Tbor 2019-2026

What is the TBOR?

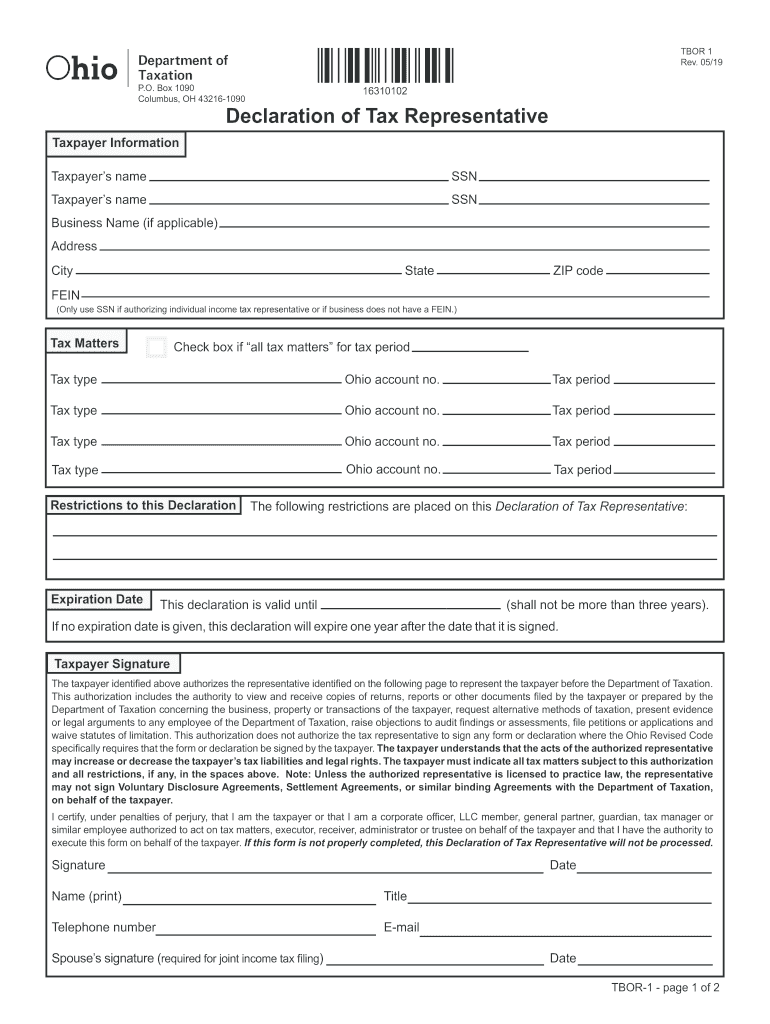

The TBOR, or Taxpayer Bill of Rights, is a crucial document in the state of Ohio that outlines the rights of taxpayers in their interactions with the Ohio Department of Taxation. The TBOR form serves as a formal declaration that allows taxpayers to appoint a representative to act on their behalf regarding tax matters. This form is essential for ensuring that taxpayers can navigate the complexities of state tax regulations while maintaining their rights throughout the process.

How to Use the TBOR

Using the TBOR form involves several straightforward steps. First, taxpayers must fill out the form with accurate information, including their personal details and the details of the representative they wish to appoint. Once completed, the form should be submitted to the Ohio Department of Taxation. This allows the appointed representative to receive information and communicate with the tax authority on behalf of the taxpayer. It is important to ensure that the form is signed and dated to validate the appointment.

Steps to Complete the TBOR

Completing the TBOR form requires careful attention to detail. Here are the steps to follow:

- Obtain the TBOR form from the Ohio Department of Taxation website or through other official channels.

- Fill in your name, address, and identification number accurately.

- Provide the name and contact information of the representative you are appointing.

- Sign and date the form to confirm your consent.

- Submit the completed form to the appropriate office of the Ohio Department of Taxation.

Legal Use of the TBOR

The legal use of the TBOR form is governed by specific regulations set forth by the Ohio Department of Taxation. This form must be completed in accordance with state laws to ensure that the appointment of a representative is recognized. Proper execution of the TBOR form guarantees that the appointed representative can legally act on behalf of the taxpayer, ensuring compliance with all relevant tax laws and regulations.

Required Documents

When submitting the TBOR form, it is essential to include any required documents that may support your application. Typically, this includes a copy of your identification, such as a driver's license or Social Security card, and any relevant tax documents that pertain to the matters your representative will address. Ensuring that all necessary documents are included can help facilitate the processing of your TBOR form.

Form Submission Methods

The TBOR form can be submitted to the Ohio Department of Taxation through various methods. Taxpayers have the option to submit the form online, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address or delivered in person at designated tax offices. Choosing the method that best suits your needs can help streamline the process of appointing a tax representative.

Filing Deadlines / Important Dates

It is important to be aware of any filing deadlines associated with the TBOR form. Typically, the form should be submitted as soon as the need for a tax representative arises. However, specific deadlines may apply depending on the nature of the tax issue being addressed. Keeping track of these important dates ensures that taxpayers can effectively manage their tax responsibilities and maintain compliance with Ohio tax regulations.

Quick guide on how to complete taxpayers namessn

Prepare Tbor effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Tbor on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Tbor seamlessly

- Find Tbor and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Tbor and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayers namessn

How to generate an electronic signature for the Taxpayers Namessn online

How to create an eSignature for your Taxpayers Namessn in Google Chrome

How to generate an electronic signature for putting it on the Taxpayers Namessn in Gmail

How to generate an electronic signature for the Taxpayers Namessn right from your smart phone

How to create an eSignature for the Taxpayers Namessn on iOS devices

How to generate an eSignature for the Taxpayers Namessn on Android OS

People also ask

-

What is the state of Ohio TBOR form?

The state of Ohio TBOR form is a document used in the real estate transaction process to provide property owners with a means to report their property tax values. It is essential for ensuring accurate assessments and appeals regarding property taxes in Ohio. Understanding this form is crucial for both homeowners and real estate professionals.

-

How can I fill out the state of Ohio TBOR form using airSlate SignNow?

Filling out the state of Ohio TBOR form with airSlate SignNow is simple and efficient. You can easily upload the form, fill in your information, and eSign it within our platform. This not only speeds up the process but also provides a secure way to manage your documents.

-

Is there a cost associated with using the state of Ohio TBOR form on airSlate SignNow?

Using airSlate SignNow to handle your state of Ohio TBOR form comes with a competitive pricing model. Plans are available based on your business needs, making it a cost-effective solution for document management. Enjoy the benefits of electronic signatures and easy access to your forms without breaking the bank.

-

What features does airSlate SignNow offer for managing the state of Ohio TBOR form?

airSlate SignNow offers a range of features for managing the state of Ohio TBOR form, including document templates, workflow automation, and real-time tracking. These features streamline the signing process and ensure that you stay organized and compliant with Ohio’s regulations. You can easily customize the form to fulfill all necessary requirements.

-

Can I integrate airSlate SignNow with other applications for the state of Ohio TBOR form?

Absolutely! airSlate SignNow offers integrations with numerous popular applications, allowing for a seamless experience when working with the state of Ohio TBOR form. Whether you need to link with accounting software or CRM systems, we make it easy to enhance your document workflow.

-

What benefits does airSlate SignNow provide for signing the state of Ohio TBOR form?

Using airSlate SignNow for signing the state of Ohio TBOR form provides signNow benefits like enhanced security, efficiency, and accessibility. You can sign documents from anywhere at any time, making it easier to manage deadlines and keep your real estate transactions flowing smoothly. Plus, our platform ensures that all documents are stored securely.

-

How can airSlate SignNow help with the compliance of the state of Ohio TBOR form?

airSlate SignNow helps ensure compliance with the state of Ohio TBOR form by providing tools that facilitate accurate completion and secure e-signatures. Our platform includes built-in compliance features that adhere to local regulations, reducing the risk of errors and keeping your documents valid and enforceable.

Get more for Tbor

- Not final until time expires to file rehearing motion and if 2dca form

- Golf club rental agreement smrp golf event smrp form

- Stan mucinic form

- Dual diagnosis workbook pdf form

- Cobra request for service form

- Aetna life insurance company designation of benefi form

- Tot reporting form sdttc comtot reporting form sdttc comtransient occupancy tax treasurer tax collectorsan diego county

- Car for sale by owner contract template form

Find out other Tbor

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online