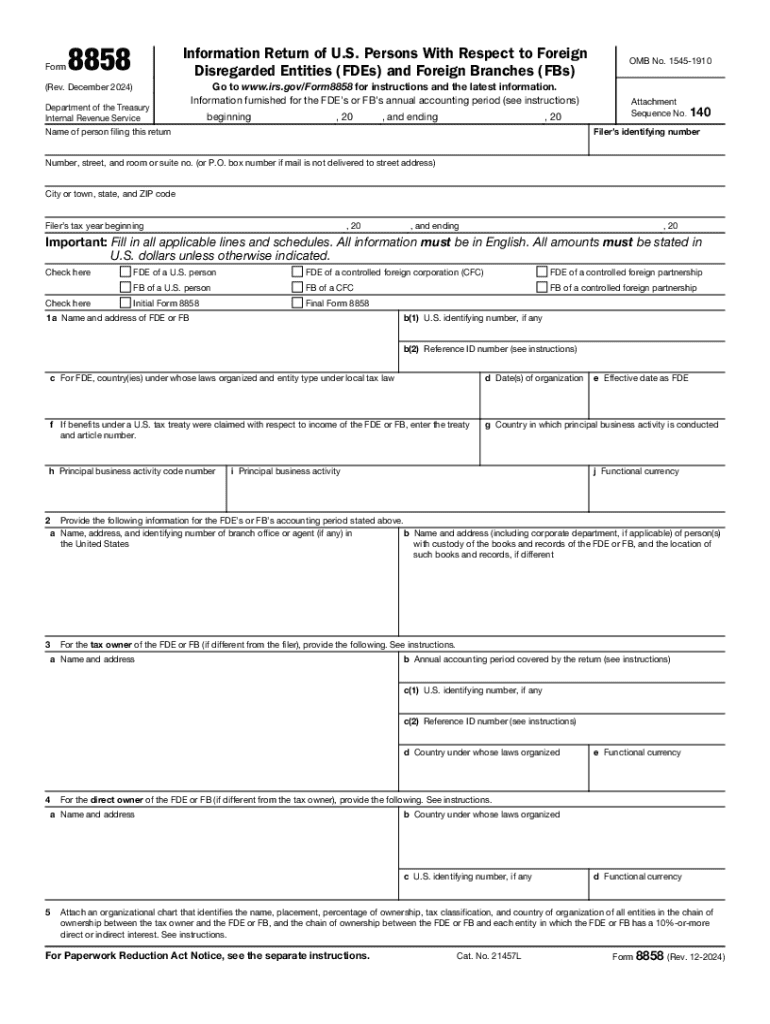

The IRS Form 8858 is specifically designed for U.S. taxpayers who own foreign disregarded entities (FDEs). An FDE is a foreign business entity that is not treated as separate from its owner for U.S. tax purposes. This form allows the IRS to collect information about these entities, ensuring compliance with U.S. tax regulations. By filing Form 8858, owners disclose the financial activities and operations of their foreign disregarded entities, which helps in accurately reporting income and taxes owed.

How to use the Tax Form 8858 For Owners Of Foreign Disregarded Entities

To effectively use Form 8858, owners of foreign disregarded entities must complete the form accurately and submit it along with their annual tax return. The form captures essential details such as the entity's name, address, and financial information. It is crucial to follow the IRS guidelines carefully to ensure that all required sections are filled out. Failure to provide complete and accurate information can lead to penalties or delays in processing.

Steps to complete the Tax Form 8858 For Owners Of Foreign Disregarded Entities

Completing Form 8858 involves several key steps:

- Gather necessary information about the foreign disregarded entity, including its financial statements and identification details.

- Fill out the form, paying close attention to sections that require financial data, ownership details, and compliance information.

- Review the completed form for accuracy and completeness before submission.

- Attach Form 8858 to your annual tax return, ensuring it is filed by the due date.

Filing Deadlines / Important Dates

Form 8858 must be filed annually, and it is typically due on the same date as the taxpayer's income tax return. For most individuals, this means the form is due on April 15. If an extension is filed for the tax return, the deadline for Form 8858 also extends. It is essential to keep track of these dates to avoid penalties for late submission.

Penalties for Non-Compliance

Failure to file Form 8858 or providing inaccurate information can result in significant penalties. The IRS may impose a penalty of up to $10,000 for each failure to file the form, along with potential additional penalties for inaccuracies. Timely and accurate filing is crucial to avoid these financial repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8858. These guidelines outline the required information, filing procedures, and compliance expectations. Taxpayers should refer to the IRS instructions for Form 8858 to ensure they understand the requirements and avoid common pitfalls in the filing process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax form 8858 for owners of foreign disregarded entities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8858 and why is it important?

Form 8858 is a tax form used by U.S. taxpayers to report information about foreign disregarded entities. It is crucial for compliance with IRS regulations and helps ensure accurate reporting of foreign income. Understanding how to properly fill out Form 8858 can prevent costly penalties.

-

How can airSlate SignNow help with Form 8858?

airSlate SignNow provides a streamlined process for sending and eSigning Form 8858 and other important documents. With its user-friendly interface, you can easily manage your forms and ensure they are signed securely and efficiently. This saves time and reduces the risk of errors in your submissions.

-

What features does airSlate SignNow offer for managing Form 8858?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 8858. These tools enhance your workflow, allowing you to focus on compliance rather than paperwork. Additionally, you can collaborate with team members in real-time.

-

Is airSlate SignNow cost-effective for filing Form 8858?

Yes, airSlate SignNow is a cost-effective solution for managing Form 8858 and other documents. With flexible pricing plans, businesses can choose the option that best fits their needs without overspending. This affordability makes it accessible for companies of all sizes.

-

Can I integrate airSlate SignNow with other software for Form 8858?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Form 8858. Whether you use accounting software or document management systems, these integrations streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for Form 8858?

Using airSlate SignNow for Form 8858 offers numerous benefits, including enhanced security, ease of use, and faster processing times. The platform ensures that your documents are signed and stored securely, reducing the risk of data bsignNowes. Additionally, it simplifies the entire signing process, making it more efficient.

-

How does airSlate SignNow ensure the security of Form 8858?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Form 8858 and other sensitive documents. This commitment to security ensures that your information remains confidential and compliant with regulations. You can trust that your data is safe with airSlate SignNow.

Get more for Tax Form 8858 For Owners Of Foreign Disregarded Entities

- Sinp ef 002 publicationsgovskca form

- Cat adoption application template 40818401 form

- A housing authority attn admissions 712 north 16 th street philadelphia pa 19130 form

- Printable timber contract 11007983 form

- Feltonfleet boarding house booking form fees for period september 2012july please complete and return to the school office name

- Rlg1023599298 001pn769299111737614a1577 auto enrolment opt out form60069

- Referrals for cataract and action on cataracts evidence form

- Request for an adjournment hmcts court and tribunal form finder

Find out other Tax Form 8858 For Owners Of Foreign Disregarded Entities

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement