Form 573 Authorization, Pursuant to the Insurance Premium Tax Act This Schedule Authorizes the Person or Firm Named to Act as a

Understanding Form 573 Authorization

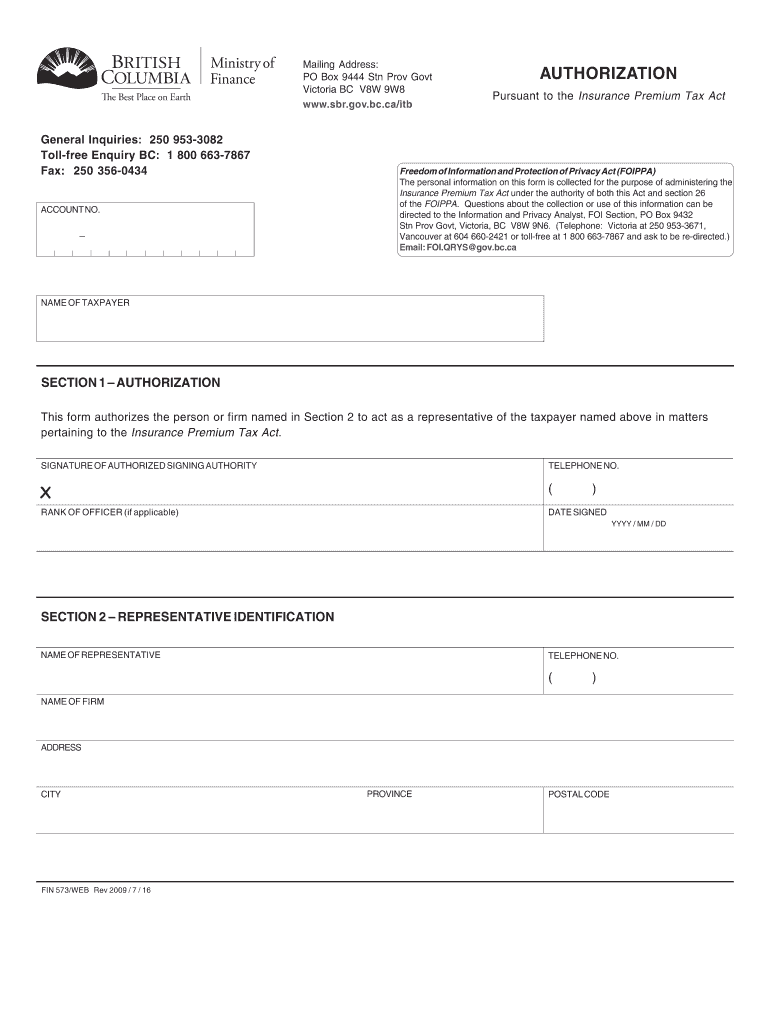

Form 573 Authorization is a critical document under the Insurance Premium Tax Act. It enables the designated person or firm to act on behalf of the taxpayer in matters related to the Insurance Premium Tax Act. This form is essential for ensuring that the taxpayer's interests are represented accurately and effectively in any dealings with tax authorities.

The form outlines the authority granted to the representative, which may include filing tax returns, making payments, and responding to inquiries from the tax office. Proper completion of this form is crucial to avoid any legal complications or misunderstandings regarding tax obligations.

Steps to Complete Form 573 Authorization

Completing Form 573 Authorization requires careful attention to detail. Here are the essential steps:

- Obtain the form from the appropriate tax authority or download it from a reliable source.

- Fill in the taxpayer's information, including name, address, and tax identification number.

- Provide the representative's details, ensuring that all information is accurate.

- Clearly specify the scope of authority granted to the representative.

- Sign and date the form to validate it.

After completing the form, it should be submitted to the relevant tax authority as instructed. Ensuring that all sections are filled out correctly will help facilitate a smooth process.

Legal Use of Form 573 Authorization

The legal use of Form 573 Authorization is paramount for compliance with the Insurance Premium Tax Act. This form serves as a formal agreement between the taxpayer and the representative, establishing the latter's authority to act on behalf of the taxpayer.

It is important to understand that any actions taken by the representative under this authorization are legally binding. Therefore, both parties should ensure that the information provided is accurate and that the representative is trustworthy and competent in handling tax matters.

Obtaining Form 573 Authorization

To obtain Form 573 Authorization, taxpayers can typically visit the official website of the relevant state tax authority or contact their office directly. The form is often available as a downloadable PDF, which can be printed and filled out manually.

In some cases, taxpayers may also be able to request the form through mail or in person at designated tax offices. It is advisable to check for any specific state requirements or additional documentation that may need to accompany the form.

Key Elements of Form 573 Authorization

Form 573 Authorization includes several key elements that are crucial for its validity:

- Taxpayer Information: This section requires the full name, address, and tax identification number of the taxpayer.

- Representative Information: Details about the person or firm authorized to act on behalf of the taxpayer must be clearly stated.

- Scope of Authority: This outlines the specific powers granted to the representative, such as filing returns or making tax payments.

- Signatures: Both the taxpayer and the representative must sign the form to confirm their agreement.

Each of these elements plays a vital role in ensuring that the form is legally binding and effective in representing the taxpayer's interests.

Examples of Using Form 573 Authorization

Form 573 Authorization can be utilized in various scenarios. For instance, a business owner may authorize an accountant to handle their insurance premium tax filings. This allows the accountant to act on the owner's behalf, ensuring compliance with tax regulations.

Another example includes a tax professional representing a retired individual who may not be familiar with the complexities of tax laws. By completing Form 573, the retiree can ensure that their tax matters are managed properly without direct involvement.

Quick guide on how to complete form 573 authorization pursuant to the insurance premium tax act this schedule authorizes the person or firm named to act as a

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among both organizations and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents promptly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent portions of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 573 Authorization, Pursuant To The Insurance Premium Tax Act This Schedule Authorizes The Person Or Firm Named To Act As A

Create this form in 5 minutes!

How to create an eSignature for the form 573 authorization pursuant to the insurance premium tax act this schedule authorizes the person or firm named to act as a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 573 Authorization, Pursuant To The Insurance Premium Tax Act?

The Form 573 Authorization, Pursuant To The Insurance Premium Tax Act, is a legal document that allows a designated person or firm to represent a taxpayer in matters related to the Insurance Premium Tax Act. This form is essential for ensuring that the representative can act on behalf of the taxpayer in all relevant tax matters.

-

How can airSlate SignNow help with the Form 573 Authorization?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Form 573 Authorization, Pursuant To The Insurance Premium Tax Act. Our solution simplifies the process, ensuring that all necessary parties can sign the document quickly and securely, reducing delays in tax representation.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that support the completion of documents like the Form 573 Authorization, Pursuant To The Insurance Premium Tax Act, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, users can enjoy features such as customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial for managing the Form 573 Authorization, Pursuant To The Insurance Premium Tax Act, making the process efficient and organized.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. This capability allows you to easily incorporate the Form 573 Authorization, Pursuant To The Insurance Premium Tax Act into your existing systems, improving efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like the Form 573 Authorization, Pursuant To The Insurance Premium Tax Act provides numerous benefits, including enhanced security, reduced processing time, and improved compliance. Our platform ensures that your documents are handled with the utmost care and efficiency.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for new users to navigate the platform. Whether you are preparing the Form 573 Authorization, Pursuant To The Insurance Premium Tax Act or any other document, our intuitive interface simplifies the process.

Get more for Form 573 Authorization, Pursuant To The Insurance Premium Tax Act This Schedule Authorizes The Person Or Firm Named To Act As A

Find out other Form 573 Authorization, Pursuant To The Insurance Premium Tax Act This Schedule Authorizes The Person Or Firm Named To Act As A

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT