3415 Sales of Product Exempt of Tax in Ontario Schedule GTFT7 Form

What is the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

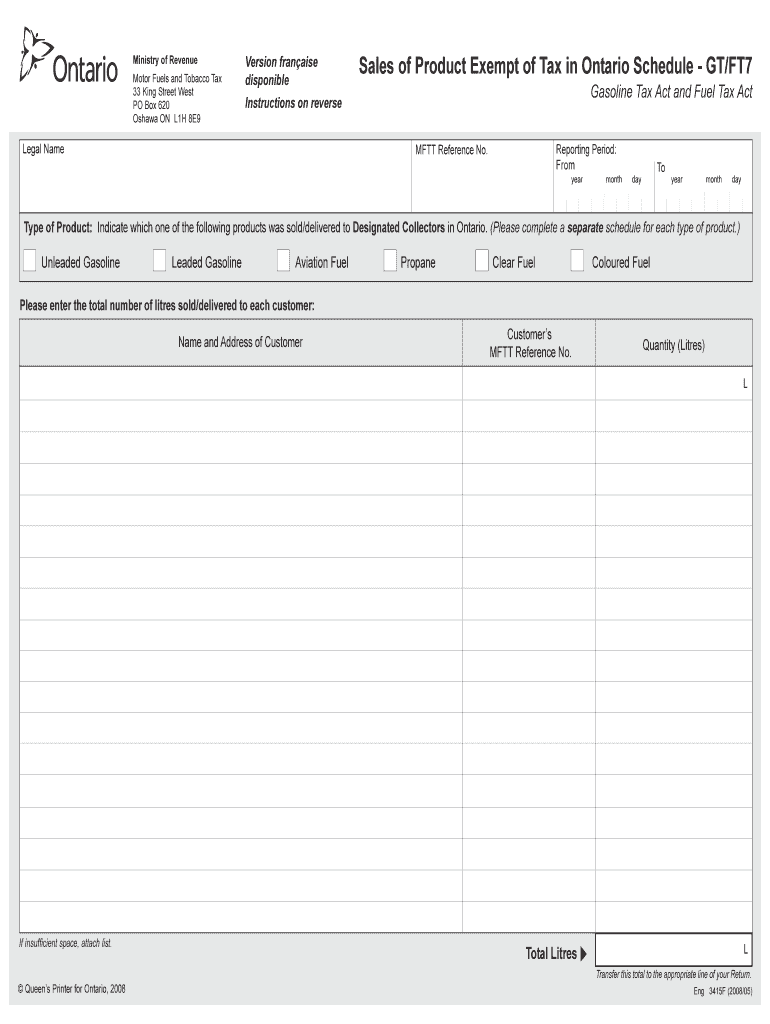

The 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7 is a specific tax form used to report sales of products that are exempt from tax in Ontario. This form is essential for businesses that sell goods or services that qualify for tax exemption under Ontario's tax regulations. By accurately completing this schedule, businesses can ensure compliance with tax laws while correctly reporting their exempt sales. This form is particularly relevant for entities engaged in sectors such as education, healthcare, and certain non-profit organizations, where specific products or services may not be subject to sales tax.

Steps to complete the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

Completing the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7 involves several key steps:

- Gather necessary information, including sales records and details of exempt products.

- Fill in the business identification section, ensuring all details are accurate.

- List all products or services sold that are exempt from tax, including descriptions and quantities.

- Calculate the total sales amount for exempt products and verify calculations for accuracy.

- Review the completed form for any errors or omissions before submission.

How to obtain the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

The 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7 can be obtained through the official tax authority or relevant government website. Businesses may also find this form available at local tax offices or through professional tax preparation services. It is important to ensure that the most current version of the form is used to comply with any updated regulations or requirements.

Legal use of the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

The legal use of the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7 is crucial for businesses to maintain compliance with tax laws. This form allows businesses to report exempt sales accurately, helping to avoid potential penalties or audits. Proper documentation and adherence to the guidelines set forth by tax authorities are essential for validating the exempt status of the products sold. Businesses should retain copies of the completed form and supporting documents for their records.

Key elements of the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

Several key elements must be included in the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7:

- Business Identification: Accurate information about the business, including name, address, and tax identification number.

- Exempt Sales Details: A comprehensive list of products or services sold that qualify for tax exemption.

- Total Sales Amount: The total dollar amount of exempt sales reported on the form.

- Signature and Date: An authorized individual must sign the form, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7 may vary based on the business's tax reporting period. It is essential for businesses to be aware of these deadlines to avoid late filing penalties. Generally, forms should be submitted according to the schedule established by the tax authority, and businesses should keep track of any changes to these dates to ensure timely compliance.

Quick guide on how to complete 3415 sales of product exempt of tax in ontario schedule gtft7

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with features provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and maintain effective communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

Create this form in 5 minutes!

How to create an eSignature for the 3415 sales of product exempt of tax in ontario schedule gtft7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7?

The 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7 is a tax form used by businesses in Ontario to report sales of products that are exempt from tax. This schedule helps ensure compliance with provincial tax regulations and simplifies the reporting process for eligible businesses.

-

How can airSlate SignNow assist with the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7?

airSlate SignNow provides an efficient platform for businesses to eSign and manage documents related to the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7. With its user-friendly interface, businesses can easily prepare, send, and track their tax-related documents, ensuring timely submissions.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those dealing with the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7. You can choose from monthly or annual subscriptions, ensuring you get the best value for your document management and eSigning needs.

-

What features does airSlate SignNow offer for managing the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7. These features streamline the process, making it easier to handle tax documents efficiently.

-

Are there any integrations available with airSlate SignNow for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7. These integrations allow for automatic data transfer, reducing manual entry and minimizing errors.

-

What are the benefits of using airSlate SignNow for the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7?

Using airSlate SignNow for the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can save time and resources while ensuring compliance with tax regulations.

-

Is airSlate SignNow suitable for small businesses handling the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal solution for small businesses managing the 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7. Its features cater to businesses of all sizes, ensuring everyone can benefit from streamlined document management.

Get more for 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

Find out other 3415 Sales Of Product Exempt Of Tax In Ontario Schedule GTFT7

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template