TOT Reporting Form Sdttc ComTOT Reporting Form Sdttc ComTransient Occupancy Tax Treasurer Tax CollectorSan Diego County Treasure

What is the TOT Reporting Form?

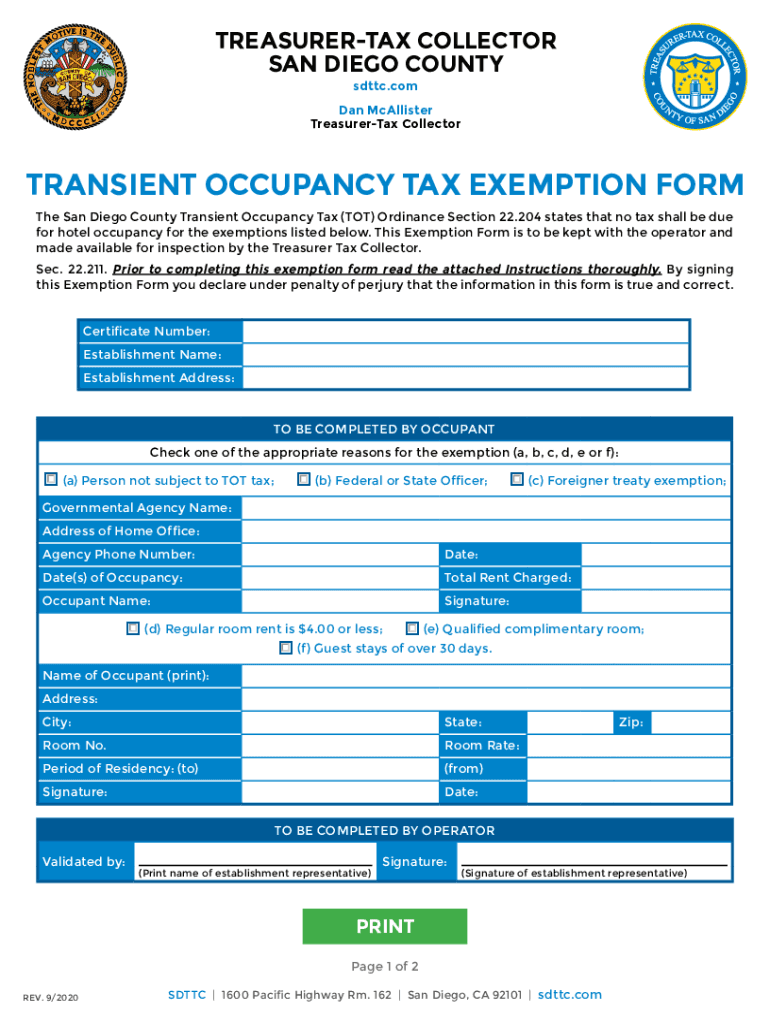

The TOT Reporting Form is a crucial document used for reporting Transient Occupancy Tax (TOT) in San Diego County. This tax is applicable to individuals or businesses that rent out accommodations for a short duration, typically less than thirty days. The form is managed by the San Diego County Treasurer-Tax Collector's Office, which oversees the collection and administration of this tax. Proper completion of the form ensures compliance with local tax regulations and contributes to funding various public services within the county.

How to Obtain the TOT Reporting Form

The TOT Reporting Form can be obtained through the San Diego County Treasurer-Tax Collector's Office. It is available online on their official website, where users can download the form in a printable format. Additionally, physical copies may be requested directly from the office. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to Complete the TOT Reporting Form

Completing the TOT Reporting Form involves several key steps:

- Gather necessary information, including rental income, the number of nights rented, and guest details.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total tax owed based on the reported rental income.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline, either online or via mail.

Key Elements of the TOT Reporting Form

The TOT Reporting Form includes several key elements that must be filled out:

- Property owner's name and contact information.

- Details of the rental property, including address and type of accommodation.

- Income generated from rentals during the reporting period.

- Calculation of the Transient Occupancy Tax owed.

- Signature of the property owner or authorized representative, certifying the accuracy of the information provided.

Legal Use of the TOT Reporting Form

The TOT Reporting Form serves a legal purpose in the collection of taxes owed to the San Diego County government. It is essential for property owners to submit this form to comply with local tax laws. Failure to file the form or inaccuracies in reporting can lead to penalties and interest charges. Therefore, understanding the legal implications of the form is vital for all property owners engaged in short-term rentals.

Filing Deadlines / Important Dates

Filing deadlines for the TOT Reporting Form vary based on the rental period. Typically, forms must be submitted quarterly, with specific due dates set by the San Diego County Treasurer-Tax Collector's Office. It is crucial for property owners to be aware of these deadlines to avoid late fees and ensure timely compliance with tax obligations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tot reporting form sdttc comtot reporting form sdttc comtransient occupancy tax treasurer tax collectorsan diego county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TOT Reporting Form Sdttc com?

The TOT Reporting Form Sdttc com is a document required for reporting transient occupancy tax in San Diego County. This form is essential for lodging providers to comply with local tax regulations and ensure accurate tax reporting to the Treasurer Tax Collector's Office.

-

How can I access the TOT Reporting Form Sdttc com?

You can access the TOT Reporting Form Sdttc com through the San Diego County Treasurer Tax Collector's Office website. The form is available for download, allowing you to fill it out and submit it electronically or via mail.

-

What are the benefits of using airSlate SignNow for the TOT Reporting Form Sdttc com?

Using airSlate SignNow for the TOT Reporting Form Sdttc com streamlines the eSigning process, making it quick and efficient. It ensures that your documents are securely signed and stored, reducing the risk of errors and enhancing compliance with the Treasurer Tax Collector's Office requirements.

-

Is there a cost associated with submitting the TOT Reporting Form Sdttc com?

While the TOT Reporting Form Sdttc com itself is free to download and fill out, there may be fees associated with the transient occupancy tax that you need to remit. Using airSlate SignNow can help you manage these processes more effectively, potentially saving you time and money.

-

Can I integrate airSlate SignNow with other software for the TOT Reporting Form Sdttc com?

Yes, airSlate SignNow offers integrations with various software solutions, allowing you to streamline your workflow when handling the TOT Reporting Form Sdttc com. This can enhance your overall efficiency and ensure that all necessary documents are easily accessible.

-

What features does airSlate SignNow offer for managing the TOT Reporting Form Sdttc com?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the TOT Reporting Form Sdttc com. These tools help ensure that your submissions to the Treasurer Tax Collector's Office are accurate and timely.

-

How does airSlate SignNow ensure the security of my TOT Reporting Form Sdttc com?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your TOT Reporting Form Sdttc com. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for TOT Reporting Form Sdttc comTOT Reporting Form Sdttc comTransient Occupancy Tax Treasurer Tax CollectorSan Diego County Treasure

- Rule 25 eligibility application dak903a dakota county co dakota mn form

- Smi form council tax

- Vtr 346 form

- Va form 21 4138 apr

- Enter income year beginning corporation business form

- Directors service agreement template form

- Disaster recovery service level agreement template form

- Disclaimer agreement template form

Find out other TOT Reporting Form Sdttc comTOT Reporting Form Sdttc comTransient Occupancy Tax Treasurer Tax CollectorSan Diego County Treasure

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors