50 135 Form 2017-2026

What is the 2017 Form 50-135?

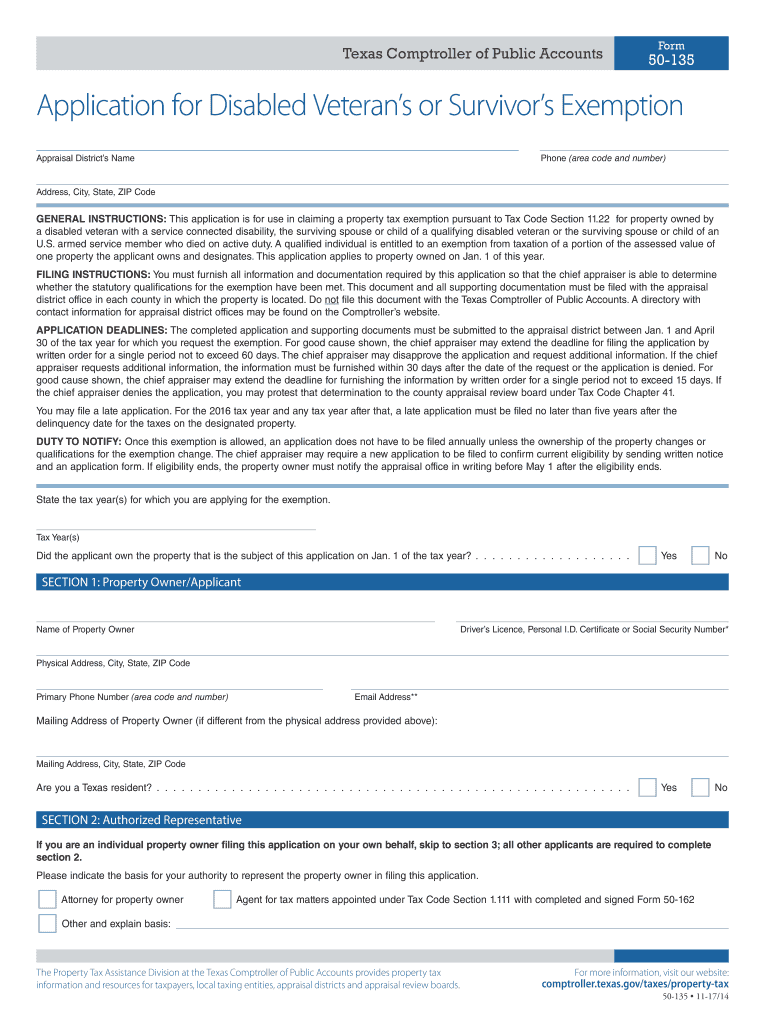

The 2017 Form 50-135 is a Texas tax exemption application specifically designed for disabled veterans and their survivors. This form allows eligible applicants to claim a property tax exemption based on their service-related disabilities. The exemption aims to provide financial relief to veterans who have served in the military and have been recognized as disabled. Understanding the purpose of this form is essential for veterans looking to benefit from tax relief options available to them.

Eligibility Criteria for the 2017 Form 50-135

To qualify for the 2017 Form 50-135, applicants must meet specific criteria established by the Texas Comptroller's office. Generally, the following conditions apply:

- The applicant must be a veteran who has been honorably discharged from the military.

- The veteran must have a service-connected disability rating from the U.S. Department of Veterans Affairs.

- Survivors of deceased veterans may also be eligible if the veteran had previously qualified for the exemption.

It is important to review these criteria thoroughly to ensure eligibility before submitting the application.

Steps to Complete the 2017 Form 50-135

Completing the 2017 Form 50-135 involves several key steps to ensure accurate submission. Follow these guidelines for a smooth application process:

- Gather necessary documentation, including proof of disability and military service.

- Fill out the form with accurate personal information, including your name, address, and details regarding your service.

- Indicate the specific exemption you are applying for, whether it is for yourself or as a survivor.

- Review the completed form for any errors or omissions before submission.

Taking these steps can help avoid delays in processing your application.

How to Obtain the 2017 Form 50-135

The 2017 Form 50-135 can be obtained through several convenient methods. Applicants can:

- Visit the Texas Comptroller's website to download a printable version of the form.

- Request a copy by contacting the local appraisal district office.

- Access the form at designated government offices or veteran service organizations.

Having the correct version of the form is crucial for ensuring that all required information is provided for the tax exemption application.

Legal Use of the 2017 Form 50-135

The 2017 Form 50-135 is legally recognized as a valid document for applying for property tax exemptions in Texas. To ensure its legal standing, the form must be completed accurately and submitted in accordance with state regulations. Compliance with Texas laws regarding tax exemptions for disabled veterans is essential to avoid potential issues with the application process.

Form Submission Methods for the 2017 Form 50-135

Submitting the 2017 Form 50-135 can be done through various methods, ensuring flexibility for applicants. The available submission options include:

- Online submission through the Texas Comptroller's website, if applicable.

- Mailing the completed form to the appropriate appraisal district office.

- In-person delivery at local government offices or appraisal districts.

Choosing the right submission method can help expedite the processing of your application.

Quick guide on how to complete 50 135 2017 form

Complete 50 135 Form easily on any device

Digital document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly option to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any hold-ups. Manage 50 135 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign 50 135 Form effortlessly

- Obtain 50 135 Form and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that function.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign 50 135 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 50 135 2017 form

How to make an electronic signature for the 50 135 2017 Form in the online mode

How to create an eSignature for the 50 135 2017 Form in Chrome

How to generate an electronic signature for putting it on the 50 135 2017 Form in Gmail

How to make an electronic signature for the 50 135 2017 Form from your smart phone

How to make an electronic signature for the 50 135 2017 Form on iOS devices

How to make an electronic signature for the 50 135 2017 Form on Android devices

People also ask

-

What is the 50 135 Form, and why is it important?

The 50 135 Form is a crucial document used for various business transactions and compliance requirements. It ensures that all necessary information is accurately captured and legally validated. Using airSlate SignNow, you can easily create, send, and eSign the 50 135 Form, streamlining your workflow and enhancing productivity.

-

How does airSlate SignNow simplify the process of handling the 50 135 Form?

airSlate SignNow simplifies the handling of the 50 135 Form by providing an intuitive interface that allows users to fill out, sign, and send documents electronically. The platform's automation features reduce the time spent on paperwork, making it easy to manage multiple forms simultaneously. Plus, its secure storage ensures your documents are always safe and accessible.

-

What features does airSlate SignNow offer for managing the 50 135 Form?

airSlate SignNow offers a range of features for managing the 50 135 Form, including customizable templates, eSigning capabilities, and document tracking. These tools allow you to efficiently create and modify the form according to your needs, while also keeping you updated on its status. This ensures a seamless experience from start to finish.

-

Is there a cost associated with using airSlate SignNow for the 50 135 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when using the 50 135 Form. Each plan includes access to essential features like eSigning, document management, and integrations. You can choose a plan that fits your budget while still benefiting from a cost-effective solution.

-

Can I integrate airSlate SignNow with other tools to manage the 50 135 Form?

Absolutely! airSlate SignNow easily integrates with various applications such as Google Drive, Salesforce, and Microsoft Office. This allows you to manage the 50 135 Form alongside your existing workflows and tools, enhancing productivity and collaboration across your team.

-

What are the benefits of using airSlate SignNow for the 50 135 Form compared to traditional methods?

Using airSlate SignNow for the 50 135 Form offers numerous benefits over traditional paper-based methods. You can save time and reduce errors with electronic signatures and automated workflows. Additionally, the secure digital storage of documents helps you stay organized and compliant with legal requirements.

-

How secure is my data when using airSlate SignNow for the 50 135 Form?

Data security is a top priority for airSlate SignNow. When handling the 50 135 Form, your information is protected with industry-standard encryption and secure servers. The platform also complies with various regulations to ensure that your documents are safe and confidential.

Get more for 50 135 Form

- Dj book contract template form

- How do i notify the nys dmv that im moving out of state form

- Statement of identity andor residence ny dmv form

- City of newport news fire department form

- Family separation supplemental information form

- Full fee mileage guidelines form

- Idaho transportation department mileage forms

- Looking for advice getting into the field rnuclear form

Find out other 50 135 Form

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free